Axios Capital

August 27, 2020

Situational awareness: It's Aug. 27, a big date on the TikTok calendar. Surely CEO Kevin Mayer knew that when he picked today as his resignation date. Expect some kind of sale announcement before Monday, possibly even including Walmart.

In this week's newsletter, I look at a financial indicator that is deeply rooted in the real world; a "mall short" that is really just a purely financial speculation; lots of companies going public; and much more. But I lead with this morning's Fed news. That has tipped the word count just over the 2,000 mark. Still, the whole thing should take you less than 8 minutes to read.

- Please send ideas and feedback to [email protected]. (Unless it's pedantry about the Dow not being an index. I know.)

1 big thing: America has a new central bank

Illustration: Eniola Odetunde/Axios

Today is a truly historic day in Fed history — one that will have a transformative effect on U.S. monetary policy for the foreseeable future.

Driving the news: For decades, the main job of central banks has been to keep inflation down. The Fed has now effectively changed that policy, to instead prioritize maximum employment.

- What they're saying: "Following periods when inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time."

Between the lines: Fed attitudes towards inflation have been evolving steadily in recent years, as it has stubbornly refused to tick up even during periods of full employment.

- Today's announcement marks the end of the Fed worrying that employment can sometimes be too high.

- Before today, the Fed was charged with assessing "deviations" from maximum employment — either to the upside or to the downside. Now, the Fed will only look at "shortfalls" from that level.

- It's an admission that an economy can never have too much employment.

The big picture: The biggest change is that if the Fed expects inflation, it now no longer needs to raise interest rates. Instead, it can wait and see whether inflation actually arrives, and act only then.

Go deeper: The Fed's messaging around this move is exemplary. There's a simple and clear press release, a major speech from Jay Powell, a detailed policy statement, and then a collection of a dozen different papers all filling out the details of the thinking that went into the new policy.

The bottom line: This news represents a radical change in how the Fed thinks about its job. It will provide powerful ammunition should ECB president Christine Lagarde want to start trying to make similar changes.

2. The most American index

Photo illustration: Sarah Grillo/Axios. Photo: Johannes Eisele/AFP via Getty Images

For all its weakness as a stock-market gauge, the Dow Jones Industrial Average continues to tell us a lot about the state of corporate America, as opposed to the state of the equity market.

Why it matters: The Dow is a slice of America masquerading as a stock-market index.

How it works: The Dow is not what it used to be.

- I mean that literally: The Dow Jones Industrial Average has had 30 components since Oct. 1, 1928. As of this Monday, none of the original companies will be represented in the average.

- The Ship of Theseus has now officially sailed: The last surviving member of the original 30, ExxonMobil (f/k/a Standard Oil of New Jersey), is being ejected from the index in favor of Salesforce, a company founded in 1999.

- ExxonMobil's rival, Chevron (f/k/a Standard Oil of California), still remains, but that's it for energy companies. Chevron accounts for a mere 2% of the Dow, which is weighted on nominal share price rather than market capitalization.

Because nominal share price matters so much to the Dow, Apple's recent decision to do a four-for-one stock split forced the biggest changes to the average since at least 2013. Pfizer and Raytheon are also out; Amgen and Honeywell replace them.

Between the lines: The Dow has accepted Nasdaq-listed companies since 1999, when Microsoft and Intel joined. But tech giants of more recent vintage are still absent.

- Amazon and Alphabet can't join because their share price is too high, and Facebook is a victim of its classification as "communication services" rather than "technology."

The big picture: The Dow is anachronistic in many ways, a creature of a time when it was easier to buy 30 stocks than to buy 500, and when "I'll take one share of each" was the height of sophistication in how people diversified their holdings.

- Still, the Dow represents a representative cross-section of America's large-cap universe, including names such as McDonald's, JPMorgan Chase, Walt Disney, Coca-Cola, Nike, and Procter & Gamble.

The bottom line: The Dow has been a notorious underperformer in recent years, when it comes to stock market indices. But if it can't keep up with the stock market as a whole, that's a sign of just how narrow the recent advance has been.

Bonus: How the Dow has lagged

Even with Apple accounting for more than 12% of the Dow, the average has underperformed all broad stock market indices this year.

