3. Priced for perfection

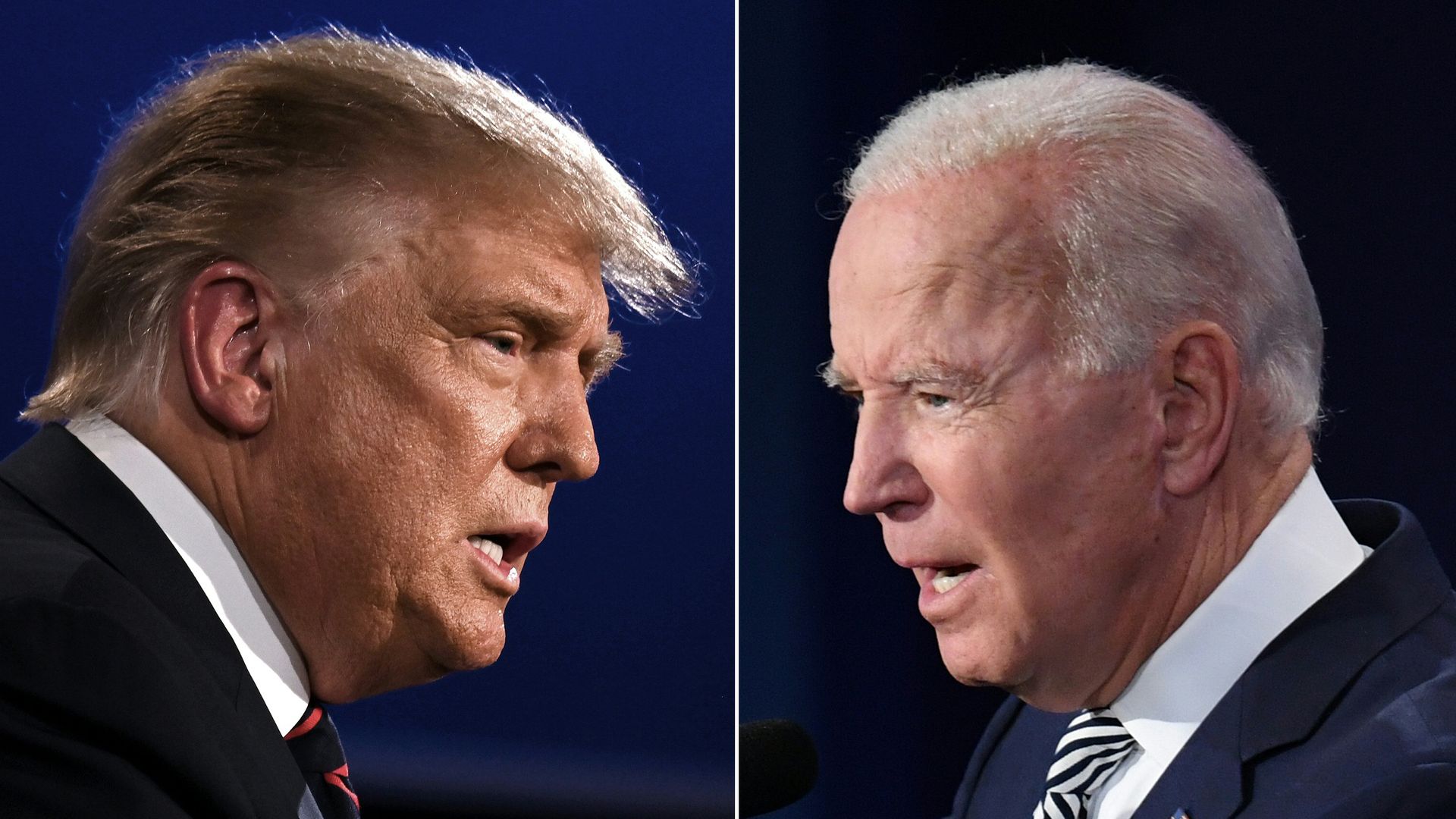

Photo illustration: Eniola Odetunde/Axios. Photo: Pool/Getty Images

It would be hard for things to get much worse than 2020, but Wall Street fund managers and the general public may be pricing in too much optimism.

Why it matters: President Biden steps into a situation that is expected to improve significantly, with projections from economists and government offices for falling unemployment, rising GDP and a booming stock market setting him up for success.

- But those prognostications aren't guaranteed, and high hopes dashed could lead to a strong blowback from a country already on edge and still highly polarized.

What's happening: The Congressional Budget Office expects U.S. growth to return to its pre-COVID level midway through this year and for the unemployment rate to reach 6% by year end — a far rosier picture than it painted just six months ago.

- Similarly, economists are ramping up their predictions for growth thanks to cabin fever and a personal savings rate that shot up to record levels during the pandemic and remains at its highest since the 1980s.

- Economists at Goldman Sachs are even predicting that U.S. GDP growth in the third quarter will reach 10%, a milestone without modern precedent, save for the 33% growth in Q3 2020 that followed the 35% contraction in Q2.

What they're saying: That's got asset managers expecting big returns from the stock market this year and businesses banking on rising sales and profits.

- "As consumer confidence returns, so will spending, with 'revenge shopping' sweeping through sectors as pent-up demand is unleashed," analysts at consulting firm McKinsey wrote in a recent outlook.

Yes, but: Even before the recent run-up in equities prices, the stock market was "priced for perfection," John Lynch, CIO of Comerica Wealth Management tells Axios.

- And if 2020 taught us anything, it's that we should prepare for the unexpected.

Look out: "The primary risks to the outlook continue to be medical," Ben Ayers, senior economist at Nationwide, tells Axios.

- "We’re keeping an eye on the COVID variants and the effectiveness of vaccines against them. A resurgence of a mutated form of the virus would be detrimental to the global recovery."

- "An early pullback in policy support from either the federal government or the Federal Reserve is another risk for growth — but policymakers have been resolute in their support for the recovery so far."

The bottom line: The key to a virtuous V-shaped recovery for the economy is the ability of policymakers to get as many people vaccinated as possible, says Joe Brusuelas, chief economist at RSM.

- "My fundamental outlook since mid-2020 on this has not changed," he tells Axios. "V stands for vaccine. No vaccine, no recovery."