Axios Pro Rata

April 18, 2019

Top of the Morning

Illustration: Rebecca Zisser/Axios

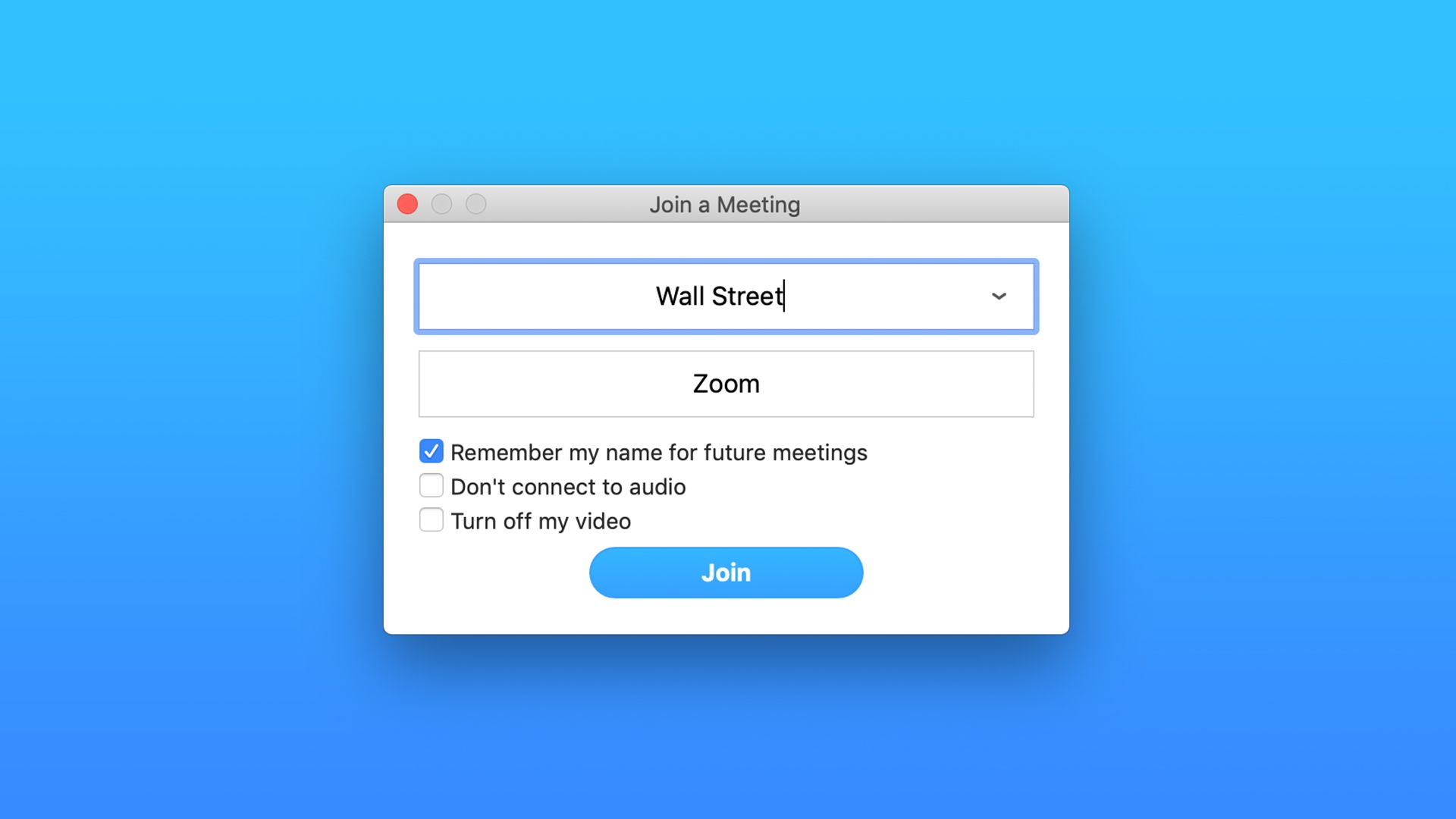

Unicorns will run rampant on Wall Street today, after both Pinterest and Zoom Communications priced IPOs above their proposed offering ranges.

- Pinterest raised $1.4 billion at $19 per share, above its $15-$17 range but below where it last sold shares to venture capitalists.

- Zoom raised $751 million at $36 per share, above its $33-$35 range, nearly 10x higher than where it last sold shares to venture capitalists.

- In both cases, it's a World Series grand-slam for early VC investors.

