Axios Markets

April 18, 2019

Was this email forwarded to you? Sign up here.

Situational awareness:

- Pinterest will price its IPO at $19 a share, $2 above the high end of its expected range, valuing the company at around $12.6 billion. Zoom priced its stock at $36 a share, valuing the company at more than $10 billion. (WSJ)

- Amazon officially gave notice to sellers that it will shutter its marketplace and seller services program on its Chinese website, Amazon.cn, starting July 18. (Reuters)

- Two separate class-action lawsuits have been filed against Lyft by investors who claim the company overstated its market position ahead of its IPO. (Bloomberg)

- Canadian cannabis giant Canopy Growth is closing in on a deal to acquire cannabis company Acreage Holdings. Acreage shares rose 10% in after-hours trading, but Canopy is also considering other partners. (CNBC)

1 big thing: The gig economy is distorting U.S. data

Illustration: Aïda Amer/Axios

Online shopping and the gig economy haven't just disrupted traditional brick-and-mortar business, they're disrupting the way U.S. job growth, wage data and inflation are tracked, asserts a new paper from the Dallas Federal Reserve.

What it means: There has been an increase in the number of workers in the gig economy who are either working as contractors or are self-employed, but report themselves as employed. These workers often have less bargaining power and lower wages than full-time employees.

- "Essentially, firms are able to hire contract or self-employed workers, who are not on their payrolls and not counted among the unemployed when not on the job," John V. Duca, a vice president in the research department at the Dallas Fed, says in the report. "As a result, the headline measure of unemployment may understate labor slack."

In essence, unemployment should be higher than it is because most gig economy workers should be counted as unemployed or underemployed, according to traditional metrics, but aren't. They also make less money, pushing down wage numbers. That is leading to unusually low readings in the data.

The big picture: Economists have long argued about just how much impact the gig economy has had on the persistently low wages in the U.S. and the change in the relationship between unemployment and inflation. Typically as unemployment falls, inflation rises, but that trend has been undermined in recent years, leading many to question the long-held economic principle of the Phillips Curve.

- Last year, Anat Bracha and Mary A. Burke, senior research economists at the Boston Fed, found recent year-over-year wage growth had fallen short of predicted values by 0.5–1 percentage point.

- They concluded that the gig economy had "an economically significant" impact on those lower wages.

Yes, but: "These shopping and employment behavior changes are still new enough that the data are insufficient for full statistical analysis," Duca says in the Dallas Fed report.

2. What stocks would look like without high profit margins

Bridgewater Associates estimates U.S. equities would be 40% lower than where they are today without the consistent expansion of profit margins, Axios' Courtenay Brown writes.

Why it matters: The world's largest hedge fund is warning that corporations' high profit margins are peaking, posing a risk to the stock market's rally.

- Several factors have contributed to companies' fatter bottom lines over the last 20 years: corporate tax cuts, the rise of globalization, less anti-trust enforcement, low interest rates and workers' shrinking bargaining power for more pay.

- But "many of these drivers of high profit margins are now under threat," Bridgewater analysts say in a new white paper, and the "long-term valuation of equities hinges heavily on what happens to margins going forward."

Of note: Without the benefit companies got from the tax cut last year, and with higher material and labor costs, analysts expect shrinking profit margins as companies release first quarter earnings.

- Still, as of yesterday's close, the S&P 500 is just 31 points from the record high set late last year.

Go deeper on the wage growth angle: The low-wage benefit for U.S. companies is over

