Feb 9, 2018

Private equity giants consider a major structural change

Add Axios as your preferred source to

see more of our stories on Google.

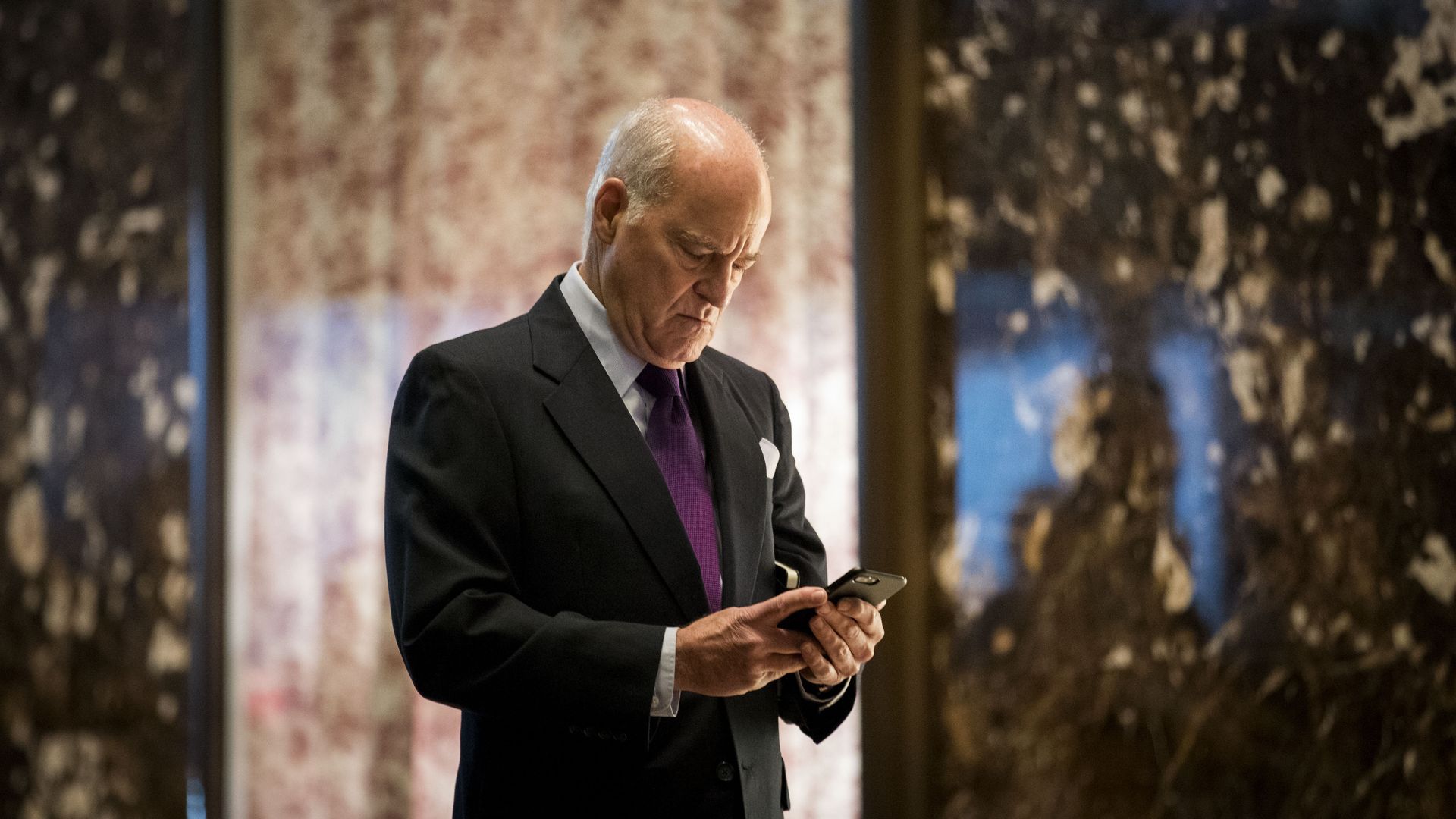

KKR co-CEO Henry Kravis. Photo by Drew Angerer/Getty Images.

