October 10, 2019

In this week's newsletter: Corporate parochialism; art; philanthropy; and the outlook for the U.S. and the U.K. All in just 1,830 words, which will take you about 7 minutes to read.

- If you like this newsletter, tell your friends! They can always sign up at edge.axios.com.

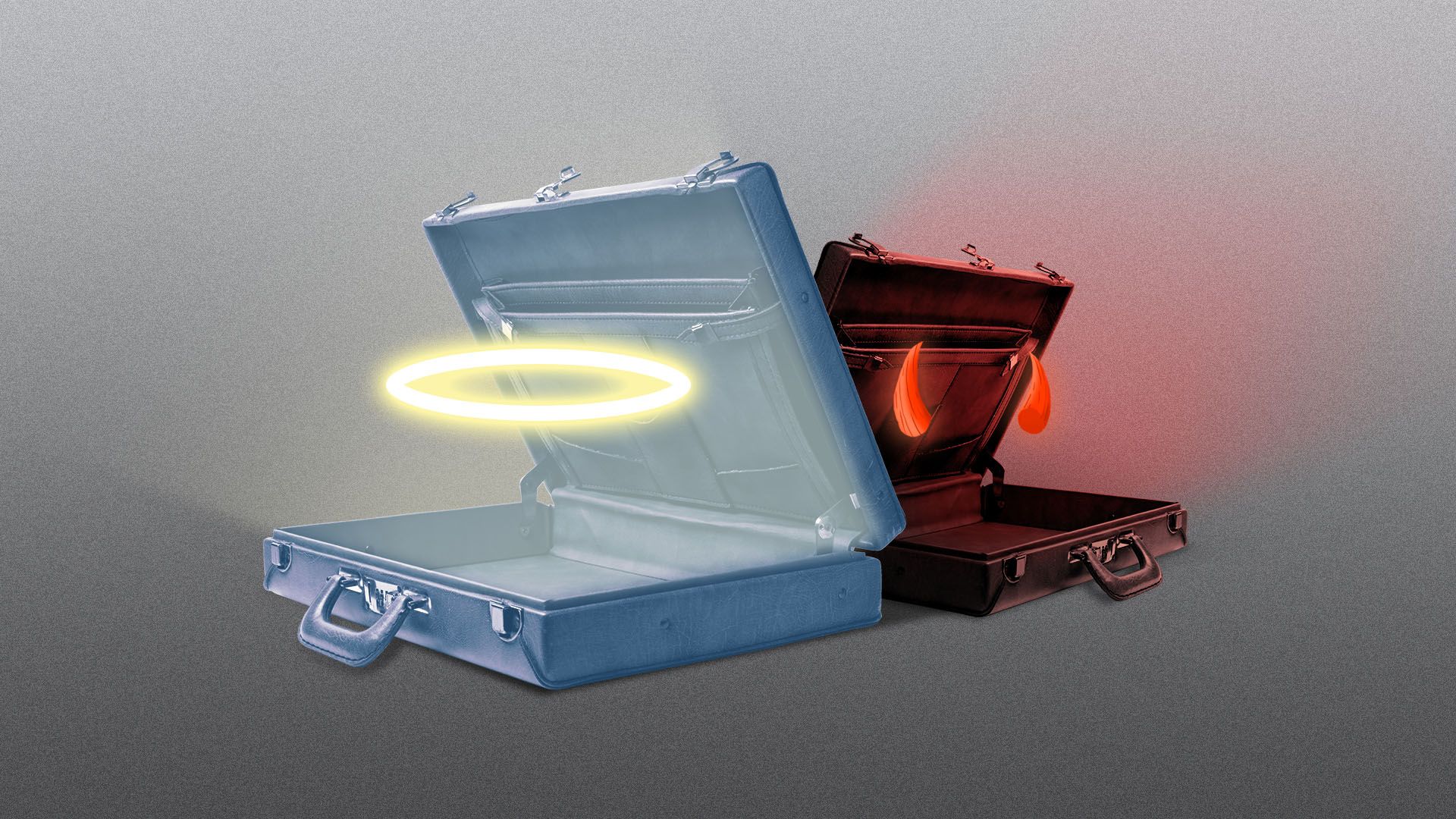

1 big thing: Corporate America's parochial morals

Illustration: Sarah Grillo/Axios

There's a double standard in corporate America. CEOs-turned-activists are experimenting with taking bold stances on social and political issues at home, writes Axios' Erica Pandey — but that activity stops at the nation's borders. It certainly doesn't reach as far as China.

Why it matters: The same companies that extol high-minded principles on U.S. soil are perfectly content to abide by every censorship rule set by the Chinese Communist Party — and are even happy to travel to Riyadh to butter up the murderous Saudi royal family.