- After its stock split, Apple will account for less than 3% of the Dow.

- From Monday onwards, two of the three biggest Dow components will be healthcare companies. UnitedHealth and Amgen will make up almost 13% of the Dow between them.

- Merck and Johnson & Johnson bring the health care sector up to 18.6% of the Dow. That's significantly larger than the S&P 500, where the health care sector is 14.2% of the index.

3. Mall rats

Photo illustration: Sarah Grillo/Axios. Photo: PL Gould/Images/Getty Images

The so-called "mall short" — an attempt to find a derivative instrument that would pay off if certain shopping malls end up defaulting on their mortgages — ended up making a lot of money for a lot of hedge funds. Largely by dumb luck.

Why it matters: The mall short, also known for the past few years as "the next big short," made more than $1 billion for Carl Icahn alone. But it wasn't an easy win.

- Eric Yip's Alder Hill Management closed last October after being too early on the mall short, which finally paid off only when the coronavirus forced malls around the country to close their doors entirely.

How it works: Short selling, per Kate Kelly of the New York Times, is seen as a business that "preys on failure and can push a business over the edge."

- In this case, however, any defaults on shopping-mall mortgages were caused by the pandemic, not by financial speculators.

At the center of the trade was an obscure financial index — the CMBX 6 — derived from a list of 25 commercial mortgages dating from 2012, each with a face value of between $32 million and $75 million. Many of those mortgages were on shopping malls.

Speculators were closely watching whether those mortgages would default, and made enormous wagers (much bigger than the mortgages themselves) on whether and when default would come.

- When the pandemic hit, the index plunged, and fortunes were made.

Of note: The speculators were betting against extremely sophisticated investors at the likes of Alliance Bernstein and Putnam Investments.

- Before the pandemic, the long side of the trade was winning. The longs have been making money since May, too. But they lost billions in March and April.

The bottom line: Looking at the fortunes of the CMBX 6, or of the hedge funders betting on it, tells you surprisingly little about the state of commercial mortgages more generally. While many analysts still expect a wave of defaults, that wave hasn't started yet.

- The mall short makes for a gripping tale of high-stakes gambling. But it's not really about malls, and it certainly isn't a morality tale.

4. A tale of two direct listings

Illustration: Lazaro Gamio/Axios

This was a big week for you, if you're a Facebook billionaire looking to take your money-losing post-Facebook company public by doing a direct listing of shares on the New York Stock Exchange.

Background: Asana was founded by Facebook co-founder Dustin Moskovitz in 2008; Palantir was founded by Facebook investor and board member Peter Thiel in 2003. Both companies released their full financials this week.

- Moskovitz, who still owns some 32 million Facebook shares worth almost $10 billion, also owns 36% of Asana. A high-profile Democrat, he is married to former Wall Street Journal reporter Cari Tuna, and has pledged to give away nearly all of his wealth.

- Thiel, who has sold all but a handful of his Facebook shares, owns just under 19% of Palantir. A high-profile Republican, he is very close friends with former Wall Street Journal reporter Alexandra Wolfe, whom he installed as a board member of Palantir. His idea of philanthropy is suing a journalistic outlet to run it out of business.

Both men own super-voting shares that give them much more control over their companies than their economic stake would imply.

- So long as that share structure remains in place, neither company will be eligible to join the S&P 500.

Asana has a leadership coach, Diana Chapman, who told Forbes that "I don't think I've ever heard them speak about profits." The company lost $118.6 million in fiscal 2020, more than double its losses the previous year, and has an accumulated deficit of $365.6 million.

- "We do not expect to be profitable in the near future," says the company in its stock-market filing, "and we cannot assure you that we will achieve profitability in the future."

Palantir lost $580 million in both 2019 and 2018.

- "We have incurred losses each year since our inception," writes the company, "and we may never achieve or maintain profitability."

The bottom line: Remember when Silicon Valley's "new mantra" was "make a profit"? Amazingly, that was less than a year ago.

5. Why the next direct listings will raise capital

Illustration: Sarah Grillo/Axios

Neither Asana nor Palantir is likely to raise any new capital as part of its direct listing. That's partly because Palantir raised $500 million as recently as July, and it's partly because raising money through a direct listing was illegal before yesterday.

