The new buyout barons

Add Axios as your preferred source to

see more of our stories on Google.

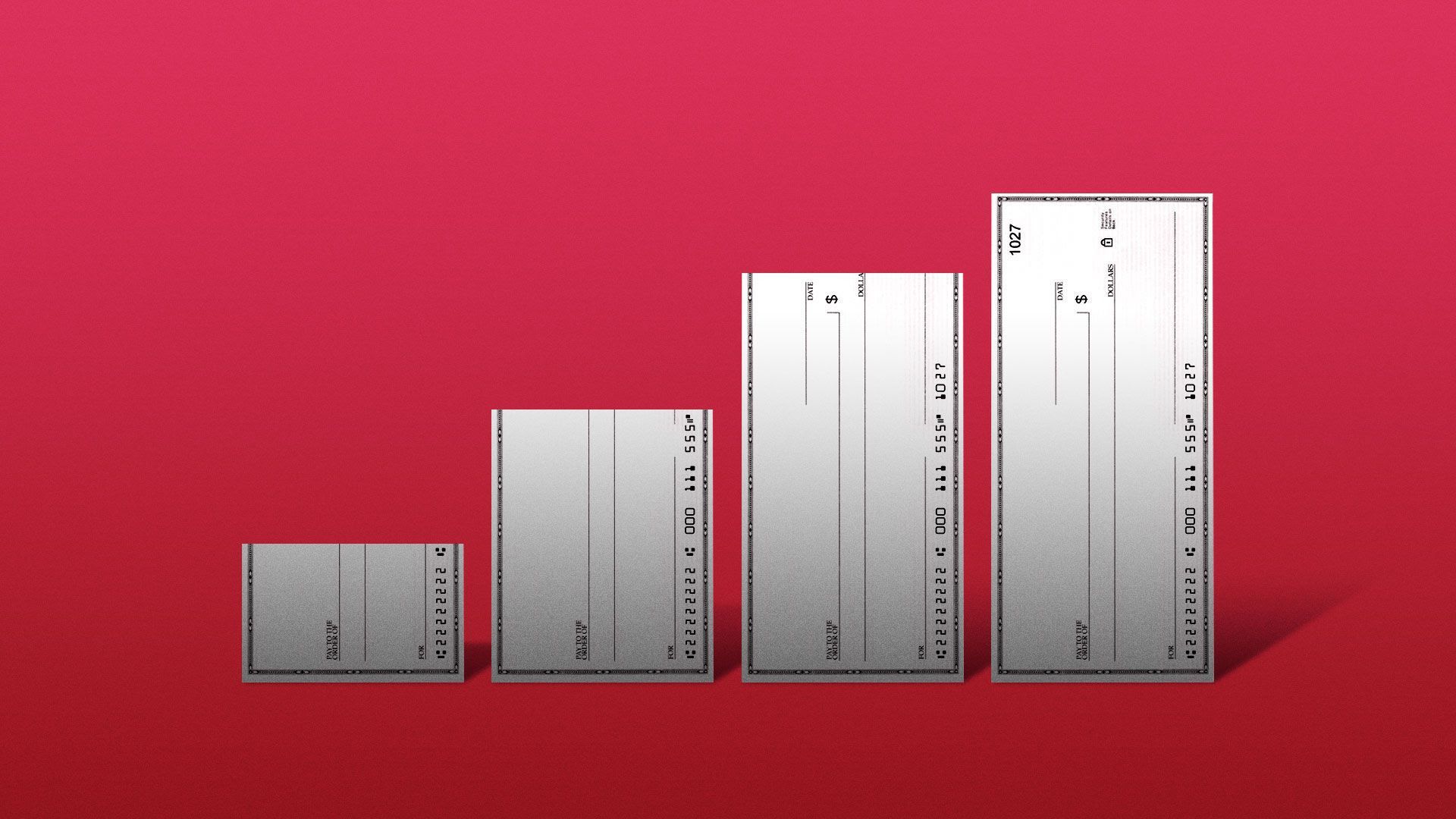

Illustration: Eniola Odetunde/Axios

Last month I wrote that SPACs are the new IPOs. But I may have understated it, because SPACs are also becoming the new private equity.

By the numbers: Short for "special purpose acquisition company," SPACs have raised $24 billion so far in 2020, with a loaded pipeline of upcoming offerings. U.S. buyout firms raised nearly $102 billion through the end of June — a much larger amount, but not so much larger that the two can't play on the same field.

What's a SPAC? A shell company that raises money from the public markets for the purpose of buying a private company, thus converting it into a public company. SPACs also are known as blank-check companies, while the acquisitions are also known as reverse mergers.

Mr. Dictionary: Yes, there's a definitional problem with claiming publicly traded entities are the new private equity. Humor me on that.

Between the lines: Private equity and strategic acquirers have long battled over which offers the greatest advantages to target companies when pricing is effectively equal. SPACs are now a sufficiently capitalized alternative to both, representing a combo platter.

- SPACs usually let existing management remain in charge. Private equity often does that too, but has much greater ability to swiftly reverse course.

- Strategics give acquired companies a public currency with which to make hires and acquisitions. So do SPACs, without having to ask for permission.

- Private equity may take a portfolio company public, but it's more likely to sell it to a strategic or other financial sponsor. SPACs give management more say in their company's future.

- Both private equity and SPACs can add debt to a company's balance sheet, but only one is likely to follow that up with dividend recaps.

Private equity does still let a company avoid the hassle and costs of public disclosure, which can lead to higher executive pay, but that’s typically a better sell for troubled companies than growing ones that plan to soon to public anyway.

The bottom line: Private equity is sitting on tons of dry powder and isn't going away. But it's no longer the only game in town.