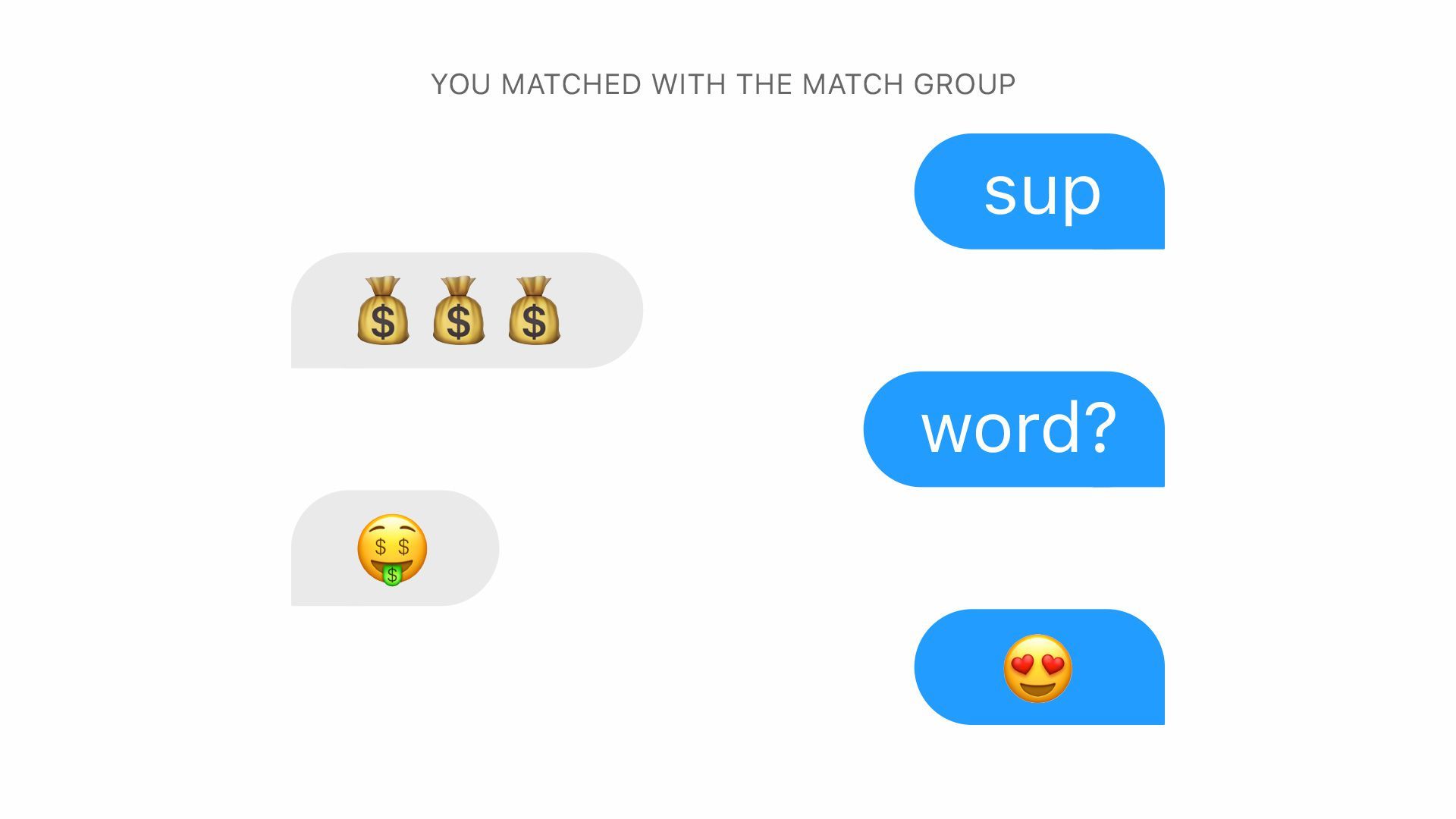

Illustration: Lazaro Gamio/Axios

Match Group, the parent company of Tinder, OKCupid, Match and other dating sites, issued a statement Tuesday criticizing Apple's 30% take on App Store purchases.

Why it matters: The move comes the same day that the European Union announced an antitrust investigation into Apple's practices.

Match Group has been in touch with regulators about its concerns, a source told Axios.

A Match Group representative told Axios:

"Apple is a partner, but also a dominant platform whose actions force the vast majority of consumers to pay more for third-party apps that Apple arbitrarily defines as “digital services.” Apple squeezes industries like e-books, music and video streaming, cloud storage, gaming and online dating for 30% of their revenue, which is all the more alarming when Apple then enters that space, as we’ve repeatedly seen. We’re acutely aware of their power over us. They claim we’re asking for a “free ride” when the reality is, “digital services” are the only category of apps that have to pay the App Store fees. The overwhelming majority of apps, including Internet behemoths that connect people (rideshare/gig apps), or monetize by selling advertising (social networks), have never been subject to Apple’s payments systems and fees, and this is not right. We welcome the opportunity to discuss this with Apple and create an equitable distribution of fees across the entire App Store, as well as with interested parties in the EU and in the U.S."— Match Group