Jan 2, 2020 - Energy & Environment

The decade's biggest unexpected boom

- Felix Salmon, author ofAxios Markets

Shale dominated the 2010s, even more than the iPhone or cloud computing. That's the claim made by blogger and investment adviser Josh Brown, who sees the U.S. shale boom causing a collapse in energy prices that had enormous economic and geopolitical consequences.

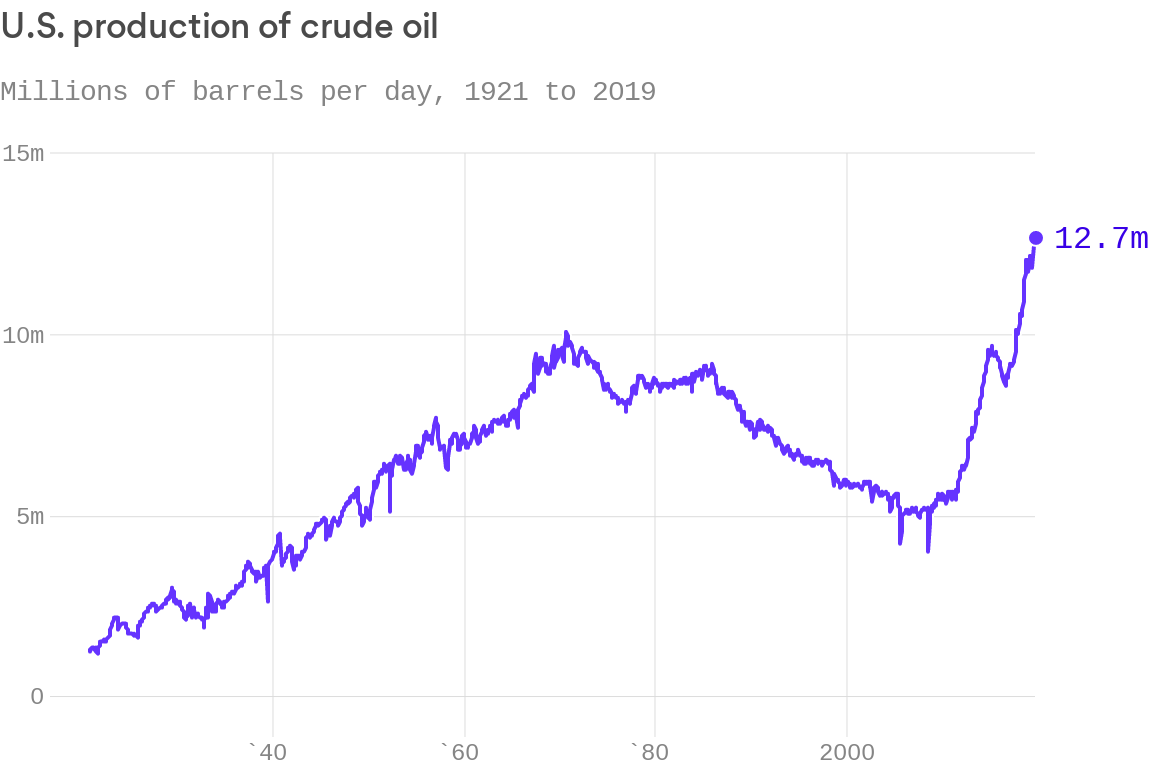

By the numbers: The U.S. currently produces roughly 12.7 million barrels of oil per day. That's an all-time high, and is more than double the 6.1 million expected 1o years ago.

- The boom was caused by the collapse of Lehman Brothers, and the tsunami of emergency liquidity that resulted from central banks around the world trying to prevent the complete failure of the global financial system.

Go deeper: OPEC is still having a hard time exerting its sway amid U.S. oil boom