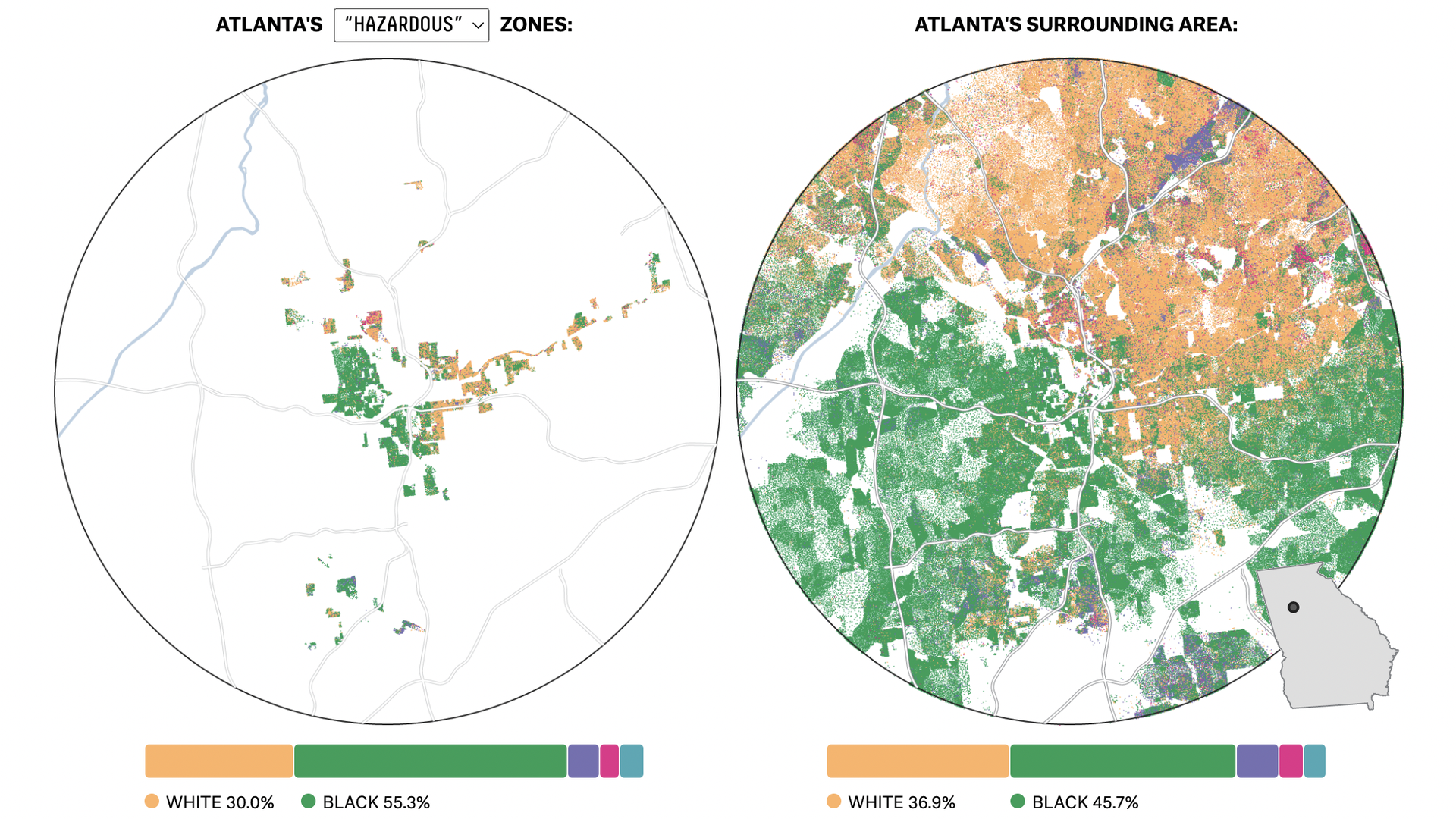

Analysis reveals Atlanta's redlining history

Add Axios as your preferred source to

see more of our stories on Google.

Maps: Courtesy of FiveThirtyEight

The federal government’s New Deal-era project to rate neighborhoods based on whether residents could make their mortgage payments — and which later helped banks practice redlining — contributed to segregation in Atlanta for generations.

Why it matters: The mapmakers heavily factored race into their evaluations, a decision that influenced lending practices for decades, leading to segregation in neighborhoods — some of which continue to this day, according to a recent FiveThirtyEight analysis, though other communities are now some of Atlanta’s most desirable.

- The maps hindered generations of Black people in Atlanta and elsewhere from homeownership, the primary driver of wealth in the U.S.

Catch up quick: In 1935, the Home Owners’ Loan Corporation dispatched 13 field agents across the nation to evaluate select neighborhoods in roughly 200 cities.

- In Atlanta, a HOLC employee graded neighborhoods like Old Fourth Ward, Pittsburgh and a swath of North Buckhead that included Tuxedo Park.

Of note: Some white neighborhoods, including working-class Cabbagetown, were also drawn red, says Todd Michney, a Georgia Tech professor who studies redlining. Today, it and other formerly redlined neighborhoods, like Old Fourth Ward and Home Park have seen substantial investment.

- The evaluations were not scientific and often were wrong. Black homeowners were just as likely to make their payments as their white neighbors.

The big picture: Though the maps were only released to the FHA, they are representative of officials’ mindsets and other agencies’ and banks’ maps. The FHA also made their own versions, which were destroyed during the Nixon administration, Michney says.

Fix it: Policymakers can chip away at the damage caused by redlining by strengthening and enforcing policies that prohibit housing discrimination and encouraging banks to re-invest funds in underserved areas, Michney says.

- Dan Immergluck, a professor at Georgia State University, also suggests targeting downpayment assistance and innovative programs like special purpose credit and baby bonds to Black, lower-wealth families, among other measures.