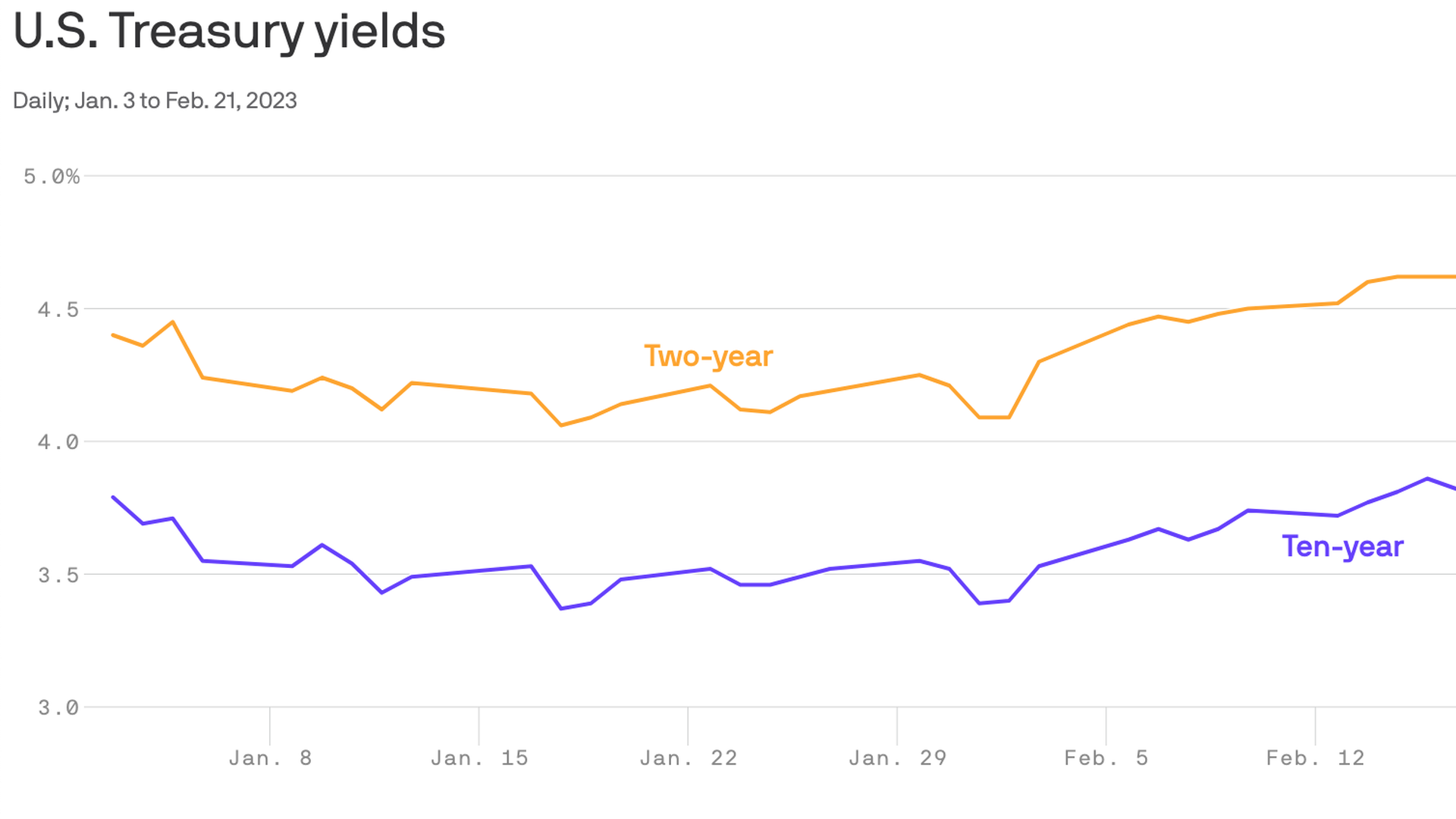

Data: Federal Reserve; Chart: Axios Visuals

Day by day, financial markets worldwide are adjusting to the reality that rates are going to go higher.

- That's the takeaway from the upward march in bond yields that has taken place throughout February and continued today.

Why it matters: In December and January, it looked like inflationary pressure was cooling, and that central banks worldwide were on track to be able to declare victory on inflation and even cut rates later this year.

- Now, a series of economic indicators point to robust growth and continued inflation pressure, and that outlook is shifting — and not just in the United States.

- Markets are now betting that major central banks will push rates higher, and that they will keep those high rates in place longer in their efforts to quash price pressures.

By the numbers: Ten-year U.S. Treasury yields are up another 0.08 percentage points, to 3.91% as of mid-morning. That rate was under 3.4% on Feb. 1.

- German bond yields are up 0.45 percentage points from their recent lows Feb. 2. The British 10-year rate is up 0.6 percentage points in the same span.

Between the lines: Steeper borrowing costs are also translating into lower prices for stocks and other risky investments. The S&P 500 is down 1.4% as of mid-morning.

The bottom line: For much of last year, financial markets were adjusting to the prospect of tighter monetary policy as stock and bond prices moved together. December and January offered a break from this pattern, but it returned with a vengeance in February.