- Pinterest's raised $1.4 billion in venture capital, and will have an initial market cap of $10 billion while Zoom's is $9.2 billion after having raised just $160 million of venture capital.

On the one hand, it's easy to now dismiss all of the hand-wringing over how Lyft's aftermarket performance would soften demand for subsequent unicorn IPOs. On the other, remember that Zoom is profitable and Pinterest has a visible path to profitability. Lyft had neither.

• New math: The Blackstone Group this morning announced that it will convert from a publicly-traded partnership to a C-corporation.

- We first discussed this trend 14 months ago, pointing out how the switch could broaden a firm's shareholder base. Publicly-traded partnerships are off-limits for many institutional investors, and also aren't eligible for most equity indexes or exchange-traded funds. Plus, the 2017 tax cut moved the corporate tax rate much closer to the capital gains tax rate.

- Put another way: It's designed to lift the stock price. And that's something very appealing to Blackstone CEO Steve Schwarzman, who has complained for years that his firm is undervalued.

- Makes sense in theory, but results have been mixed. KKR shares have declined 5.93% since it converted to a C-corp last July, while Ares Management shares have climbed 4.37% since last November. (note: yes, there are all sorts of other firm-specific variables... just pointing out the conversion isn't a universal salve.)

• Game of Phones: TechCrunch's Josh Constine dives into the turmoil at mobile gameshow company HQ, where he reports that half the employees signed an internal petition to oust the CEO. Just one year ago it raised $15 million at a $100 million valuation from firms like Founders Fund and Lightspeed, but now is running short on cash and is struggling to find new investors. Worthy of your time.

• Debt distress: Yesterday we noted that Rob Jackson Jr. is planning to leave the SEC's board, potentially leaving the bipartisan group without a Democratic Party member. But, before he goes, Jackson is sounding the alarm on leveraged loans. From an interview with Bloomberg:

"As a former banker, I think leveraged loans are an area where

investors’ liquidity expectations might not match up with reality, and

the SEC should do all we can to help investors understand that. The

question is, is it time to go to Congress to get a new law to make sure

the SEC can do that work? It may be time."

🎧 Pro Rata Podcast: Our new episode focuses on the Apple-Qualcomm settlement. Listen here.

The BFD

Luckin Coffee, a Chinese coffee shop chain, raised $150 million in new funding led by Blackrock at a $2.9 billion valuation.

- Why it's the BFD: Because this will help fuel Luckin's caffeinated sprint against Starbucks, during which it has employed the Silicon Valley hypergrowth strategy of using venture capital to support deep pricing discounts.

- Drinking with the enemy: Blackrock, which pumped $125 million into the round, is Starbucks' second-largest outside shareholder with a 6.58% stake (valued at $6.2 billion).

- Bottom line: "Luckin said last year it plans to open 200 to 300 outlets a month, putting it on track to overtake Starbucks, which has over 3,300 locations in China, by the end of this year." — Tom Hancock, FT

Venture Capital Deals

• Outreach, a Seattle-based sales engagement platform, raised $114 million in Series E funding at a $1.1 billion valuation. Lone Pine Capital led, and was joined by Meritech Capital Partners, Lemonade Capita and return backers DFJ Growth, Four Rivers Group, Mayfield, M12, Sapphire Ventures, Spark Capital and Trinity Ventures. http://axios.link/YIfU

• Gen.G, a Los Angeles-based e-sports group, raised $46 million from NEA, Conductive Ventures, Battery Ventures, Canaan Partners, SVB Capital, Stanford University and individual angels like Will Smith and Keisuke Honda. http://axios.link/S6lN

• Pilot.com, a San Francisco-based bookkeeping platform , raised $40 million in Series B funding. Index Ventures led, and was joined by Stripe. http://axios.link/QFEC

🚑 Redox, a Madison, Wis.-based integration platform for digital healthcare apps, raised $33 million in Series C funding. Battery Ventures led, and was joined by return backers .406 Ventures, RRE Ventures, and Intermountain Ventures. http://axios.link/E8gs

• Moveworks, a Mountain View, Calif.-based provider of automated solutions for employee IT issues, raised $30 million in Series A funding from Bain Capital Ventures and Lightspeed Venture Partners. http://axios.link/Pnzk

🚑 Nocion Therapeutics, a Cambridge, Mass.-based biotech targeting neurons mediating cough, itch, pain and inflammation, raised $27 million in Series A funding. F-Prime Capital Partners and Canaan Partners co-led, and were joined by Partners Innovation Fund and Bio-Innovation Capital. www.nociontx.com

