The war between Carl Icahn and Cigna

Add Axios as your preferred source to

see more of our stories on Google.

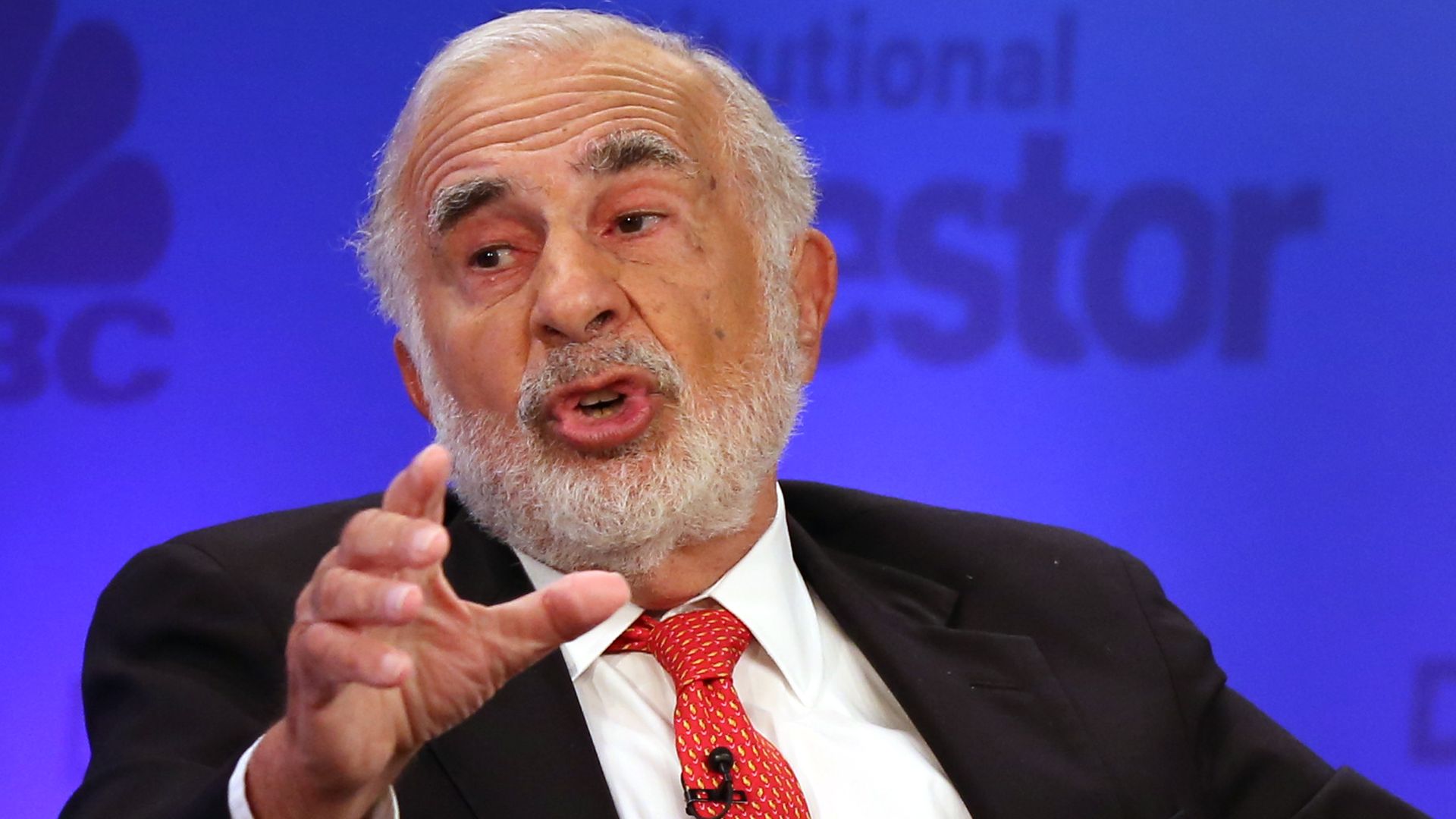

Billionaire investor Carl Icahn. Photo: Adam Jeffery/CNBC/NBCU Photo Bank via Getty Images

Even though Carl Icahn knows he is fighting an "uphill battle" in his opposition to Cigna's $67 billion buyout of Express Scripts, the billionaire investor continued his verbal onslaught Wednesday in an interview with Fox Business when he said passive investors should view the acquisition as a "bullshit deal."

What to watch: Cigna shareholders will vote on the deal Aug. 24, and many Wall Street analysts expect it will still go through. But anything is possible, given how rare it is to see open warfare over a deal of this size.

The intrigue: Adding to his open letter, Icahn repeated warnings about impending changes to prescription drug rebates that are a core part of pharmacy benefit managers like Express Scripts. The Trump administration is considering a rule that could limit the scope of how rebates are used between drug manufacturers and PBMs.

Yes, but: As Cigna was quick to point out to shareholders, any rebate changes would not happen for a while, and "there is no clear mechanism for the federal government to regulate commercial rebates without congressional action."

- It's also worth reminding that although PBMs play games with rebates, which ultimately affect what everyone pays for drugs, pharmaceutical companies still rely on PBMs to put their drugs on approved insurance lists.

The bottom line: Both sides have a point, which makes the shareholder vote so interesting.

- Express Scripts' business model is at risk from changes to federal rebate rules and Amazon (not to mention the company is losing its most profitable client, Anthem).

- However, commercial rebates appear safe, and Express Scripts likely can find other ways of making money with other rebate-like fees and administrative charges.

- The onus falls on Icahn to persuade large institutional investors (including Vanguard, T. Rowe Price, Dodge & Cox and BlackRock) to vote his way, which may be difficult to do at this late stage.

- Don't forget Cigna and Express Scripts have to clear antitrust muster as well.