Axios Generate

February 08, 2023

🐪 Halfway there! Today's newsletter has a Smart Brevity count of 1,083 words, 4 minutes.

📬 Did a friend send you this newsletter? Welcome, please sign up.

🎶This week in 1980, funk and R&B greats The Brothers Johnson released today's irresistible intro tune...

1 big thing: Biden tries to control the 2024 climate

Illustration: Eniola Odetunde/Axios

The themes and internal tensions in President Biden's energy policy were visible in last night's State of the Union speech that previews his potential 2024 re-election campaign, Ben writes.

Why it matters: The annual ritual is a high-profile chance for presidents to set the terms of policy and political battles.

Quick take: Below are some things that caught our eye.

💰 His climate message is heavy on economics. Biden emphasized what he called major jobs and consumer benefits of the big climate law.

- He cited tax credits for buying electric cars and efficient appliances, along with lower power bills.

- "We’re building 500,000 electric vehicle charging stations installed across the country by tens of thousands of IBEW workers."

🌀 But he didn't shy away from harms. "I’ve visited the devastating aftermaths of record floods and droughts, storms and wildfires," Biden said.

- "The climate crisis doesn't care if your state is red or blue. It is an existential threat."

🛢️ Big Oil is Biden's favorite foil. He tried to take advantage of the speech coming as oil giants report record annual profits and new share buybacks.

- "They invested too little of that profit to increase domestic production" and aren't doing enough to lower prices, he said.

- He proposed quadrupling the tax on corporate stock buybacks "to encourage long term investments instead."

🤔 But oil is complicated for Biden. He went off script to note that "we're still going to need oil and gas for a while."

- He also veered from the text to try and rebut oil industry claims that his policies discourage supply investment — and in the process he acknowledged long-term fossil fuel demand.

- "I said, 'we're going to need oil for at least another decade... and beyond that," Biden said.

- It highlights a tension in White House policy — calling for more output even as Biden's under pressure to act more aggressively on climate.

🛑 What he didn't say is revealing. Biden didn't mention legislation to speed up permitting for energy projects.

- It's sought by traditional and low-carbon industries, but faces divisions on the left over fears of boosting fossil projects.

- Nor did he explicitly talk up domestic manufacturing projects for battery and solar equipment spurred by climate law subsidies, Bloomberg notes.

- That would have "risked intensifying trade tensions with European allies worried the subsidies will siphon economic activity from the EU."

2. What they're saying: BP's pivot

Photo: Peter Byrne/PA Images via Getty Images

Here's a few takes on BP's decision (which we covered yesterday) to scale back targets for cutting oil and gas production and boost planned supply investments, Ben writes.

What we're watching: There may be a wider shift among other European majors, which have made high-profile climate commitments, per a Citi analyst note quoted in the NYT.

- "This feels, to us, an important moment for the oil and gas industry," Citi's Alastair Syme wrote.

What they're saying: "The problem that BP faces is similar to much larger European competitors Shell Plc and TotalEnergies SE — it's having an identity crisis," Bloomberg columnist Javier Blas writes.

- U.S.-based firms offer "more direct exposure to oil profits" for investors, he writes. For shareholders interested in renewables and climate, "BP isn’t green enough and probably never will be."

- Still, he notes that BP's shares bounced on the news of yesterday's course adjustment.

Zoom in: Blas notes the strategy's success "depends largely on high oil and gas prices, higher spending and a shift to green projects with a higher payback," citing EV charging and hydrogen vs. wind and solar on that last point.

Catch up fast: BP yesterday announced upward revisions to investments in both oil and gas and low-carbon business lines.

- Russia's attack on Ukraine underscored the importance of both oil and gas supply security and low-carbon transition, CEO Bernard Looney said.

