Photo Illustration: Shoshana Gordon/Axios. Photo: Tim Graham/Getty Images

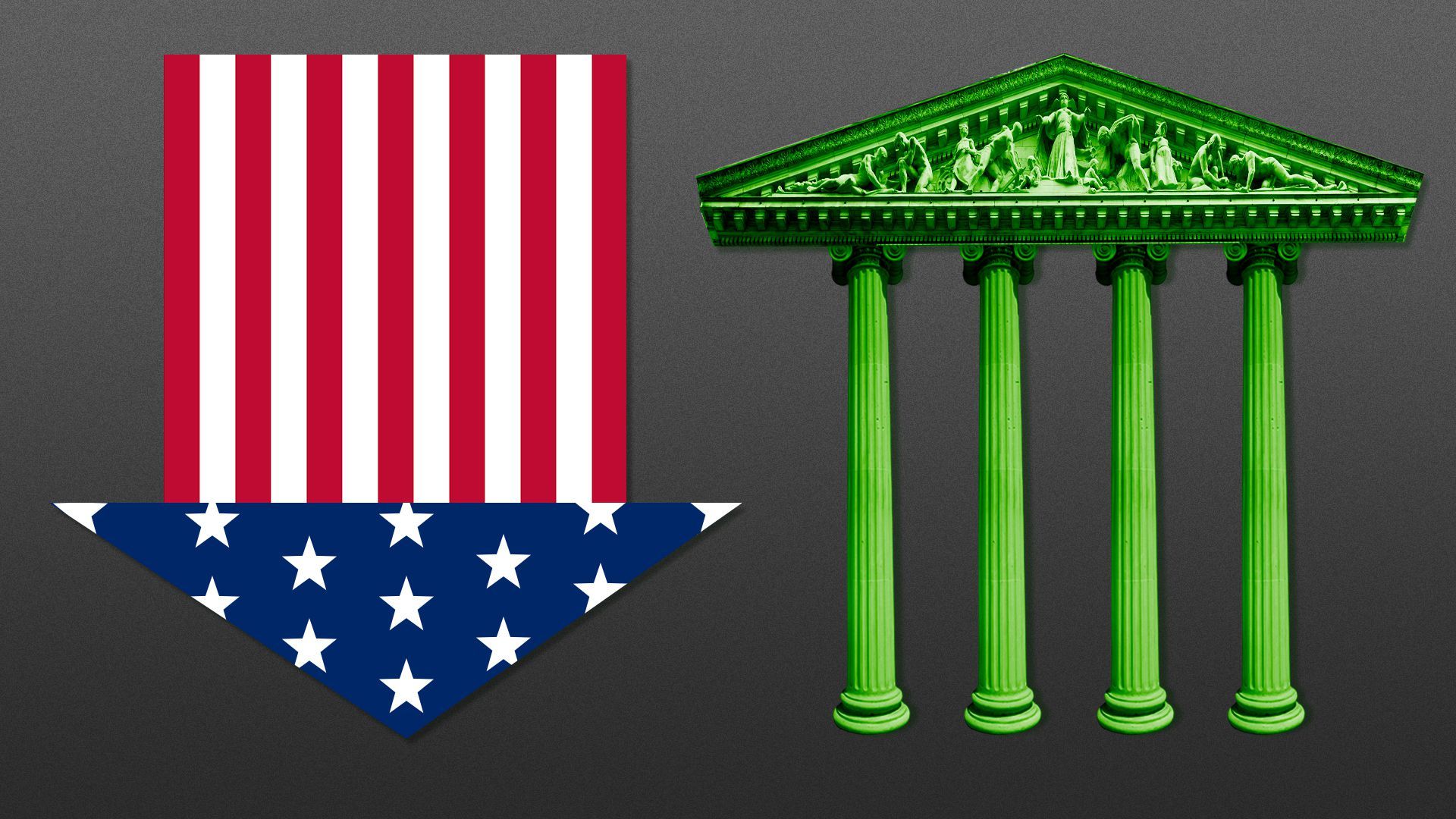

Economists have recently been paring back expectations for U.S. economic growth, even as financial market forecasters ramped up their expectations for U.S. stock prices.

Why it matters: The divergence in these two measures implies an uneven economic recovery as the stock market tends to slant toward financially powerful large corporations.

Driving the news: On Thursday, BofA’s U.S. equity strategy team raised its 2021 forecast for S&P 500 earnings per share to $204 from an earlier estimate of $185, following what it characterized as “another blowout earnings quarter.”

- While BofA maintained its bearish year-end S&P price target of 3,800, Wells Fargo made waves on Tuesday cranking up its target to 4,825 from its prior target of 3,850.

- This implies another 8% gain in the market by the end of the year from Thursday’s close.

- “Strong returns beget higher prices,” Wells Fargo strategist Chris Harvey said. “Over the last 31 years, there have been nine instances where the S&P 500 had a price return of 10%+ in the first eight months of the year; over the next four months, the index averaged another +8.4%.”

- This follows a slew of upwardly revised targets Axios covered earlier this month.

State of play: But last Friday, BofA’s U.S economics team actually lowered its outlook for Q3 U.S. GDP growth to 4.5% from 7.0%, citing slower activity amid the spread of the Delta variant.

- This followed similar downgrades by economists from Goldman Sachs and Wells Fargo.

The big picture: While GDP is a measure of activity across the entire U.S. economy, the stock market — as measured by the S&P — largely reflects the financial performance of the country’s largest companies, which have a much greater ability to compete than the country’s small businesses.

- Unlike GDP, which is a hard measure of activity, the stock market reflects prices determined by traders and investors, who in turn can be driven by forces like sentiment.

- Stock prices can also be affected by various technical forces like supply and demand.

The bottom line: Over much longer periods of time, stock prices and GDP have generally moved in the same direction as they are exposed to the same overarching trends like aggregate demand.

- But over shorter periods of time, they’ll sometimes move in different directions, reminding everyone they are not the same.

Go deeper: What to make of trader sentiment