Axios Pro Rata

May 11, 2020

📺 Tonight's "Axios on HBO" features interviews with Vice President Mike Pence (clip), Sen. Marco Rubio, and Salesforce CEO Marc Benioff. Plus, we explore the bioethics of contact tracing. 11pm ET/PT on all HBO platforms.

🎧 Pro Rata Podcast digs into the U.S. Postal Service crisis. Listen here.

Top of the Morning

Illustration: Aïda Amer/Axios

The Paycheck Protection Program no longer seems likely to run out of funds, as daily loan approvals have slowed to less than $2 billion per day.

What happened: Politicians and pundits, led by Treasury Secretary Steve Mnuchin, moved the goalposts. It no longer matters if you can qualify for such a loan, per the original rules. It only matters if the loan is worth enduring media floggings and government threats — all without promised clarity into loan forgiveness.

By the numbers: The SBA reports that $188 billion of the refreshed $311 billion pot was spoken for as of last night, representing loans to 1.2 million small businesses. The average loan size between PPP and PPP2 has fallen from $206,000 to $73,000.

SBA has implemented the program as intended. That's the top-line finding of an Inspector General report released Friday, which had been requested by congressional Democrats.

- The IG did identify some areas for SBA to improve, including having lenders prioritize underserved and rural markets. But, again, overall it felt SBA was meeting its mandate.

Criticism of larger loan recipients has been bipartisan, with Mnuchin going so far as to threaten investigations and criminal investigations.

- The common denominator has been frustration that smaller businesses without established banking relationships were shut out of the original PPP, and that it could happen again.

- That’s why Mnuchin said all would be forgiven if larger recipients just poured their money back into the pool.

The bottom line: Moral suasion worked, judging by the current loan pace. But if PPP 2 ends up with plenty of cash in the till, and unemployment keeps growing, there could be boomerang questions about why some businesses were discouraged from applying for loans that could have kept people on payrolls.

The BFD

The Carlyle Group and GIC aren't proceeding with their $900 million deal for a 20% stake in American Express Global Business Travel, claiming that the sellers didn't meet closing conditions. The two sides are now suing each other, with a Delaware court to hear the case on Thursday.

- Why it's the BFD: This could lead to the first judicial ruling over whether or not the coronavirus pandemic has tripped a material adverse effect (MAE) clause in a merger agreement. Every deal is unique, but this could establish some broad legal guardrails.

- At issue: Carlyle and GIC not only argue for the existence of an MAE, due to the global travel slowdown, but also that the sellers violated financing terms by planning to use proceeds to bolster the company's balance sheet (i.e., a de facto bailout) rather than to fund a potential acquisition and provide shareholder dividends. Amex GBT argues that Carlyle and GIC are wrong on both counts.

- The bottom line: This is a broader test case than was L Brands vs. Sycamore Partners over Victoria's Secret, which ended after L Brands inexplicably gave up, where the MAE had an explicit carve-out for pandemics.

Pro Rata for Kids

Today's project is for your kids to make a robot. For older kids with circuitry skills, this could be an actual robot. For younger kids, it could be a drawing or Legos or craft supplies. Or maybe designed via an iPad. What's its name? What can it do?

- Per usual, please send me what they create.

This weekend's project was to make a giant Mothers Day card. Here's Anthony with reader mom Donna:

Venture Capital Deals

• M17 Entertainment, a Singapore-based live-streaming platform, raised $26.5 million in Series D funding. Vertex Growth Fund led, and was joined by Stonebridge Korea, Innoven Capital, Kaga Electronics, and ASE Global Group. http://axios.link/2Xsq

🚑 Carbon Health, a San Francisco-based mobile connected health care network, raised $26 million in new Series B funding from insider DCVC. The round total is now $56 million. www.carbonhealth.com

• Shiprocket, an Indian logistics aggregator, raised $13 million in Series C funding. Tribe Capital led, and was joined by Innoven Capital and return backer Bertelsmann India Investments. http://axios.link/i25l

• Archistar, an Australian property intelligence platform, raised $6 million in Series A funding led by AirTree Ventures. www.archistar.ai

🚑 Hummingbird Bioscience, a Singapore-based developer of antibodies for cancer therapeutics, raised $6 million in new Series B funding (round total now $25m). SK Holdings led, and was joined by return backers Heritas Capital and Seeds Capital. http://axios.link/mZqx

BurnAlong, a Pikesville, Md.-based health and wellness video platform, raised $4 million from backers like DM Wellness and CR2 Ventures. http://axios.link/lQjp

• Primer, a British fintech startup focused on helping merchants consolidate the payments stack, raised £3.2 million in seed funding led by Balderton Capital. http://axios.link/lXYm

