The wealth gap between Latinos and white non-Hispanics is being driven not only by income, but by a lack of savings, per a report from the financial firm Morningstar.

Why it matters: Having less in savings can leave Latinos in a pinch when they retire, since many already have lower wages and less access to services like health care and caregiving.

By the numbers: 69% of U.S. Latinos have no retirement plans through their employers, such as 401(K)s, and only 8% have savings from an alternate private investment plan.

- Overall, Hispanic households are 17% less likely than non-Hispanic households to have a retirement plan.

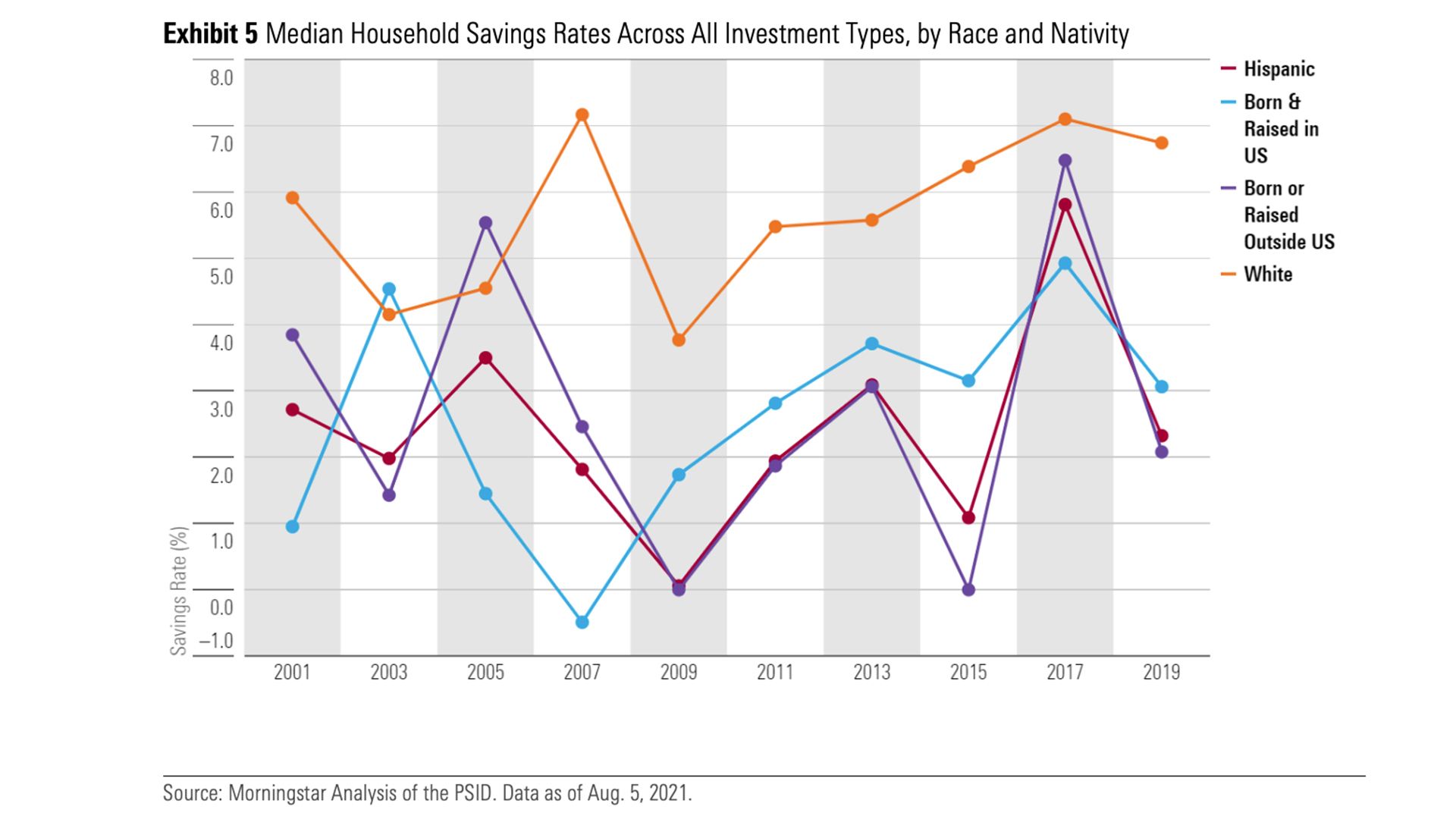

- And the rate of savings, either through retirement accounts or investments in real estate, approaches 2%, five percentage points less than the rate of white non-Hispanics.

Between the lines: Latinos also tend to support family members, either from the same household or from abroad, rather than saving for themselves much more than white non-Hispanics, according to a survey.

- Almost half of Hispanic respondents, both those with an annual income of $35,000 or less and those who earned $75,000 or more, said helping loved ones was a priority. Only 37% and 33% of white non-Hispanics in the same income brackets said the same.

- That means the lack of retirement savings can be cyclical: Older generations keep moving what money they have to their peers or the younger members, who have no family examples of how to save, so lack the knowledge to do so.

What they’re saying: “The problem is not that there’s a lack of information, rather there’s an abundance of information that can be intimidating,” James Cotto, financial advisor for Morgan Stanley, tells Axios Latino.

- He added one solution for Latinos to improve their financial condition is to create an individualized budget and seek out a financial coach that can find their best savings options.

- “They should also consider budgeting for 3-6 months of emergency savings to prepare for unexpected financial challenges,” says Cotto.