The rise and fall of a Black banking icon

Add Axios as your preferred source to

see more of our stories on Google.

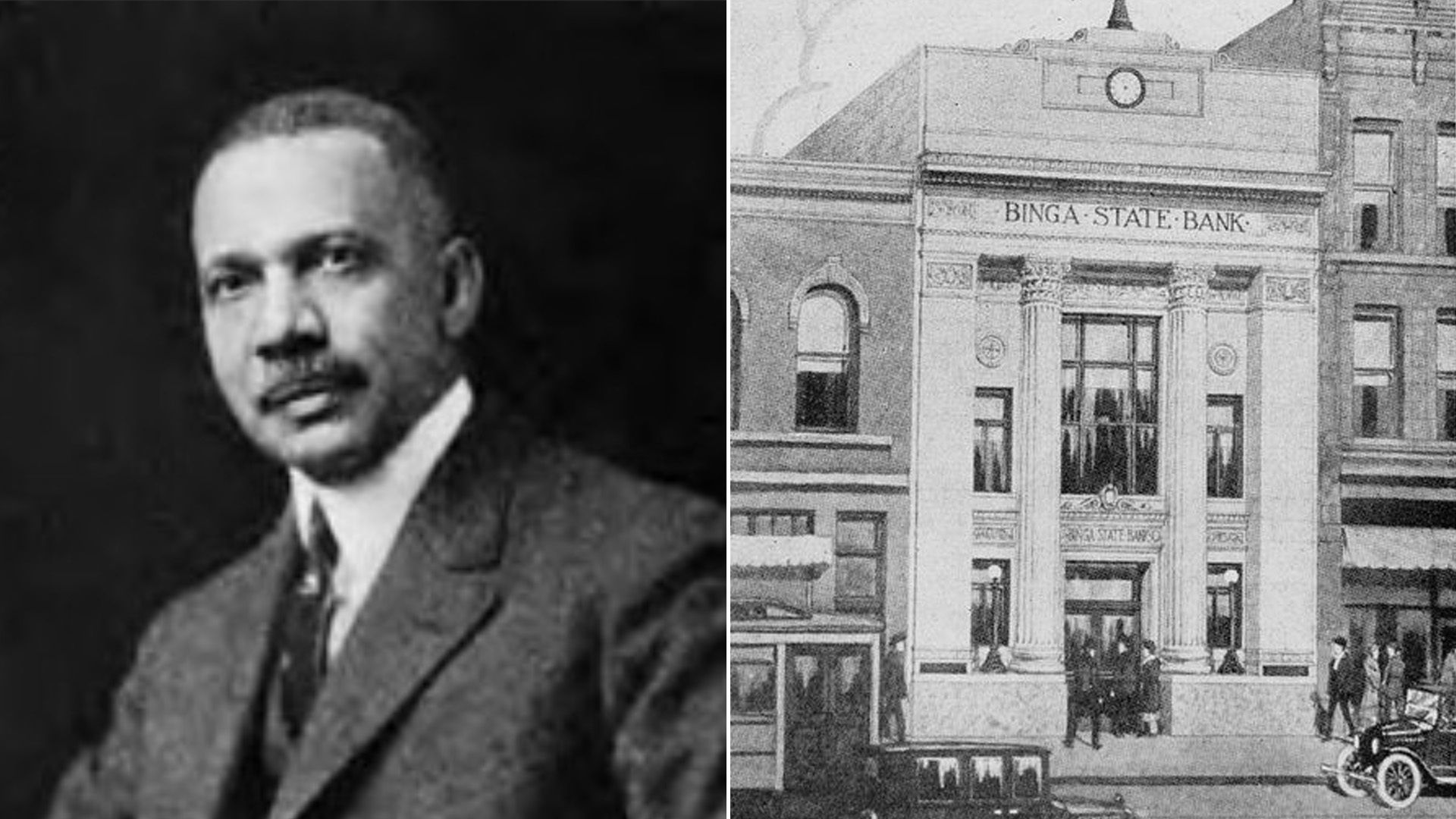

Photos: Jesse Binga and Binga State Bank. Photos courtesy Chicago Tribune Markers of Distinction and The New York Public Library Digital Collections

On this last day of Black history month, we'd like to take a break from the news and tell you the story of Jesse Binga, a titan of banking in the early 20th century. The Binga State bank, which he founded in 1908 in Chicago, was one of two pre-eminent Black-owned financial institutions in the U.S. until its collapse during the Great Depression.

Why it matters: Binga's rise and fall — he died virtually penniless — shows how overt racism affects market values and businesses.

- It's also an example of how more subtle kinds of discrimination, still at play today, hold Black entrepreneurs back, said Mehrsa Baradaran, who writes about Binga in her 2017 book "The Color of Money: Black Banks and the Racial Wealth Gap." (Read Axios' Kia Kokalitcheva for more on Black entrepreneurs.)

- In his prime, "[Binga] was a hero of entrepreneurs and an icon of success and hope," says Don Hayner, the author of "Binga: The Rise and Fall of Chicago's First Black Banker."

Details: Born in Detroit in 1865, Binga established himself in Chicago first as a real estate broker during the Great Migration. Binga was able to buy homes cheaply from white locals fleeing their neighborhoods in the wake of Black Americans moving in from the South. He fixed the houses up himself and sold them to Black families, Baradaran explains.

- His Black clients could not get loans from white banks, so Binga chartered a bank himself.

- "Just as discrimination and white flight led to his real estate success, he turned the white banks' refusal to lend to his real estate clients into another source of profit," Baradaran writes.

- At the height of its success, Binga's bank was "consistently more capitalized" than its white counterparts and seen as "a model of sound banking," she writes.

- Success didn't come easy. Binga's home, in a white neighborhood, was bombed seven times. Each bomber left a note telling him to move. "I will not run. The race is at stake and not myself," he said at the time.

What happened: Back then, before the Federal Reserve or the FDIC, Binga and other Chicago bankers paid for memberships in the Chicago Clearinghouse, a cooperative of bankers who provided funds to ensure members had access to liquidity in a crisis.

- That was Binga's downfall. When the Depression hit, he turned to the Clearinghouse — where he'd paid dues for more than a decade. They didn't even acknowledge he was a member, Hayner said.

- "Binga was not the kind of man they wanted to succeed," W. E. B. Du Bois said at the time.

- The bank closed in 1930 and Binga's customers, including many prominent Black Chicagoans, lost most of their money. All the other Clearinghouse members made it through the Depression, Baradaran notes.

- Binga would later be sent to jail on trumped up embezzlement charges that a white bank owner would never have faced. He was eventually pardoned, and died in 1950.

The bottom line: Black banking has been seen as both a shield and a sword through American history, Baradaran tells Axios.

- A shield to give Black Americans access to capital when they were shut out of the white financial industry entirely.

- And a sword — promoted by figures like Martin Luther King Jr. — to allow Black people to create their own alternative to white dominated institutions.

- Today there are only about 20 Black-owned banks left in the U.S., and they're having trouble staying open, as ProPublica reporters point out in a piece from last year about GN Bank, the last Black-owned bank in Chicago.