October 31, 2019

⚾️ Congratulations to the Nationals for winning the World Series!

Was this email forwarded to you? Sign up here.

Situational awareness:

- After news of Fiat-Chrysler's planned merger with Peugeot maker PSA Groupe, Ford announced it signed a new deal with the UAW, averting a strike. (Axios)

- The Justice Department agreed to a deal with fugitive financier Jho Low, who will give up nearly $1 billion looted from Malaysian investment fund 1MDB. (Bloomberg)

- The Bank of Japan kept its interest rates policy unchanged but added language suggesting a possible interest rate cut in the future. (WSJ)

(Today's Smart Brevity count: 1,189 words, < 5 minutes.)

1 big thing: The amazing pause

Illustration: Eniola Odetunde/Axios

Fed chair Jerome Powell almost rocked the boat during the FOMC's October press conference on Wednesday after announcing a third straight cut to U.S. interest rates.

What happened: Powell initially said it would take a “material reassessment” in the outlook for the Fed to change its view that no further rate cuts were needed.

- But minutes later he reversed course, saying that holding rates at their current levels would be appropriate as long as the outlook stayed within the Fed’s expectations.

Quick take: That meant the Fed's rate-cutting cycle went from pause to "pause lite," DRW Trading rates strategist Lou Brien tells Axios.

- Powell's adjustment to "pause lite" reversed the decline in U.S. equities and the gains in U.S. Treasury yields and the dollar, sending both lower on the day.

The big picture: "Pause lite" is also an apt description for the status of the global economy's two major risks — the U.S-China trade war and Brexit.

- The tariffs on imported U.S. and Chinese goods that have been wreaking havoc on the manufacturing sector, business sentiment and investment remain in place, but no new tariffs have been added thanks to the "phase one" trade deal.

- Similarly, Brexit has been pushed back to Jan. 31, leaving in place the uncertainty that has curtailed business activity in Britain and caused economic growth to fall into negative territory in Q2. But the U.K. is still in the EU.

Why it matters: "It can be said that Powell thinks there will not be any reason to ease again in the short or medium term, but that he can be convinced to ease if things don’t go right," Brien adds.

- Powell's view seems to reflect that of the market, as stocks have jumped to new all-time highs this week and Treasury yields have risen to their highest level in more than a month, with the yield curve steepening.

- And with Powell's assurances that the Fed will be there to cut rates further should things get worse, the market is feeling confident.

Between the lines: Rick Rieder, BlackRock’s CIO of global fixed income, asserts that the Fed's policy rate is now just right and is "delivering a very powerful dose of the 'right stuff' from a policy perspective."

- The Fed has moved to near "the equilibrium rate of interest in an economy that’s facing aging demographic trends, and which benefits from still positive interest rates," Rieder says in a note.

- "Vitally important is the fact that Fed policy will stop short of persistently cutting rates into the unproductive arena of negative rates."

Bonus: The Fed helps steepen the yield curve

Yesterday I noted that the yield curve had steepened significantly this month, with yields on the 3-month and 1-month Treasury bills falling meaningfully below the 10-year note.

Why it matters: The Fed's $60 billion a month Treasury bill purchase program, announced as a "technical" salve to calm the $2 trillion U.S. repo market, looks to have provided some assistance in the steepening.

- The spread between 3-month and 10-year yields widened by the most in five months on Oct. 11, the day the Fed announced it was beginning the T-bill buying program.

- The curve had been inverted since May 22 but moved into positive territory on Oct. 11 and hasn't inverted since.

Of note: An inverted yield curve is a sign of an unhealthy economy and typically precedes a recession.

What to watch: Rieder says the Fed is pushing all the right buttons.

- The Fed "is absorbing massive amounts of Treasury issuance, is steepening the yield curve, and is allowing banks and others to lend and create velocity to the economy."

- But don't call it quantitative easing.