- Apple has been a leader on immigration in the U.S., going to bat for Dreamers. But it also removed the HKmap.live app from its app store after complaints from China, citing danger to Hong Kong’s police. Its latest iOS update caused the Taiwanese flag to disappear for users in the Chinese territories of Hong Kong and Macau, as well as anybody on the mainland.

- Google has taken the same stance on Dreamers and on its app store. It was also caught building a censored search engine for China.

"China’s economic miracle hasn’t just failed to liberate Chinese people. It is also now routinely corrupting the rest of us outside of China."— Farhad Manjoo writes in NYT Opinion

The list is almost endless. All three big U.S. airlines — American, United and Delta — bent to the party’s will last summer and scrubbed references to Taiwan; Marriott did likewise. Gap apologized for selling T-shirts with a map of China that didn't include Taiwan, saying its map was "incorrect." Even news organizations are treading carefully, if they're owned by Disney. Hollywood has long accepted China's censorship rules to rake in its profits.

Driving the news: American firms’ instinctive deference to Chinese autocrats was thrust into the national spotlight this week.

- Basketball fans watched the NBA chide the Houston Rockets’ GM for tweeting — then deleting — a single image supporting Hong Kong protestors.

- Sneakerheads watched Vans pull shoe designs that alluded to the Hong Kong movement from a global sneaker design contest.

- Gamers watched Activision Blizzard — an American company in which Chinese tech giant Tencent has a 4.9% stake — suspend and take prize money from a Hong Kong-based player who publicly supported the protests.

One level deeper: Thermo Fisher Scientific, which is based in Massachusetts, boasts of its "strong global citizenship practices." But, it has also supplied the Chinese government with DNA sequencers that are being used to collect the DNA of Uighur ethnic minorities in Xinjiang.

The bottom line: For all that CEOs increasingly talk of their "moral duty to speak up," those moral duties seem to be left on the tarmac whenever they hop on their corporate jet.

2. The perfect economy ...

We're in a Goldilocks economy, if you believe Fed chair Jay Powell. He gave a speech on Tuesday to the National Association for Business Economics in which he reminded the attendees just how special the current economic situation is.

"We don’t get to see the 11th year of an expansion a lot, and there’s a lot to like about it, particularly for people at the lower end of the wage scale who are getting now the highest raises. And it’d be great to continue."— Jay Powell

Powell was upbeat about his interest rate cuts, which he said were designed to give the economy room to "gather steam again." He was also optimistic on inflation, and said he was trying very hard to persuade the markets that he wants to see it higher.

Powell barely needed to mention unemployment, which is at a 50-year low. There are now just 1.04 Americans looking for work for every job vacancy in America, according to new data from the U.S. Chamber of Commerce. That's an all-time low and bespeaks a very healthy labor market.

3. ... but a far from perfect earnings season

Next week is the official start of earnings season. Major banks will report their 3rd quarter results, including JPMorgan, Wells Fargo and Goldman Sachs, writes Axios' Courtenay Brown. Look out for United Airlines and J&J too.

Why it matters: Expectations are low. Analysts expect S&P companies' third-quarter earnings to come in 4% lower than the same period last year. That would mark the biggest year-over-year drop since 2016, according to FactSet.

- Companies have been guiding investors' expectations downward in the wake of uncertainty about the trade war, higher tariff-related costs and concerns about the global economy. What's certain is that earnings won't come close to the expectations that the market priced in last year.

4. Brexit vs. democracy

The Brexit omnishambles continues. The chance of Britain agreeing to any kind of a deal with the European Union seems to have fallen to zero, and no one has a clue what will happen after Oct. 17, the date of the last EU summit before the Oct. 31 deadline.

- By law, U.K. Prime Minister Boris Johnson is going to have to officially ask the EU for yet another extension. Whether he'll do so, however, is unclear; he certainly doesn't want to.

- After that, things get even murkier. Will there be a vote of no confidence? (Probably.) Will Johnson lose that vote and resign as prime minister? (Yes and maybe.) Will there be another general election, who will win it, and will Brexit even happen? ¯\_(ツ)_/¯

The will of the people is clear. Britons voted narrowly to leave the EU in 2016, but in the intervening 3 years, some of them have changed their minds. Plus, a large number of older "Leave" voters have died and a similar number of young "Remainers" have attained voting age.

- The result can be seen in the chart above. YouGov looked at 300 different Leave vs. Remain opinion polls and found that most of the polls in 2016 favored some kind of Brexit. Now, however, they all favor Remain.

The bottom line: Brexit remains more likely than not. But it's not what the people want.

5. Devolved art

One of the few winners from the Brexit mess was the anonymous consignor of “Devolved Parliament,” a Banksy painting that sold for £9.9 million, or $12.2 million, a few days ago at Sotheby’s in London.

