February 27, 2018

Good morning and welcome back!

The internet is slightly divided on this point, but it seems like XTC's Oranges & Lemons may have been released on this date in 1989. That's reason enough to get going with some well-crafted British pop . . .

New warnings on LNG investment needs

A company planning to export liquefied natural gas from the Gulf Coast will warn lawmakers this morning that surging U.S. gas production could become "stranded" absent bigger investment in pipeline and LNG infrastructure.

On the record: In testimony prepared for a House Natural Resources Committee hearing today on the geopolitics of LNG, Tellurian president Meg Gentle says the government plays a key role in both laying the infrastructure groundwork for exports and offering a supportive and efficient regulatory environment.

"The U.S. clearly enjoys many advantages, but our valuable supply stands at risk of being left behind if we don’t build infrastructure now."— Tellurian president Meg Gentle

By the numbers: Gentle says her company plans to invest $29 billion in infrastructure. But, she says more is needed — an estimated $170 billion is required in initial investments industry-wide.

Why you'll hear about this again: The U.S. is poised to become a key player in global LNG markets. Exports from the Gulf Coast that began in 2016 with Cheniere Energy helped the U.S. recently become a net gas exporter.

- Pipeline exports are currently much larger. But the Energy Information Administration's long-term forecast shows LNG increasingly dominating the nation's gas trade.

Shell's global warning: In a report yesterday, Shell points out that final investment commitments in LNG projects worldwide have stalled since 2015. And, this creates the risk of a supply-demand gap opening in the mid-2020s.

- The problem, Shell says, is a "mismatch" — customers want shorter and smaller contracts, but that does not bring the kind of certainty that supports investment commitments for massive new supply projects.

Go deeper: CNBC breaks down Shell's analysis here.

Latest in policy: nuke talks in London and ethanol wars at home

Nuclear power: Energy secretary Rick Perry will travel to London to meet with Saudi Arabian officials Friday to discuss a possible deal to build nuclear reactors in the kingdom, per Bloomberg citing sources familiar with the plan.

- The administration is negotiating with the Saudis on a nuclear agreement that would pave the way for Westinghouse to win lucrative development contracts there.

- But there are unresolved questions about whether the U.S. will bend on provisions that would bar uranium enrichment and reprocessing in exchange for access to U.S. nuclear tech, Bloomberg reports.

Biofuels: President Trump is slated to meet at the White House today with several GOP senators, EPA administrator Scott Pruitt and others to discuss possible changes to the Renewable Fuel Standard that would ease compliance costs for oil refiners.

- New pressure: The National Corn Growers Association, the American Farm Bureau Federation and four other agriculture groups sent an open letter to Trump yesterday urging him not to "entertain proposals that would undermine the purpose and intent of the RFS."

- More: Reuters discusses the state of play here.

The crude oil "supply gap" risk

A big question among oil experts these days is whether today's worldwide investments in new supplies are too low to avoid risk of a "supply gap" opening up in the early 2020s as demand grows and existing fields decline. Here are two competing views offered this week...

Fresh warning: The head of one of the world's largest oil-and-gas companies says the surge in U.S. crude production is not enough to prevent problems from emerging in a few years.

- “Even if the U.S. shale oil is dynamic, we do not invest enough in this industry,” Total CEO Patrick Pouyanné says on the new episode of the Columbia Energy Exchange podcast.

- He says under-investment in recent years is still a problem in 2018.

- “Post-2020, the price will go high, because we will have a lack of capacity, and even with the shale oil dynamic, the global production of oil will be not enough. We are under-investing,” Pouyanné says.

Don't worry so much: A research note this week from Barclays analysts, however, suggests that these types of concerns are likely misplaced.

- They argue that even with declines from mature fields, there has been enough new supply coming online from 2011–2017 even outside OPEC and U.S. shale to nearly offset it. And they don't see that changing.

- "In the next couple of years, projects that have already received a green light are coming online and will further mitigate those declines. That means that the ‘mature base’ of non-OPEC non-US supply is flat from now through at least 2022, and it leaves OPEC liquids, US tight oil, Canadian oil sands, and non-crude liquids available to meet incremental demand growth," they write.

23 states hiked gas taxes since 2013

Data: American Petroleum Institute; Cartogram: Chris Canipe / Axios

Via my colleague Amy Harder...

Nearly half of all U.S. states have raised their gasoline taxes since 2013, according to industry data compiled by Axios.

Why it matters: The trend, which includes conservative states, stands in stark contrast to the opposition that congressional Republicans and conservative interest groups have to raising the federal gas tax.

- Trump has endorsed the idea of raising it to help fund his administration’s infrastructure proposal. The tax, which Congress hasn’t raised in 25 years, stands at 18.4 cents per gallon.

What’s next: A battle between two corners of the Republican Party.

- The U.S. Chamber of Commerce is pushing a 25 cent gas tax hike as part of the broader infrastructure overhaul plan it’s pitching to Congress.

- Conservative groups led by Americans for Prosperity are fighting it. The head of that group, Tim Phillips, told Axios recently this is a top issue for them and they’re considering running campaigns against conservatives who support such a policy.

Quick take: The Chamber’s proposal, despite an apparent endorsement by Trump, faces steep odds in Congress. Many Republicans are opposed to the notion that Washington would raise taxes shortly after passing tax cuts. But both sides of this battle view the proposal as the beginning of a years’ long fight.

Electric vehicle news and notes

Policy: My Axios colleague Kia Kokalitcheva reports that "California regulators have approved new rules that will allow the testing of fully driverless cars on state roads as soon as April."