Driving the news: The SEC now allows companies to raise new money as part of a direct listing — what I called a "direct listing IPO" last year, when Axios' Dan Primack and I were wondering whether such a thing would ever happen.

How it works: The NYSE structure receiving the SEC's stamp of approval is not the kind of hybrid model that Dan envisioned last year, in which companies would be able to allocate shares to investors like they do in a traditional IPO.

- Instead, the company will simply promise to sell a certain number of shares at the auction that kicks off the first day of trading.

- The company can set a minimum price below which it won't sell — but if the company doesn't sell its own stock, then the whole listing is abandoned, and nobody is allowed to buy or sell the stock.

- The company's share offer gets priority — those shares will be the first to be sold.

The upside of this system for issuers is that they don't "leave money on the table" when a stock "pops" on its first trade. Whatever price the market sets is the price the company receives.

- The downside is that the company has no idea how much money it's going to end up raising until after the auction is over.

The bottom line: Airbnb expressed interest in a direct listing in the pre-pandemic days before it had to lay off a quarter of its workforce. Now that it's finally going public, maybe this kind of direct listing IPO will prove attractive.

6. Ant financials

Illustration: Eniola Odetunde/Axios

A more traditional IPO is coming up in Hong Kong and Singapore. The two jurisdictions are going to see a dual listing from Ant, the Chinese financial giant spun off from Alibaba Group.

- "We call ourselves Ant because we believe that small is beautiful, small is powerful," says the prospectus. But Ant is anything but small.

Ant owns Alipay, half of China's private-sector payments duopoly; it processed ¥118 trillion ($17 trillion) in the year ending June 2020. To put that in perspective, in the same period Visa saw transaction volumes across credit and debit cards combined of $4.4 trillion in the U.S. and $7 trillion in the rest of the world.

- Alipay alone has more than 1 billion users.

- Ant also owns Yu'ebao, China's largest money-market fund, with $170 billion in assets.

Ant is already profitable, making $3 billion in profit in the first half of this year.

- It has already lent $300 billion to Chinese consumers and small businesses, and it manages $590 billion of its customers' wealth.

What they're saying: "We do not believe bigger is better; our pursuit is sustainable development that lasts at least 102 years."

The bottom line: Ant is expected to be worth more than $200 billion when it goes public. That's a lot of money, but Visa is worth $460 billion. Ant does more business than Visa, across more product lines, and is growing much faster.

7. Putting home sales in perspective

July saw a surge in both new and existing home sales, breaking month-on-month records as homebuyers flocked to take out cheap mortgages and buy bigger homes with more space for living and working.

The big picture: Don't get too caught up in the narrative. For all the anecdotes you have probably heard about urban renters deserting the city and buying homes in the suburbs, the fact is that 2020, through July, has actually seen fewer home sales than there were during the first seven months of 2019.

By the numbers: July saw 597,000 sales of existing homes, per the National Association of Realtors, and 78,000 sales of new homes, per the U.S. Census Bureau. Those numbers represent a year-on-year increase of 57,000 homes and 23,000 homes respectively.

- For the year as a whole, however, 2020 is still running 110,000 homes behind 2019, thanks to the decline in home sales during the earlier months of the pandemic.

8. Coming up: Brazil's Q2 GDP

Illustration: Aïda Amer/Axios

Brazil's second-quarter GDP is out on Tuesday.

Why it matters: It's expected to show the worst plunge in economic activity in the country's history,

- The economic implosion comes as President Jair Bolsonaro has expended serious efforts to downplay the severity of the coronavirus.

- Brazil is a pandemic hotspot, with more infections and deaths from the virus than any other country in the world except the U.S.

By the numbers: The economy likely shrunk 9.4% from the prior quarter, economists say — though estimates range from -7.5% to -13.6%, according to Reuters.