• Payfone, a New York-based digital identity authentication startup, raised $24 million. TransUnion led, and was joined by Synchrony, MassMutual Ventures and Wellington Management. www.payfone.com

• Unqork, a New York-based provider of a a no-code platform for financial services and insurance firms, raised $22 million in Series A funding. Goldman Sachs led, and was joined by Broadridge Financial Solutions. http://axios.link/bM5g

• Zapata Computing, a Cambridge, Mass.-based quantum computing startup, raised $21 million in Series A funding. Comcast Ventures and Prelude Ventures co-led, and were joined by return backers Pitango Ventures, BASF Venture Capital, Robert Bosch Venture Capital, Pillar VC and The Engine. http://axios.link/Rsdd

• Bankin’, a French financial management app, raised €20 million from Omnes Capital, Commerz Ventures and Génération New Tech. http://axios.link/KQaD

• Super, a San Francisco-based subscription service for home care and repair, raised $20 million in Series B funding. Aquiline Technology Growth led, and was joined by Munich Re Ventures, Liberty Mutual Strategic Ventures, Moderne Ventures, 8VC, QIA and Solon Mack Capital. http://axios.link/tusm

• Returnly, a San Francisco-based post-purchase payments startup, raised $19 million in Series B funding. Craft Ventures led, and was joined by Affirm. http://axios.link/7K8L

Phantom Auto, a Mountain View, Calif.-based remote AV driving startup, raised $13.5 million in Series A funding led by Bessemer Venture Partners. http://axios.link/g8Ye

• Alsid, a French cybersecurity startup focused on active directory breaches, raised €13 million. Idinvest Partners led, and was joined by return backers 360 Capital and Axeleo Capital. http://axios.link/AVP5

• Adverity, an Austrian data intelligence platform for marketers, raised €11 million in Series B funding. Felix Capital led, and was joined by Sapphire Ventures and SAP.io. http://axios.link/YJSb

• Kangaroo, a New York-based smart home security startup, raised $10.3 million in Series A funding. Greycroft led, and was joined by Lerer Hippeau. http://axios.link/BWXG

🚑 AllyAlign Health, a Richmond, Va.-based provider of Medicare Advantage special need plans, raised $10 million. McKesson Ventures led, and was joined by Heritage Healthcare Innovation Fund, Health Enterprise Partners and the LinkAge Fund. www.allyalign.com

• Airbase, a San Francisco-based spend management startup, raised $7 million in Series A funding led by First Round Capital. http://axios.link/NaI6

• Weengs, a British e-commerce logistics startup, raised £6.5 million in Series A funding. Oxford Capital led, and was joined by seed backers Local Globe, Cherry Ventures and Venture Friends. http://axios.link/05XY

• Co-Star, maker of an astrology app, raised $5.2 million in seed funding from Maveron, Aspect Ventures, 14w and Female Founders Fund. http://axios.link/sW3J

• Imandra, an automated reasoning engine with offices in the UK and Texas, raised $5 million in seed funding from AlbionVC, IQ Capital and LiveOak Venture Partners. http://axios.link/OkqB

• Slingshot Aerospace, an Austin, Texas-based provider of analytics for geospatial and orbital exploration, raised $5 million in seed funding. ATX Ventures led, and was joined by Rise of the Rest. www.slingshotaerospace.com

• Native, a New York-based on-demand local data marketplace, raised $2.5 million led by Lavrock Ventures. http://axios.link/RApA

Private Equity Deals

• Marlin Equity Partners acquired Skuid, a Chattanooga, Tenn.-based cloud app development platform that had raised over $30 million from firms like Iconiq Capital. www.skuid.com

• Polaris Growth Fund invested in Emergency Reporting, a Bellingham, Wash.-based provider of reporting and records management software for fire and EMS agencies. www.emergencyreporting.com

• Sverica invested in Stream Cos., a Malvern, Penn.-based provider of marketing solutions to the auto industry. www.streamcompanies.com

• Synergy Capital of Atlanta invested in Fitness Holdings Northeast, a Greenwich, Conn.-based franchisee of Crunch Fitness gyms. www.synergycapitalinv.com

• Thoma Bravo completed its $3.7 billion take-private buyout of mortgage software company Ellie Mae. http://axios.link/JuTY

Public Offerings

⛽ Brigham Minerals, an Austin, Texas-based owner of oil and gas mineral royalty interests, raised $261 million in its IPO. The company priced 14.5 million shares at $18, versus plans to sell 13.5 million shares at $15-$18. It will trade on the NYSE (MNRL) and Credit Suisse as lead underwriter. Shareholders include Warburg Pincus and Yorktown Partners.