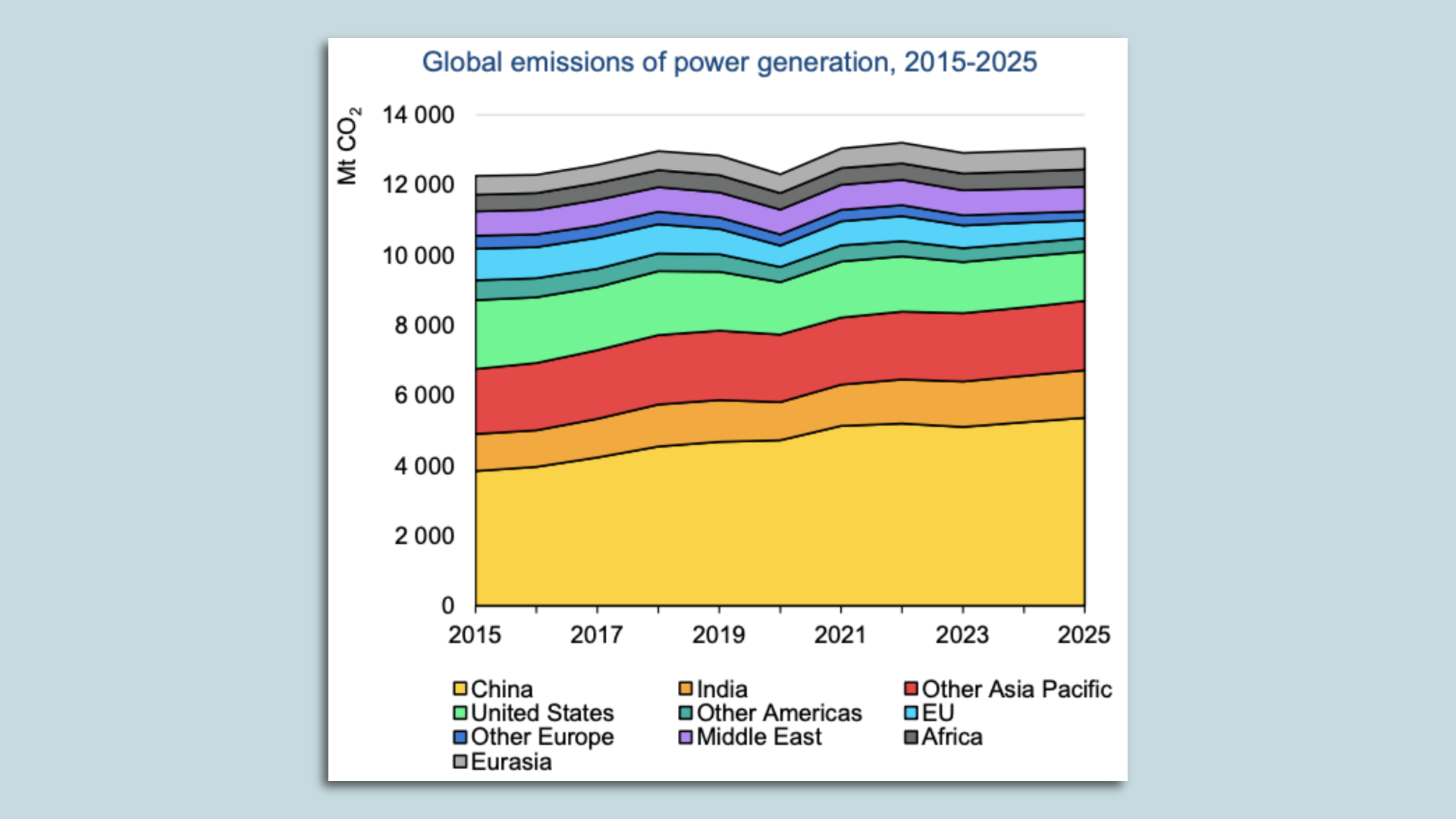

3. The near-term future of global power

Image courtesy of the International Energy Agency

A new International Energy Agency report offers a mixed verdict on the decarbonization of worldwide electricity generation, Ben writes.

Driving the news: Renewables will "dominate" supply growth over the next three years and, along with nuclear, meet the vast majority of increased demand.

Why it matters: That should prevent significant increases in power sector CO2 emissions.

- IEA head Fatih Birol said in a statement that a "tipping point" may be nearing.

Yes, but: Emissions need to fall sharply to get on pace with Paris Agreement targets, and there's no evidence that this is on the horizon yet.

- Birol said governments need to accelerate low-carbon power growth.

4. The EV revolution needs equitable charging

Illustration: Sarah Grillo/Axios

The EV movement is growing nationwide, but people who live in apartments, low-income neighborhoods, and rural areas without easy charging access could get left behind, Axios' Joann Muller reports.

Why it matters: If the benefits of cleaner transportation — better air quality, less noise, lower energy costs — don't flow equitably to all Americans, EV adoption is likely to stall.

The big picture: With most EVs priced like luxury cars, early adopters have typically been wealthy people who live in single-family homes where it's relatively easy to install a home charger.

- But when more affordable cars, such as GM's $30,000 plug-in Chevrolet Equinox, hit the market in 2024, access to public charging will become more important — especially for those who don't have a private garage or driveway.

What we're watching: The federal government aims to spur more investment in public charging with $7.5 billion allocated over five years under the 2021 infrastructure law.

- But installing more public chargers doesn't fully address inequity issues because it's more expensive to charge at a public station than at home.

5. Fake meat's real problems

Illustration: Sarah Grillo/Axios

Customers and investors alike are sticking a fork in fake meat, Axios' Megan Hernbroth reports.

Why it matters: Eating plant-based meats is one of the easiest ways for Americans to reduce their overall carbon footprint.

- But after years of hype, the tide is turning against the first generation of plant-based protein makers.

The big picture: Impossible Foods and Beyond Meat captured headlines — and plenty of legitimate interest from consumers — with their plant-based burgers.

- Both companies' products were a hit. They were so popular that fast food giant Burger King noticed and added an Impossible Whopper to its menu.

- Impossible and Beyond started looking at other types of meat they could replace, and expanded their range of offerings.

Yes, but: The sector's fortunes appear to be waning, with prominent industry names facing headwinds.

- Impossible Foods plans to lay off roughly 20% of its workforce, per a Bloomberg report.

- Impossible's primary competitor, Beyond Meat, also cut roughly 20% of its workers, and lost several executives, amid its own stock slump.

🙏 Thanks to Nick Aspinwall and David Nather for edits to today's newsletter.

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories