Al Gore's new net-zero emissions investment push has big-name backers

- Ben Geman, author ofAxios Generate

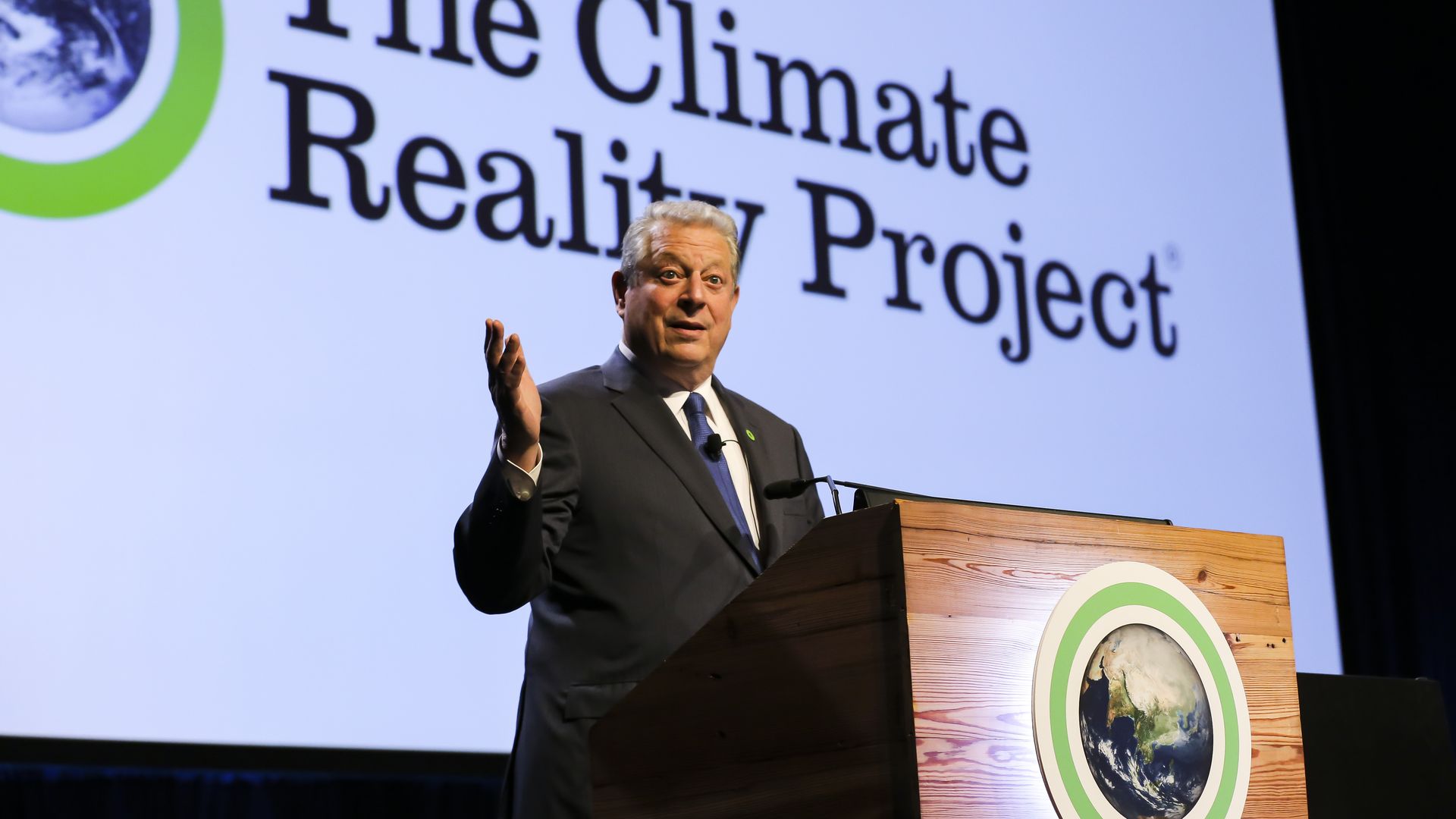

Al Gore speaks at the Climate Reality Leadership Corps training in Brisbane, Australia. (Mark Cranitch/Newspix/Getty Images)

Al Gore and other finance veterans are launching a new investment vehicle with backers including Microsoft, Goldman Sachs and Harvard — and hope to help shift global investment patterns more broadly.

Driving the news: The newly unveiled Just Climate seeks to "catalyze and channel" capital into companies and projects that can help deeply decarbonize the economy, "but which are not yet fully served by traditional investment mandates." The aim is to limit global warming to 1.5ºC, which is the more ambitious target under the Paris Agreement.

- Just Climate says that many solutions are "still largely ignored by investors on the basis that they are often too capital-intensive, unproven at scale or in challenging geographies."

- It has a wide aim of investing in energy, transport, industry, natural climate solutions, food and more.

Zoom in: The initiative is being launched out of Generation Investment Management, which Gore co-founded in 2004.

- David Blood, another Generation co-founder, will serve as chairman.

- Founding "strategic partners" include Microsoft's climate tech fund, the Ireland Strategic Investment Fund, IMAS Foundation, Harvard Management Company, Goldman Sachs Asset Management and Hall Capital Partners.

The intrigue: Gore, in a statement, said the investment sector must "seriously rethink how capital is allocated" to help transform net-zero emissions commitments into reality.

- Blood and colleagues plan to meet with some of the world’s biggest asset managers to "try to persuade them to reallocate funds," per Bloomberg.

What we don't know: How much the backers are investing, which is not listed in the release. But Blood told the Financial Times they hope it will be "as big as Generation in months and years ahead," and the FT notes that Generation has $36 billion in assets under management.