🚑 Hookipa Pharma, an Austria-based immuno-oncology company, raised $84 million in its IPO. It priced 6 million shares at $14 (low end of range), and will trade on the Nasdaq (HOOK). BAML was lead underwriter. The company had raised $134 million in VC funding from firms like Baker Brothers (19.68% pre-IPO stake), Sofinnova (18.58%), Forbion Capital (12.57%), Boehringer Ingelheim (8.59%), Takeda, Gilead Sciences, Redmile Group and HBM. www.hookipapharma.com

🚑 KCI Holdings, a San Antonio-based maker of wound care and specialty surgical products, filed for a $100 million IPO. It plans to trade on the NYSE, with JPMorgan as lead underwriter, and reports a $138 million net loss on $1.47 billion in revenue for 2018. Shareholders include Apax Partners, CPP Investment Board and PSP Investments.

• Life360, a San Francisco-based family-tracking app, launched a A$145 million IPO in Australia. It’s raised over $120 million in VC funding from firms like Expansion VC, Bessemer Venture Partners, Carthona Capital, American Family Ventures, Kelly Perdew, ZenStone Venture Capital, Regal Funds Management, Samsung NEXT Ventures and Greencape Capital. http://axios.link/XehN

🚑 Turning Point Therapeutics, a San Diego-based developer of tyrosine kinase inhibitors for treating lung cancer and solid tumors, raised $167 million in its IPO. The pre-revenue company priced 9.3 million shares (increased for a second time) at the top of its $16-$18 range. Its initial market cap was $526 million, and it had raised around $76 million in VC funding from firms like Cormorant Asset Management (13.3% pre-IPO stake), OrviMed (8.2%), S.R. One (8.2%), Foresite Capital (6.3%) and VenBio Partners (6.3%). www.tptherapeutics.com

Liquidity Events

🎲 The Blackstone Group is seeking a buyer for the Cosmopolitan hotel and casino in Las Vegas, per Bloomberg. It reportedly could fetch over $4 billion. http://axios.link/8J76

• Mastercard (NYSE: MA) bought Vyze, an Austin, Texas-based provider of customer credit solutions that had raised $47 million from Austin Ventures, Fathom Capital and StarVest Partners. http://axios.link/qjK2

• Salesforce (Nasdaq: CRM) agreed to buy MapAnything, a Charlotte-based provider of mapping, geo-analytics and location intelligence solutions. MapAnything had raised $84 million in VC funding from Columbus Nova, ServiceNow, Greycroft Partners, Harbert Venture Partners and Salesforce Ventures. http://axios.link/v6c6

• Vector Capital and Cerium Technology sold Allegro Development, a Dallas-based provider of enterprise commodity management software, to ION. www.allegrodev.com

More M&A

• Canopy Growth (TSX: WEED) is nearing an agreement to buy Acreage Holdings (CNSX: ACRG), a New York-based cannabis company with a market cap of nearly US$2 billion, per Reuters. http://axios.link/ZAGL

Kiadis Pharma (Amst: ADS) agreed to buy CytoSen Therapeutics, a Texas-based developer of anti-cancer natural killer cell therapies. http://axios.link/6nnd

• Stripe, the San Francisco-based digital payments company, bought Touchtech Payments, an Irish provider of customer authentication solutions for banks. http://axios.link/mFR4

Fundraising

• Armory Square Ventures raised $31 million for its second fund focused on startups in upstate New York, per an SEC filing. www.armorysv.com

• Cerberus Capital Management raised $5.1 billion for a fund to buy non-performing loans.

• Petershill, a unit of Goldman Sachs, acquired a minority stake in Industry Ventures. http://axios.link/4oZS

It's Personnel

• Monica Crowley, a Fox News commentator, is expected to become the U.S. Treasury Department's top spokesperson, succeeding Tony Sayegh, per the NY Times. http://axios.link/yqvJ

• Elliott Robinson joined Bessemer Venture Partners as a principal focused on growth equity deals. He previously was with both M12 and Georgian Partners. www.bvp.com

• JPMorgan Chase said that Marianne Lake will now run the bank's consumer lllending unit, while former credit card boss Jennifer Piepszak will assume Lake's CFO role. http://axios.link/OPGY

Final Numbers

Go deeper with Axios Markets:

Companies made headlines last year as they gave out a bounty of bonuses to their employees thanks to 2017's Tax Cut and Jobs Act. But those bonuses ended up totaling just one penny in extra compensation for American workers, according to data analysis from the Economic Policy Institute.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.