- The painting is a decade old, but has never been more timely, given that the only politician disliked more than Boris Johnson is the leader of the opposition, Jeremy Corbyn.

The painting easily set a new auction record for Banksy, whose previous record was $1.9 million that was set at a charity auction for a Damien Hirst collaboration.

- Auction records have also been smashed recently by another street artist, KAWS, whose “The Kaws Album” sold for $14.7 million at Sotheby’s in Hong Kong in April. His previous auction record was $2.7 million.

- Yoshitomo Nara’s “Knife Behind Back” sold for an astonishing $25 million this week, again at Sotheby’s in Hong Kong. That's more than 5 times his previous auction record.

These might be highbrow prices, but they are not highbrow paintings. “The Kaws Album” and “Devolved Parliament” are not-very-funny one-note jokes, while “Knife Behind Back” is an oversized cartoon figure. Art gadfly Kenny Schachter has given this trend a name: "infantilism".

Why are these artworks so expensive? Part of the reason is relatively mundane: All 3 canvases are old-fashioned paintings, and all of them are unusually large.

- There's also supply and demand. These artists have large fan bases, and the top 0.01% of those fan bases will want to own strikingly large unique works. All you need is 2 rich collectors duking it out in an auction room for a single piece, and a crazy new record is set.

Simplicity sells. In the modern era, each successive generation of artists has generally become easier to understand and appreciate.

- Take an old master: Try to unpack the layers and craftsmanship in “Las Meninas” by Velázquez.

- Then look at, say, “The Dance” by Matisse. The “difficulty level” has clearly gone down, not up.

- Then fast-forward to Pollock’s drip paintings, Warhol’s Marilyns, and finally the cartoonish stylings of Jeff Koons or Meow Wolf. Each is simpler, more universal, more easily grokked, more exportable than the last. You need less and less specific cultural context or connoisseurship to appreciate these works.

The bottom line: As the world of art collectors has expanded and globalized, the minimum level of sophistication that an artwork needs in order to fetch 8 figures at auction has clearly been falling.

6. Unphilanthropic philanthropy

Illustration: Aïda Amer/Axios

You must read this ProPublica investigation into the philanthropic predilections of hedge fund billionaire David Shaw. Per the article...

- Shaw donated $37.3 million over the course of 7 years to Harvard, Yale, Princeton, Stanford, Columbia and Brown. The donations, most of which went to universities where neither he nor his wife had any connection, accounted for the majority of his charitable giving. His apparent aim: "Making selecting a college as easy as ordering from a takeout menu."

- The money spent on donations was backed up with millions more spent on school fees, tutors and other personal services for his 3 children. (The great cartoonist Jules Feiffer, for instance, was given what he describes as "real money" to illustrate a book written by Shaw's 9-year-old.)

- Shaw's two eldest children went to Yale, after receiving every conceivable advantage in life, plus some that frankly I couldn't even have imagined. ("Even the children’s friends who visited the Shaws’ apartment on the Upper West Side were not aware that the family owned other apartments in the building brimming with personal staff.")

By the numbers: The overall cost of raising a child in America was $233,610 in 2015, or just under $14,000 per year. Then again, as Yale law professor Daniel Markovits demonstrates in his new book, the average child in America has essentially zero chance of getting into Yale — or any of the other schools that Shaw attempted to buy entry to.

- If you pour tens of millions of dollars into maximizing your children's opportunities in life, they will generally end up outperforming most normal children. But in no sense can that expenditure be considered philanthropic.

Elsewhere in academia, MIT has launched "a groundbreaking philanthropic venture fund" called Solve Innovation Future. It plans to take in some $30 million in tax-deductible philanthropic dollars, starting with a $3 million pledge from Noubar Afeyan, the CEO of Flagship Pioneering.

- All of the money will be put into for-profit investments or internal expenses. When the investments pay out, any profits will be rolled into yet more for-profit investments, in perpetuity.

- There's no limit to how big the fund can get, there are no limited partners to get any payouts, and there are no plans for the fund to ever give away any money in the form of philanthropic grants.

My thought bubble: The giant tax-exempt hedge funds known as Harvard and Yale lose about 5% of their assets every year, in the form of donations to their venerable educational subsidiaries. Solve Innovation Future makes you wonder why that's even necessary.

7. Building of the week: Güstrow Castle

Photo: Bernd Wüstneck/picture alliance via Getty Images

When you think of the Renaissance you normally think of Italy — but Güstrow Castle, in northern Germany, is a masterpiece of 16th Century architecture by master builder Franz Parr.

- The castle was built for Ulrich, Duke of Mecklenburg, and the original stucco ceilings survive to this day.

- Now a museum, the building is about to undergo its first major renovation since 1978. The work, which is planned to last until 2023, will cost about €28 million, much of which will be covered by the EU.