Apr 3, 2021 - Economy

3. Everything old is new again

Not all instances of easy money cause asset-price bubbles — but all asset price bubbles for the past 250 years have been associated with loose monetary policy.

Flashback: The first bubble to be inflated at least in part by expansive monetary policy was probably the Mississippi bubble of 1719.

- France's Banque Royal issued abundant currency to finance the purchase of shares in Compagnie des Indes, the company controlling trade in Louisiana and elsewhere.

- Share prices spiked sharply, as did inflation, until John Law, who controlled the company, stopped printing money and managed to deflate the share price.

Central banks have fueled dozens of subsequent bubbles.

- In fact, it's almost impossible to find a bubble since 1770 that isn't associated with lax monetary policy.

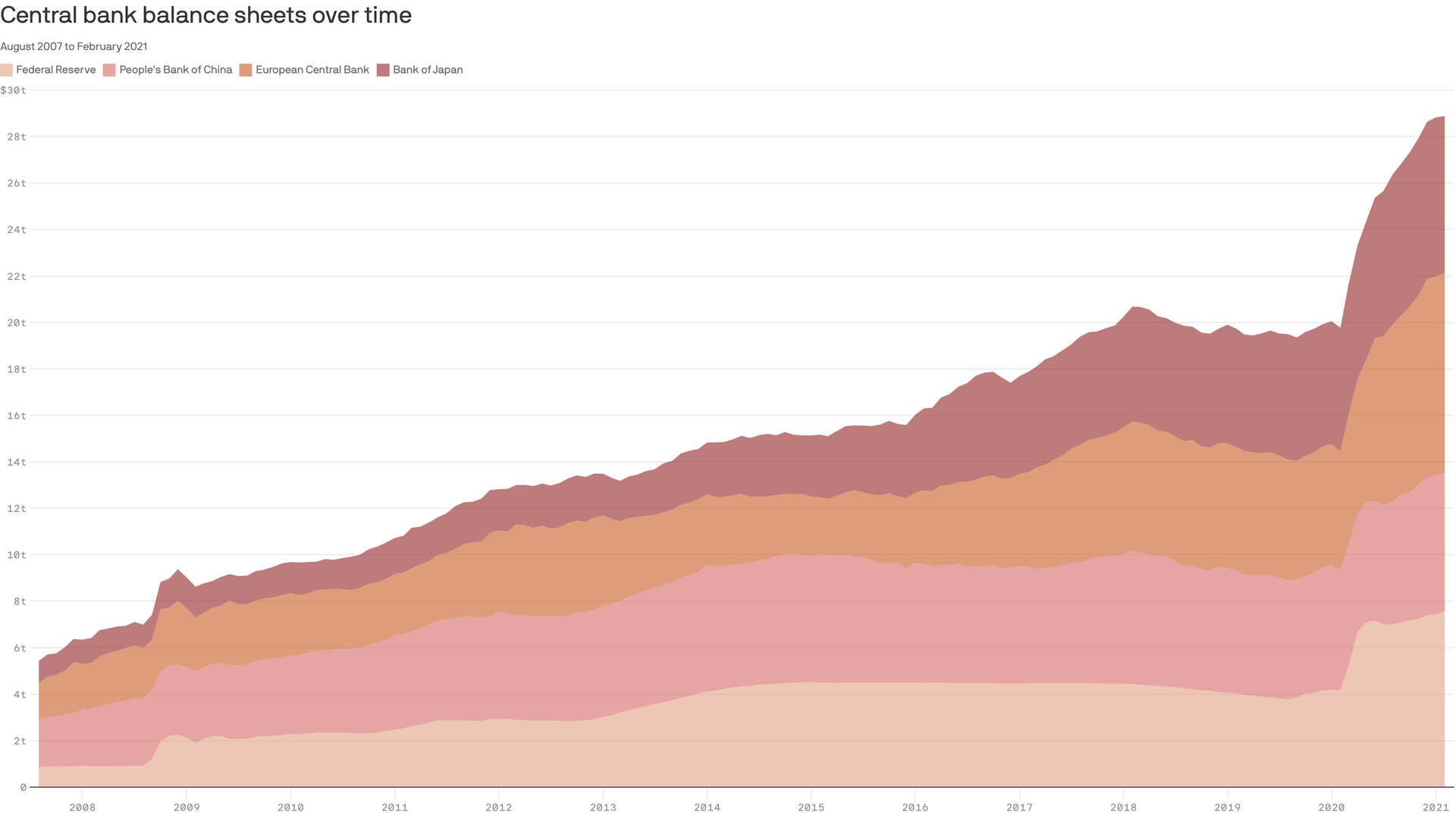

- The current run-up in both stock prices and real estate has many observers diagnosing a bubble. If that's the case, it's entirely in line with previous episodes where interest rates were kept extremely low for an extended period.

The big picture: Not all bubbles end in crises, although many do — at which point the very central banks that fueled the bubble are generally tasked with cleaning up the mess.

- What they said: "The central bank cannot effectively directly target stock or other asset prices," said Fed Chair Alan Greenspan in 1999. "It is the job of economic policymakers to mitigate the fallout when it occurs and, hopefully, ease the transition to the next expansion."