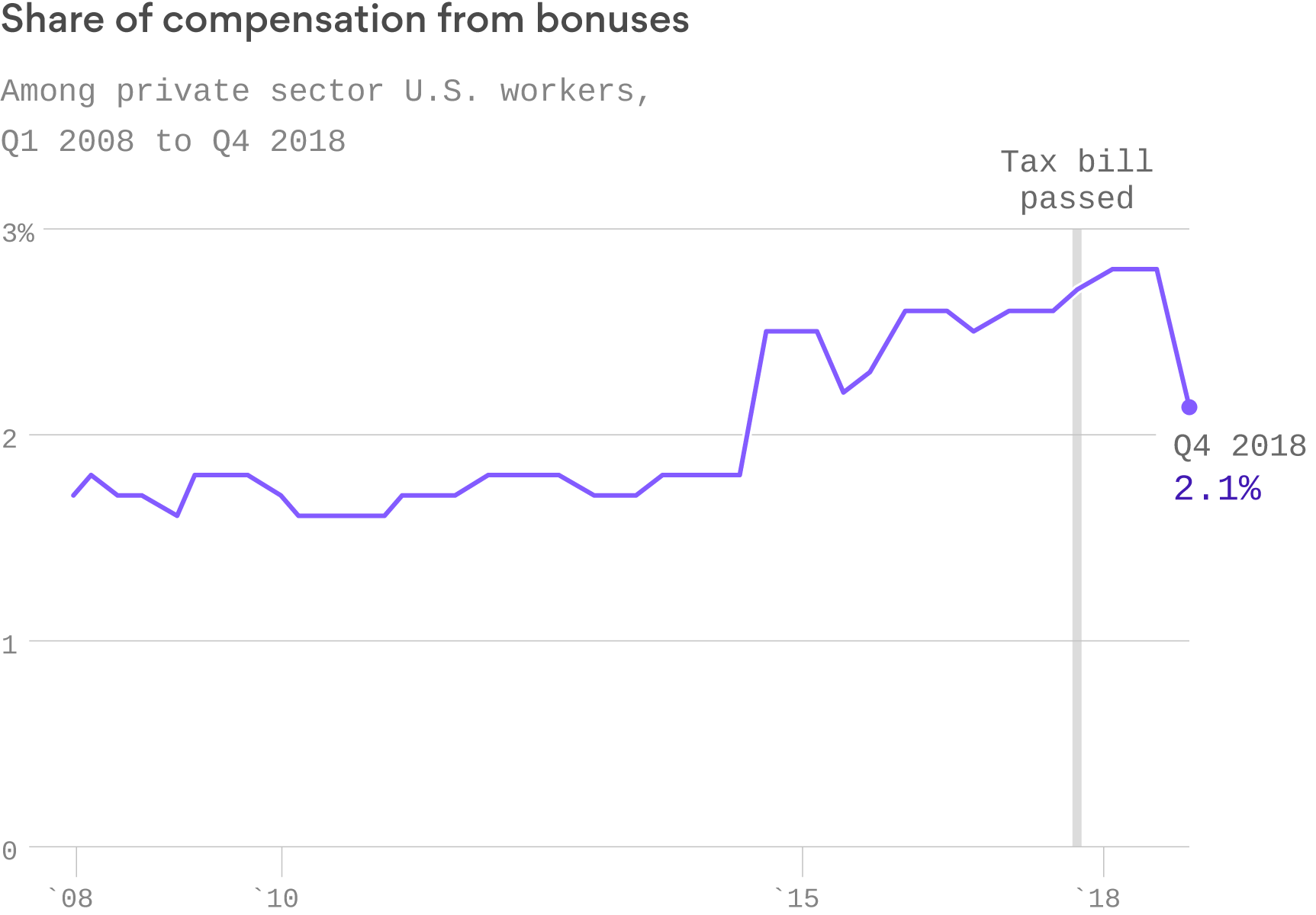

3. Americans have gotten 1 cent more in bonuses since the tax cut

Companies made headlines last year as they gave out a bounty of bonuses to their employees thanks to 2017's Tax Cut and Jobs Act. But those bonuses ended up totaling just 1 red cent in extra compensation for American workers, according to data analysis from the Economic Policy Institute.

What it means: The left-leaning think tank's inflation-adjusted calculations based on Bureau of Labor Statistics’ Employer Costs for Employee Compensation showed that bonuses fell $0.22 from December 2017 to December 2018, and the average bonus for 2018 was just $0.01 higher than in 2017.

- EPI's analysis of the government data shows very little increase in private sector pay or W-2 wages since the end of 2017. W-2 wages fell 2% from December 2017 to December 2018, and total compensation fell by 0.9%. For the full year, W-2 wages and compensation in 2018 rose by 0.2% and 0.1%, respectively, over their 2017 levels.

"This is not what the tax cutters promised, or bragged about soon after the tax bill passed," Lawrence Mishel, a distinguished fellow at EPI, said in the report.

- "They claimed that their bill would raise the wages of rank-and-file workers, with congressional Republicans and members of the Trump administration promising raises of many thousands of dollars within ten years. The Trump administration’s chair of the Council of Economic Advisers argued last April that we were already seeing the positive wage impact of the tax cuts."

4. Death of ex-president sheds light on Peru's corrupt politics

Peru's former President Alan García. LUIS ROBAYO/AFP/Getty Images

Former Peruvian President Alan García killed himself on Wednesday, reportedly as authorities closed in to arrest him for links to the corruption scandal involving Brazilian construction firm Odebrecht, known as Operation Car Wash, or Lava Jato.

Eye-popping stat: Peru's last 5 former presidents have all been charged with crimes. Three have been sent to jail, 1 is currently on house arrest and the other is an international fugitive.

The last president not sought by authorities for graft was Fernando Belaúnde Terry, who left office in 1985 and died in 2002.

- Peru's most recent ex-president, Pedro Pablo Kuczynski, was removed from office and eventually sentenced to 10 days in jail over charges a consulting firm he co-owned accepted nearly $1 million in payments from Odebrecht.

- Former President Ollanta Humala is currently under house arrest facing allegations he took $3 million in bribes, largely from Odebrecht, during his term from 2011 to 2016.

- García served 2 terms as president, most recently prior to Humala, and shot himself in the head as authorities arrived to take him to jail.

- Alejandro Toledo has reportedly fled to the United States to avoid trial on corruption charges for taking bribes from Odebrecht.

- Alberto Fujimori, who oversaw a 10-year dictatorship in Peru from 1990 to 2000, was sentenced in 2009 to 25 years in prison for crimes against humanity, including killing more than 2 dozen people by military death squad.

- Fujimori was freed by Kuczynski in a controversial deal with Fujimori's daughter Keiko, who at the time was leader of the congressional opposition party. But last year he was sent back to prison. Keiko was arrested for taking bribes from Odebrecht in October and sentenced to 36 months pretrial detention.

Despite the political chaos, Peru's stock market delivered world-beating returns from the start of 2016 to the end of 2017. An ETF tracking MSCI's Peruvian index (EPU) gained 114% during that time, far outpacing the S&P 500's 43% rise and almost doubling MSCI's broader gauge of emerging market equities, which rose 66%, according to data from Yahoo Finance.

- It has since underperformed both indexes.

Sign up for Axios Markets

Stay on top of the latest market trends and economic insights