2024 elections complicate climate tech startup investing

- Dan Primack, author ofAxios Pro Rata

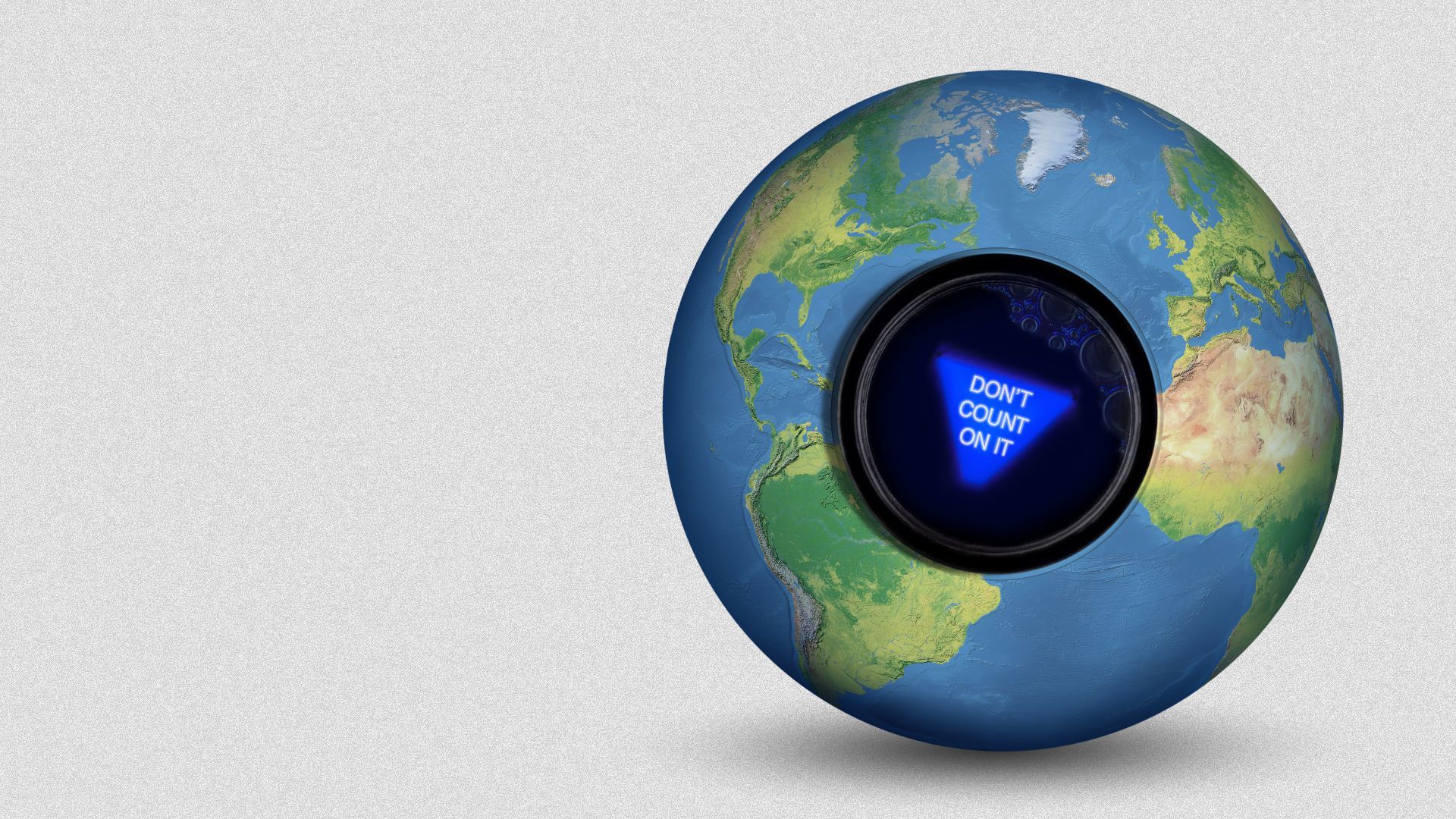

Illustration: Aïda Amer/Axios

The Inflation Reduction Act is a mighty boon to the climate tech sector, with its hundreds of billions of dollars in federal spending, grants and tax incentives.

Behind the scenes: It's also creating a schism among climate tech-focused venture capitalists, who are warily eyeing next fall's elections.

State of play: The IRA was passed via a partisan vote in late 2022, and the political rhetoric has remained largely unchanged.

- House Republicans unsuccessfully tried to gut IRA climate and energy provisions during the debt ceiling standoff earlier this year, and several leading GOP presidential candidates have suggested similar intentions.

- Democrats, including President Biden, remain strongly supportive.

Look ahead: Were Democrats to retain the White House, climate tech investors would breathe a sigh of relief, at least in terms of their business interests. Particularly those with portfolio companies whose IRA tailwinds are expected to be stronger in the bill's later years.

- The risk comes with Republican control of the executive and legislative branches. So does the aforementioned schism.

The cautious case: Some climate tech investors are preparing for a worst-case scenario of full IRA repeal.

- This means ignoring potential IRA benefits beginning in 2025 for prospective portfolio companies, and hardening revenue streams for existing ones. Not only in terms of direct government spend, but also in terms of IRA incentives for company clients.

- This strategy risks slower growth, but still gets to benefit from the federal largesse if either Democrats win or the GOP doesn't follow through.

The courageous case: Other climate tech investors remain all-in on IRA benefits, believing that a victorious GOP would be more talk than walk.

- Their basic argument is that big IRA money is flowing fast to red states, and that a Republican rep won't vote to stop construction on the new EV battery plant that just opened in their district. Let alone kill the slew of new renewable energy jobs in oil-rich places like Texas and Oklahoma.

The bottom line: Venture capitalists will continue to support the energy transition, regardless of federal spending. Their investment strategies, however, won't be uniform.