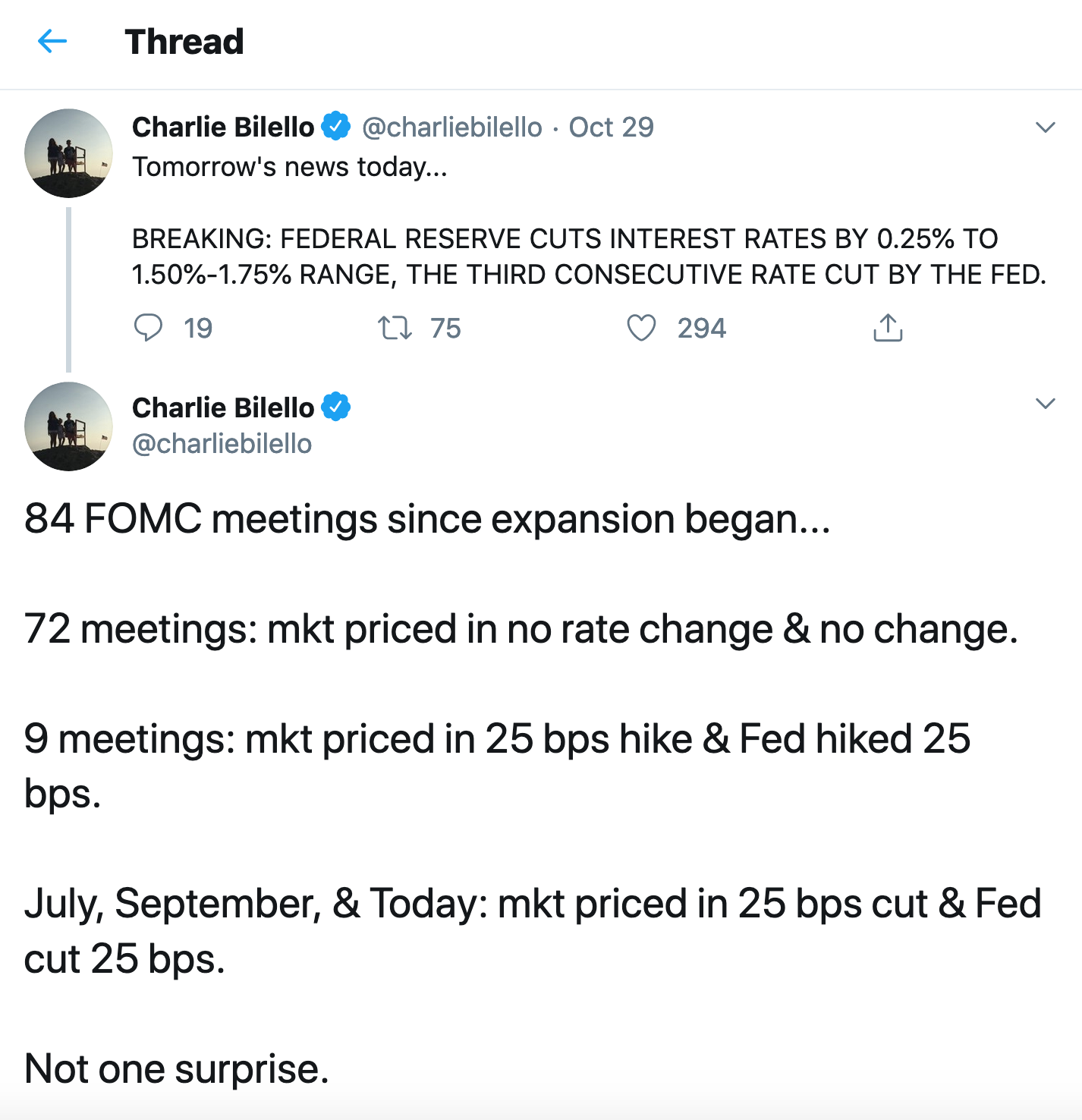

Double Bonus: No surprises

The Fed has been very predictable the past 10 years.

2. GDP beats estimates, but business investment falls further

There was good news and bad news in the U.S. third quarter GDP report released Wednesday.

On one side: GDP growth slowed less than expected, dipping to 1.9%, which is above expectations of 1.6% growth.

- It's also well above the growth seen in developed market peers like the eurozone and Japan, which have seen growth this year between 0% and 1%, or worse.

On the other side: Business investment was negative for the second consecutive quarter, falling 3%, which follows a 1% decline in the previous quarter.

- It's a dramatic turnaround from increases of 4.4% and 4.8% in the two preceding quarters, the latest sign that President Trump's trade war is showing up in more U.S. economic data.

3. IPhone sales fall again, but Apple may have the answer

Apple delivered a generally positive earnings report on Wednesday, with CEO Tim Cook telling Reuters that iPhone 11 was off to a "very, very good start," despite sales falling 9.2% in the quarter, continuing a pattern that has been in place for the past year.

- Apple reported revenue of $64 billion, up 2% from a year earlier, but the report marked the first time since CEO Tim Cook took over in 2011 that the company’s profit has declined in all four quarters of a fiscal year.

Why it matters: The iPhone is the bulk of Apple's business and critical to driving demand for its other products.

The intrigue: An earlier report from Bloomberg, citing unnamed sources, said Apple expects iPhone sales to return to growth next year, thanks to the introduction of 5G. But the company will be entering the 5G arena at least a year behind companies including Samsung and Huawei.

- "Apple aims to ship more than 200 million handsets in 2020 after introducing more than four new iPhone models, possibly including 4G and 5G models and a low-cost successor to the budget iPhone SE device," Bloomberg reported, based on information from the anonymous source.

4. Facebook just keeps making money

Facebook stock rose nearly 4% in after-hours trading after the tech giant again shrugged off controversy and beat Wall Street expectations on earnings per share and revenue.

Why it matters: Facebook has faced growing backlash from users, Congress and attorneys general across the country for its growing size, handling of user data and most recently its refusal to censor false political ads.

- Twitter threw some added fuel on the fire Wednesday when the company announced it would ban political advertising, something a strong majority of Facebook users said in a recent survey they wanted it to do.

By the numbers: Facebook's revenue rose 29% to $17.65 billion from $13.73 billion a year ago. Advertising sales accounted for 98% of total revenue.

Be smart: Axios' Sara Fischer notes that Facebook has been warning for several quarters that ad growth (where nearly all of its revenue comes from) is expected to slow late this year due to saturation in its main News Feed.

- The company has faced increased competition from other tech giants for ad revenue and engagement.

- Amazon has notably begun to eat into its ad market share slightly. TikTok has also started to steal attention from younger users.

5. With deficits rising, the ultralong bond is back in consideration

The Treasury Department announced Wednesday that it was looking into releasing two new maturities — a 50-year and 20-year bond.

- Secretary Steven Mnuchin said in September that Treasury was studying whether there was enough demand for 50-year Treasury bonds.

Why it matters: The new issues would help offset the increasing share of Treasuries that U.S. financial institutions have had to buy recently, largely as a result of decreasing foreign buyers and the Trump administration's increasing deficits.

Context: The glut of government debt has been blamed for some of the problems in the repo market and for weak auctions this year.

What's next: Per a Treasury press release...

"Treasury is considering a range of potential new products that includes a 20-year bond, an ultra-long bond such as a 50-year, and a floating rate note linked to the Secured Overnight Financing Rate."

"Overall, primary dealers viewed the potential introduction of a new 20-year bond favorably in the context of increased financing needs beginning in FY2021."