- Why it matters: Analysts expect that the rise of autonomy and shared mobility will help boost electric vehicle deployment in years and decades ahead.

More policy: Utility Dive looks at a recent report on state-level and utility policy moves on EVs last year, and draws a contrast with tensions over solar.

- "[W]hereas the rooftop solar battles often divided utilities and environmental organizations, the two are finding new common ground in transportation electrification.

Forecasts: The Financial Times reports that big automotive supplier Valeo has doubled its forecast for EV sales, thanks to increased spending by automakers on their EV lines.

- "Valeo...expects at least [10%] of all vehicles sold by 2025 to be powered by a battery, compared with the [5%–6%] internal forecast it had last year," the paper reports.

Fuel mix: "The Boston Consulting Group added its voice to the chorus of forecasts predicting a slump in U.S. gasoline consumption as electric vehicles become popular and internal combustion engines turn more efficient," per Bloomberg.

- They see gasoline demand falling by as much as 35% by 2035.

- BCG notes that EV policies in China and elsewhere — such as British and French plans to ban sales of internal combustion cars by 2040 — will have a spillover effect here.

- "Even if the US doesn’t follow suit, global EV demand is likely to increase, driving costs down further and supporting US adoption."

- Go deeper: Click here to read the whole BCG report, a big-picture look at the challenges facing oil-and-gas companies.

One cool website

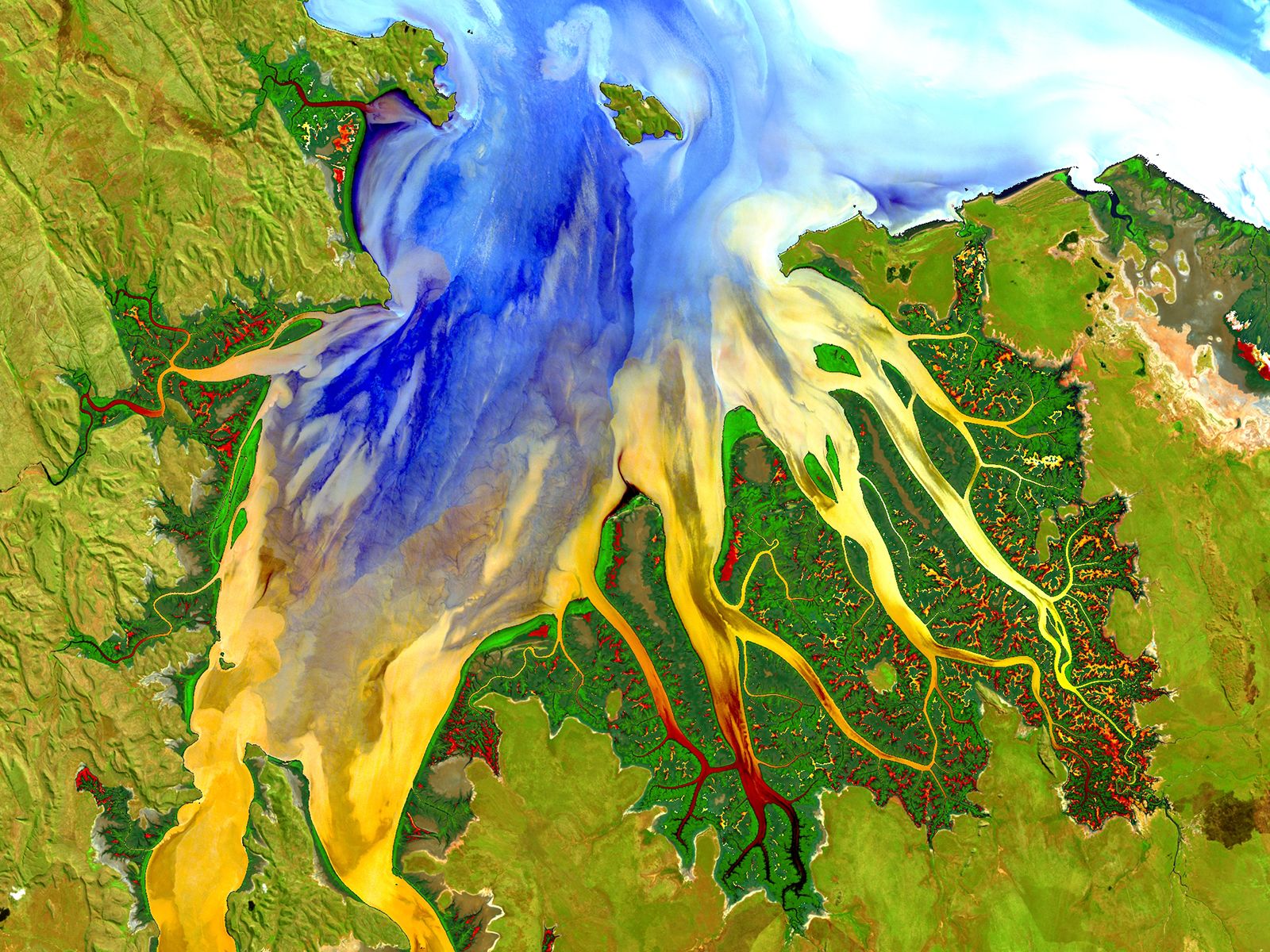

View from above: This corner of NASA's website has a bunch of amazing satellite photos of places all over the planet. The shot above, from the Landsat-8 satellite in 2013, is part of Western Australia.

"The image shows rich sediment and nutrient patterns in a tropical estuary area and complex patterns and conditions in vegetated areas," NASA's description states.