Fed expects the U.S. economy will shrink by 6.5% this year

Add Axios as your preferred source to

see more of our stories on Google.

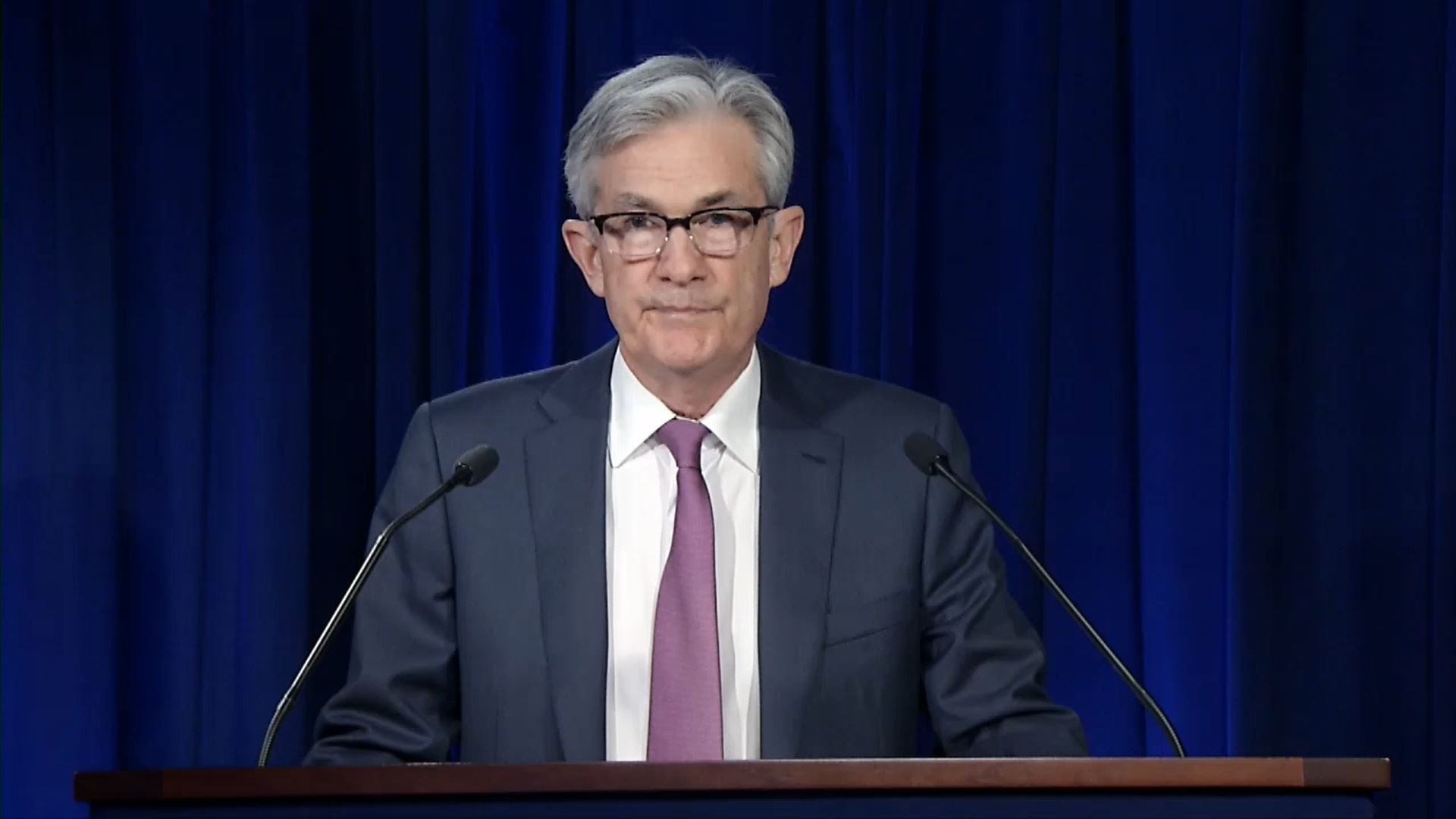

Fed chair Jerome Powell. Photo: Federal Reserve via Getty Images

The Federal Reserve expects the economy will shrink by 6.5% this year due to the impact of the coronavirus pandemic, before growing 5% next year, according to new projections released Wednesday.

The state of play: The central bank also predicts unemployment rate will drop to a still-elevated rate of 9.3% this year. By 2022, it expects the unemployment rate to be 5.5% — still higher than the pre-pandemic rate of 3.5%.

Details: The Fed almost unanimously expects to maintain this low-rate environment as the economy begins to heal through 2022.

- The central bank dropped interest rates to near zero in March after early signs that the pandemic would wreak havoc on the economy.

- "We're not thinking about raising rates. We're not even thinking about thinking about raising rates," Powell said at a press conference.

Between the lines: It's the first time the Fed is releasing its economic projections this year. The numbers show the median projection among the Fed's 17-person committee.

- The Fed didn't publish the figures in March, citing unprecedented economic uncertainty.

What they're saying: The projections show the Fed's "general expectation of an economic recovery beginning in the second half of this year, and lasting over the next couple of years," Powell said.

- But, he noted, there's a ton of uncertainty and these projections could change.

The Fed's projections don't show expectations that the coronavirus downturn will cause permanent damage to the labor market or the economy. Its guesses for the unemployment rate and GDP growth in the "longer run" — or several years down the line — didn't budge from its pre-pandemic projections.

- "I think we can avoid that," Powell said, referring to permanent scarring.

- "We do that with measures that keep people in their homes and that support hiring and support growth and that avoid unnecessary business insolvencies."

- Still, Powell noted that "well into the millions" of workers may not return to their job and that "there may not a job in that industry for them in a long time."

The big picture: Since the pandemic hit, the Fed has announced a series of measures to support key funding markets, as well as $2.3 trillion in loan programs.

- One of them is the Main Street Lending Program, which is meant to provide loans to mid-sized companies shut out of the Paycheck Protection Program.

- The Fed has been tweaking the terms and eligibility requirements for the program, which still hasn't launched.

- Powell said the Fed is in "the final run-up to starting the facility." (He said on May 29 that the program was "within days" of making its first loans in the program).

Of note: Powell said the Fed was briefed on "yield curve control" at its policy meeting this week — a measure that would cap Treasury yields at a certain level (and the Fed would buy as many government bonds needed to keep the yields at that level).

- But whether the Fed will implement this is still an "open question," Powell said.