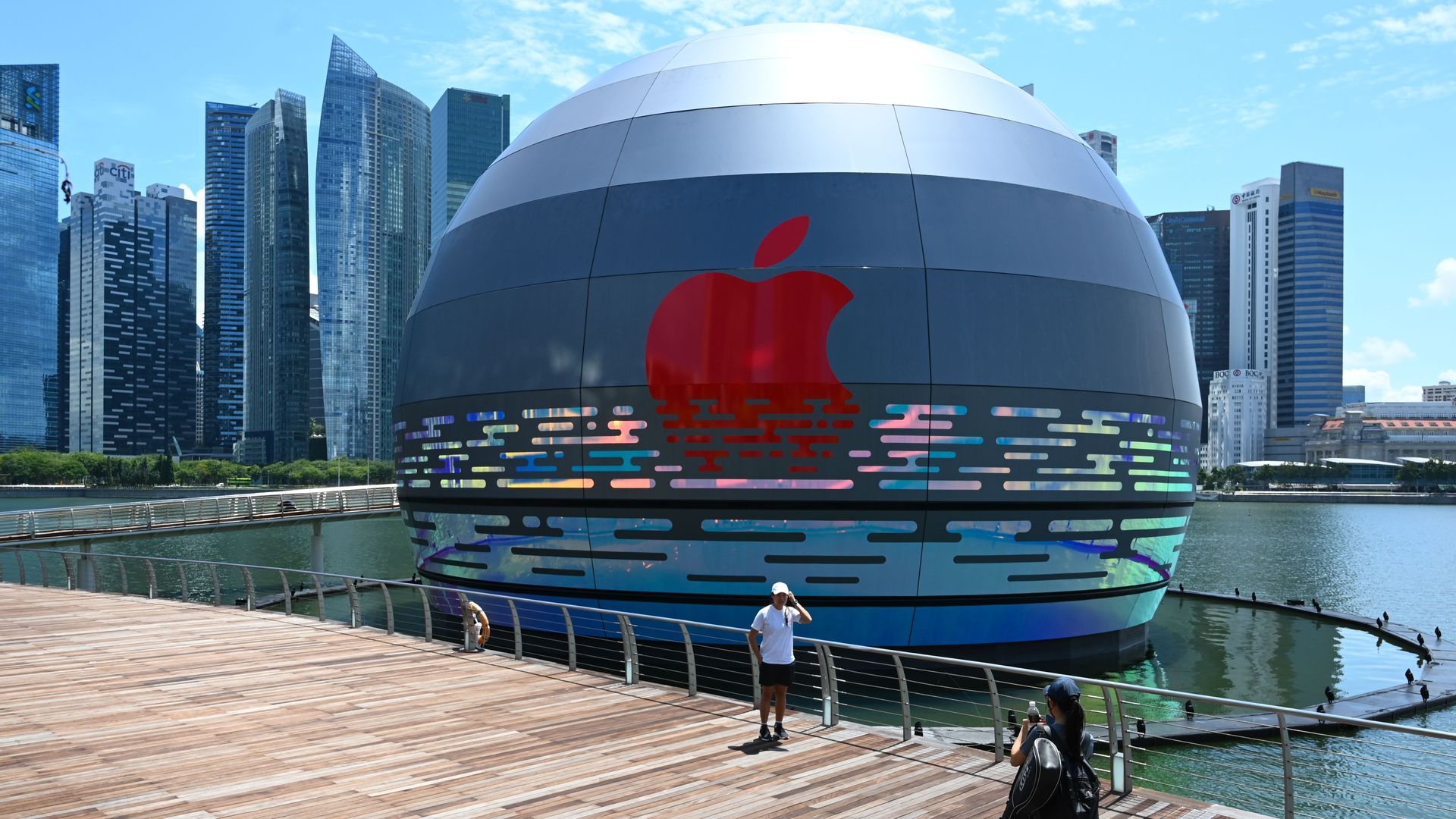

9. Building of the week: Apple Marina Bay Sands

Photo: Roslan Rahman/AFP via Getty Images

Apple's newest store, in Moshe Safdie's Marina Bay Sands complex in Singapore, was designed by Foster + Partners.

- As Dezeen's Tom Ravenscroft drily notes, "the store will be Apple's first spherical shop and the first surrounded by water."

- The store floats, rising and falling with the tide.

Entrance to the store, which glows at night and has its own custom signage, is via underwater passage.

- The center of the roof is an iris-like oculus, harkening back to the Pantheon in Rome.

Sign up for Axios Capital

Learn about all the ways that money drives the world