Inside the offshore betting market

Add Axios as your preferred source to

see more of our stories on Google.

For decades, the black market — which consists of offshore sports books and local "bookies" — has been the only option for U.S. sports bettors looking to place wagers.

- Now that states can legalize and regulate sports betting, those offshore books — most of which are located in the Caribbean — are facing competition from well-financed companies running legal operations in the U.S.

- As legal sports betting advances, some believe the offshore market will shrink and become a shell of itself, while others believe the two will live side by side with legal books unable to match what offshore books can offer.

The state of play: Sports betting is currently legal and operational in 18 states plus Washington, D.C. It's legal but not yet operational in four more states, and another seven have active legislation.

- In states with legal betting in 2019, bettors reported a 25% decrease in spend with illegal bookies, according to a recent survey by the American Gaming Association.

- Yes, but: 52% of bettors in those states still participated in the illegal market — evidence that offshore sportsbooks may be under threat but aren't going away.

Offshore advantages: Most states still don't offer legal sports betting, so the majority of Americans who want to place a wager end up using an offshore book that they find through a friend or internet search.

- In addition to ease of access, offshore books also have a pricing advantage since they don't have to pay state/federal taxes or licensing/compliance fees (which often trickle down to customers).

- While a local sportsbook might offer a moneyline of -115 (bet $115 to win $100) on Team A to win, an offshore operator would maybe offer -105 (bet $105 to win $100) since it doesn't have to make up for lost revenue from taxes and fees.

Stateside advantages: The biggest advantage for legal operators is that they're, well, legal. As a result, customers don't feel like they're taking a risk with their money. Stateside operators can also open retail locations and have more of a marketing presence, whether that's through TV commercials or partnerships with leagues and teams.

What they're saying: "As an operator, you have to recognize that offshore books are the competition. So you've got to beat them on product, on customer service, and on payments," FanDuel CEO Matt King tells me.

- "And we think we do that. But it's not like when the legal market starts, the illegal market shuts down overnight. I think you're going to have a vibrant illegal market for a long time to come."

- "The goal for us is, first and foremost, to work with regulators to make sure they put common sense legislation in place that allows us to compete effectively. And then once we have the laws we need, it's on us to deliver a better customer experience than what the illegal market can offer."

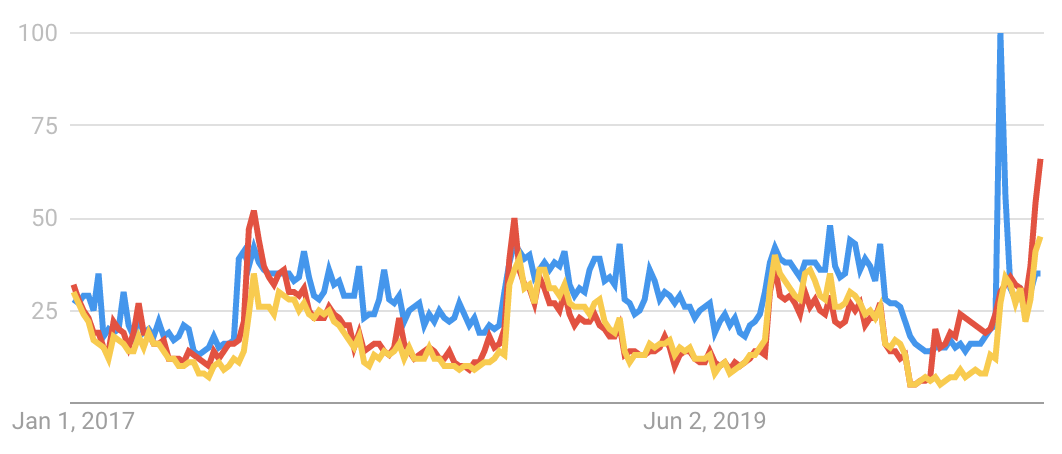

The bottom line: FanDuel (yellow line above) and DraftKings (red) have collectively poured about a billion dollars into marketing over the last five years. And yet, offshore giant Bovada (blue) still wins the search interest battle.

- Just goes to show how big — and how ingrained — the illegal market is, and how comfortable people are with offshore options. This battle is far from over.