Add Axios as your preferred source to

see more of our stories on Google.

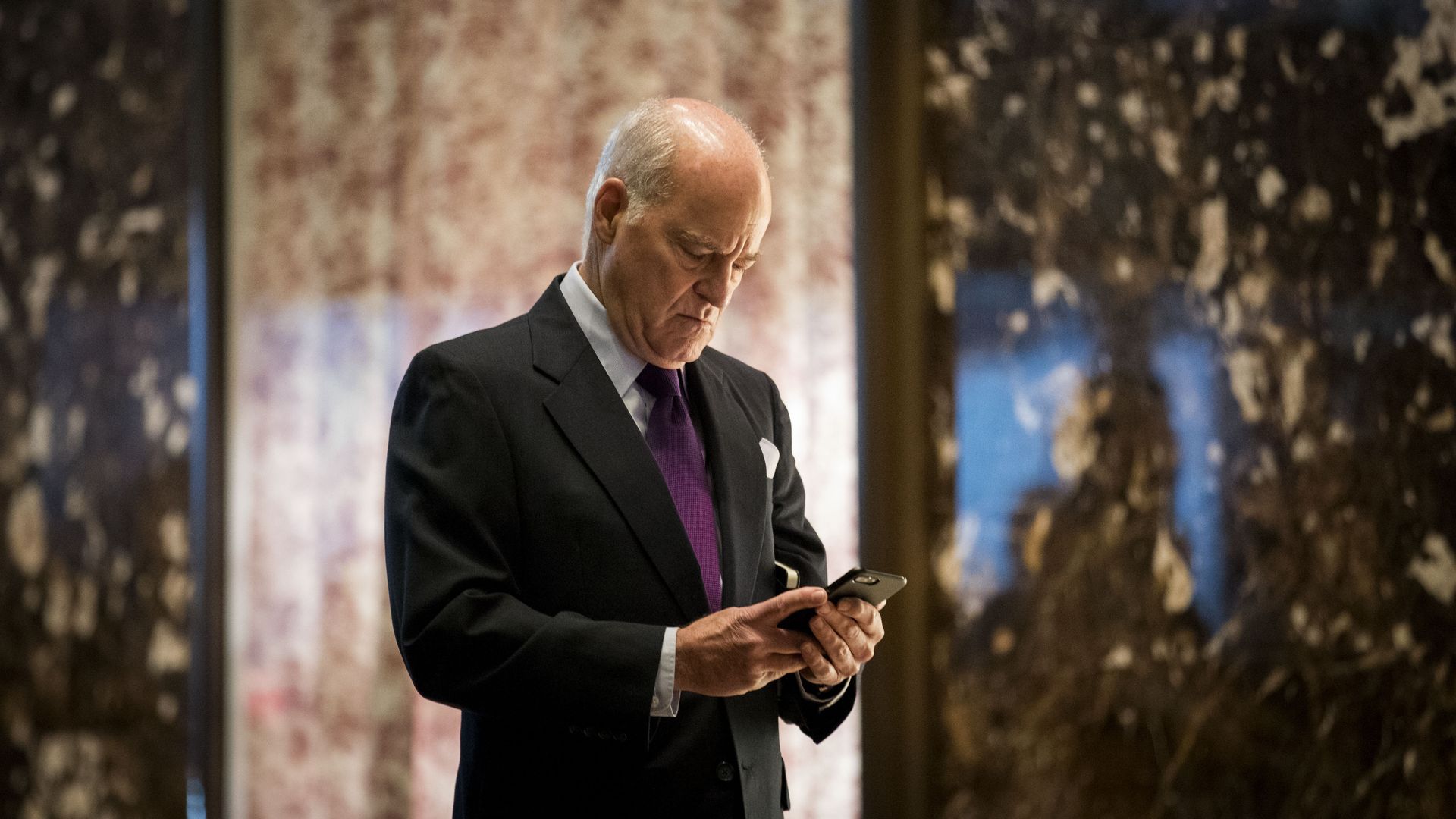

KKR co-CEO Henry Kravis. Photo by Drew Angerer/Getty Images.