Metro Atlanta homebuyers overpaid, analysis says

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Sarah Grillo/Axios

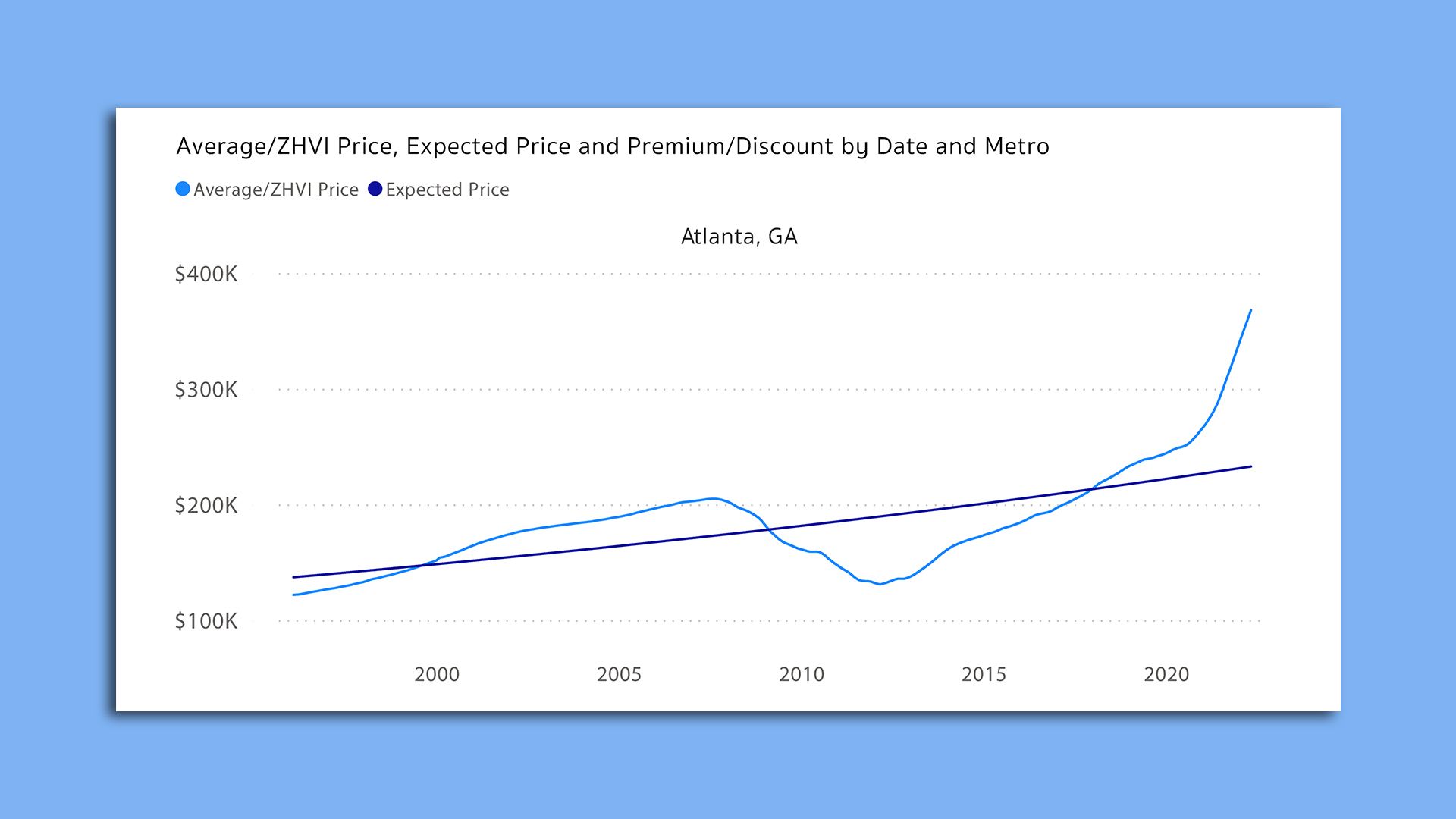

The pandemic inflated metro Atlanta housing prices by 58% above the trend line, making the region one of the country's most overvalued markets, a new analysis finds.

Why it matters: Bloated costs are making homeownership less attainable, and current owners are facing a "reckoning" when it comes to declining home values, experts say.

By the numbers: The expected average home value in metro Atlanta stood at $232,867 in April, but the actual sales price was an average of $367,946, economists at two Florida universities say.

The big picture: Atlanta is one of 15 metro areas where home prices are inflated by 50% or more.

- Homes in Boise — a magnet for West Coasters (and Atlanta’s previous planning commissioner) during the pandemic — are 73% overvalued, the highest rate in the nation, the study says.

- Rounding out the top five are Austin; Ogden, Utah; and Las Vegas.

Context: Metro Atlanta peaked in late 2007 with an 18.5% premium, Professor Ken Johnson, the study’s co-author, tells Axios. When the housing bubble burst in mid-2008, overpricing was lower than it is today — roughly 11% in the area.

- Values bottomed out in early 2012 at just under a 31% discount.

- Since late 2017, homeowners have been paying more than the expected value, the study says.

“You can see that the Atlanta housing market is much frothier this time around,” Johnson says.

What they’re saying: Mark Zandi, the chief economist at Moody’s Analytics recently told Fortune that the housing market is in correction mode — and it's premature to call it a bubble.

Of note: Studies about overvalued housing markets can be speculative, says Professor Dan Immergluck of Georgia State University’s Urban Studies Institute, "especially given the influence of COVID and big changes in mortgage rates lately."

Break it down: Under the worst-case scenario, Johnson says, someone who buys a home in Atlanta now could see a long holding period before being able to resell it for the same price.

Yes, but: A low supply of available homes and a significant influx in population are two big factors keeping prices up, Johnson says.

- "My best guess is that prices will soften a bit relative to where they are today. But you will not see a 2007 – 2012 style crash as many markets such as NYC, Miami, and LA experienced last time around."