• Stardog, an Arlington, Va.-based enterprise knowledge graph platform, raised $3 million in new Series B funding from Contour Venture Partners, Dcode Capital, and Presidio Ventures. http://axios.link/2Az0

• JobHopin, a Vietnam-based job recruiting platform, raised $2.45 million in Series A funding from SEMA Translink, KK Fund, Mynavi Corporation, Edulab Capital Partners, NKC Asia and Canaan Capital. http://axios.link/kwPZ

• Vochi, a Belarus-based video editing and effects app, raised $1.5 million in seed funding led by Genesis Investments. http://axios.link/nffS

Private Equity Deals

• KKR agreed to buy a 60% stake in Coty’s (NYSE: COTY) pro hair and nail products unit, including the Wella and Clairol brands, for $4.3 billion. http://axios.link/PJhr

• Bain Capital is offering around $1 billion to buy Japanese nursing home operator Nichii Gakkan (Tokyo: 9792). http://axios.link/zKya

• ClearLight Partners invested in ICS, an Endicott, N.Y.-based provider of IT managed services. www.clearlightpartners.com

• INVL Asset Management agreed to buy a controlling stake in Eco Baltia, a Latvian provider of plastic recycling and waste collection services. www.ekobaltija.lv

• Right Networks, a Hudson, N.H.-based portfolio company of BV Investment Partners, acquired Rootworks, a Burlington, Calif.-based accounting firm improvement solutions. http://axios.link/CD3E

• SurfacePrep, an acquisition platform backed by CenterOak Partners, acquired Temple Associates, a Sacramento-based distributor of loose abrasives and blast equipment. www.surfaceprep.com

Public Offerings

• Deutsche Bahn is indefinitely postponing an IPO for European transport business Arriva, per Reuters. http://axios.link/CNgV

🚑 Pliant Therapeutics, a South San Francisco-based developer of fibrosis treatments, filed for an $86 million IPO. It plans to trade on the Nasdaq (PLRX) with Citigroup as lead underwriter, and has raised over $280 million in VC funding from firms like Third Rock Ventures (32.3% pre-IPO stake), Eventide Asset Management (9.3%), Redmile Group (7.8%), Cowen Healthcare (7.7%), and Novartis (6.2%). http://axios.link/Pvgz

Liquidity Events

• Target (NYSE: TGT) agreed to buy the tech assets of Deliv, a Menlo Park-based last-mile logistics startup that had raised over $80 million from companies like Google, UPS, Macerich, Clayton Venture Group, General Catalyst, PivotNorth Capital, Upfront Ventures, FirstMark Capital, and RPM Ventures. http://axios.link/K0Mc

More M&A

• Avianca, a Bogota-based airline, filed for bankruptcy protection. http://axios.link/uGeC

• LafargeHolcim has decided to hold onto four cement plants and a grinding plant in The Philippines, after a $2.15 billion sale to San Miguel Corp. was unable to gain regulatory approval. http://axios.link/ruGE

⛽ Saudi Aramco is seeking to restructure its $69.1 billion deal for a 70% stake in petrochemicals maker SABIC from the Saudi Public Investment Fund, per Reuters. http://axios.link/djKN

Fundraising

• Dave McClure is raising $10 million for a special purpose vehicle to buy out some limited partners in the first fund of 500 Startups, the firm he founded and led until resigning in 2017 due to sexual harassment allegations, Axios' Kia Kokalitcheva reports. The SPV is being raised under McClure’s new Practical Venture Capital platform, in which he’s partnered with former 500 Startups COO Aman Verjee.

• Summit Partners is seeking to raise more than $960 million for its fifth VC fund, per public pension documents. http://axios.link/Fn83

It's Personnel

• Raphael Thuin joined Tikehau Capital as head of capital markets strategies. He previously led fixed income for TOBAM. www.tikehaucapital.com

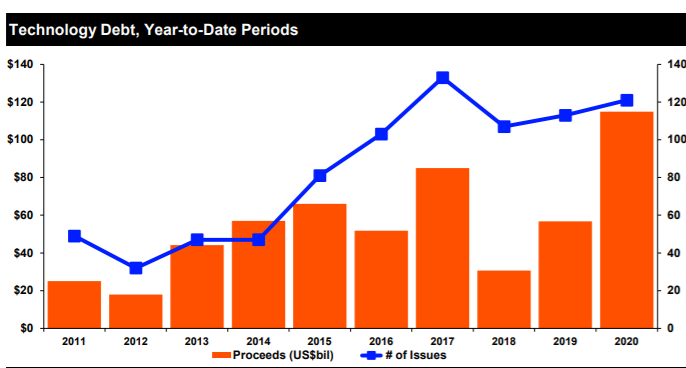

Final Numbers

🙏 Thanks for reading Axios Pro Rata! Please ask your friends, colleagues, and traveler's check hoarders to sign up.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.