Axios Media Trends

August 15, 2017

Good morning and happy Tuesday. Thanks for subscribing to Axios Media Trends. Send tips and ideas to [email protected] and tell your friends and colleagues to join the conversation by signing up here.

1. The global online terror crackdown

China announced Friday that it's investigating its own tech companies, like Tencent and Baidu, for giving users an avenue to spread violence and terror. That follows government campaigns announced earlier this year in the U.K., France, and Germany to place legal liability on tech companies for failing to control the presence of terrorist-related content on their platforms.

- Why it matters in Washington: U.S. regulators have largely remained silent when it comes to policing the role of tech giants in distributing terrorist content, leaving tech companies to police themselves in accordance with their own standards.

- Why it matters in Silicon Valley: In the past, tech companies have reacted to crises in a uniform fashion, but the attack in Charlottesville shows a split. Some sites, like Google and GoDaddy, announced Monday that they would cut ties to a white nationalist website, while others have yet to comment. Neither Facebook nor Twitter updated their policies in response to the attack, although both groups do already have policies about violence and hate speech.

2. The Charlottesville rally Facebook event

The Facebook issue: Critics argue that Facebook didn't do enough to prevent the attack, as the marches had apparently been organized through Facebook.

- In a statement, Facebook told Axios it "does not allow hate speech or praise of terrorist acts or hate crimes, and [it's] actively removing any posts that glorify the horrendous act committed in Charlottesville."

- Facebook says it uses both technology and people to determine whether users take advantage of that openness with posts that glorify violence, or otherwise violate their community standards. In this case, the tech company didn't find that the event that brought together the Charlottesville rally violated community standards until the weekend of the event, when it was removed. Posts related to the "Daily Stormer" website Google and GoDaddy have disassociated with have mostly been removed by Facebook.

Sound smart: Facebook's business model is built around scale. Its corporate vision is based on inclusivity of all voices and perspectives. These goals are directly challenged when the company filters out content or restricts user privileges.

3. China putting media and tech on notice

Aside from the investigation into its own media companies, China recently added WhatsApp to its list of blocked properties in the country and cracked down on apps within Apple's App Store that allow users to get around content filters.

- Why it matters: China has emerged as one of the more lucrative markets in the new global trade war for consumer data and it's leveraging that position for power and security, putting strains on the abilities of global media and tech companies to penetrate China.

- Media/tech companies currently blocked in China: Facebook, Twitter, Instagram, Pinterest, Tumblr, Snapchat, Google Search, NYT, WSJ, The Economist, Bloomberg, Reuters, Netflix, Youtube, and many more.

- Some companies are looking for shortcuts: On Friday, the NYT reported that Facebook authorized a copycat app to be built in China that could be used for photo-sharing in the country, since Facebook has been blocked there since 2009.

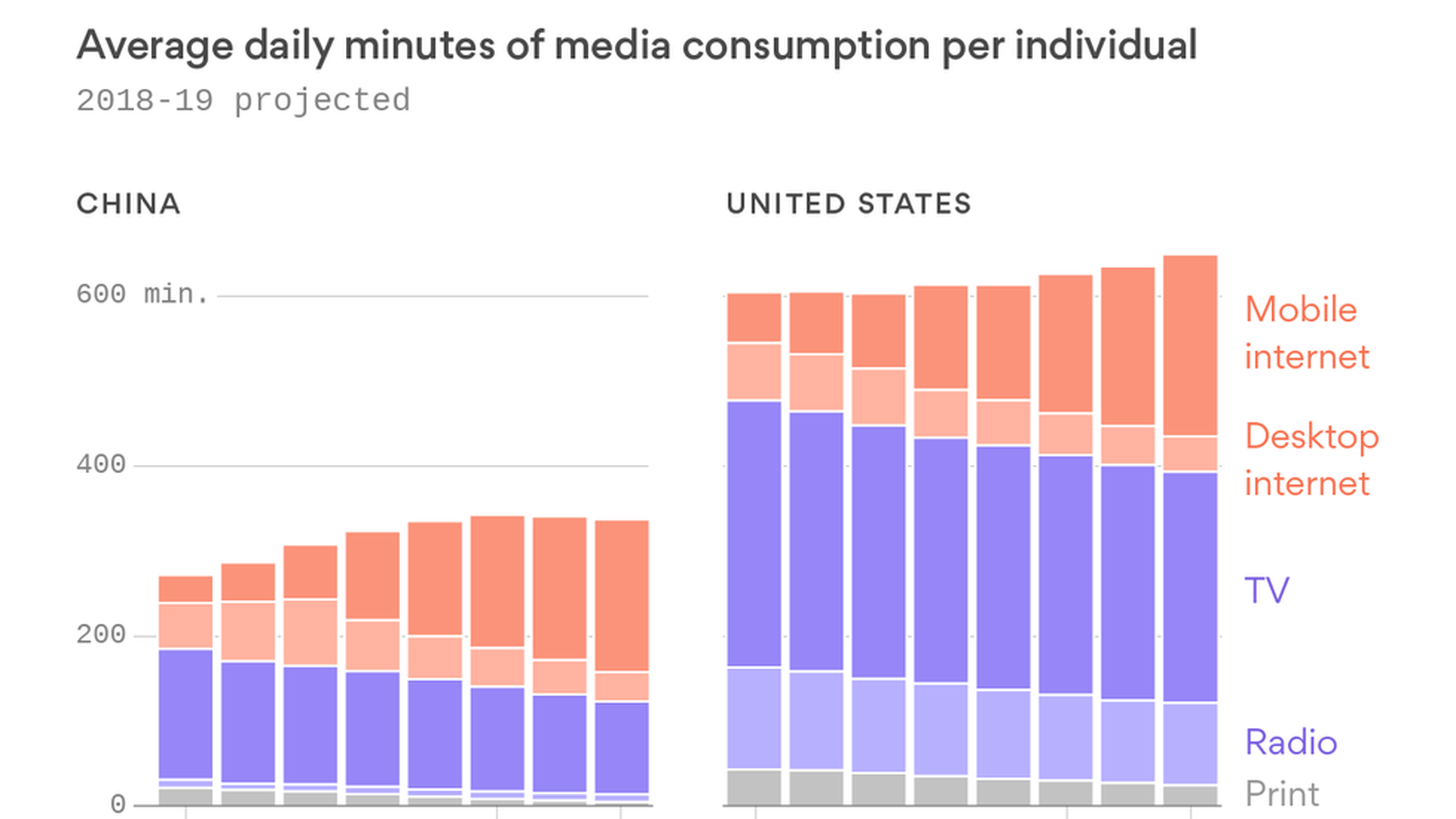

4. Gut Check: China vs. U.S. media consumption

China may have the highest number of internet users globally, but it still pales in comparison to the U.S. by overall media consumption and ad revenue.

- The average person in the U.S. spends 649.5 minutes daily on media, while the average person in China spends 337.5 minutes, per ZenithOptimedia's latest global consumption report.

- The U.S. ad market (the largest globally) is also much bigger, worth roughly $191 billion compared to the Chinese ad market (the second-largest globally) worth roughly $80 billion.

- This is why U.S. media and tech companies are so focused on ARPU (average revenue per user) in the U.S., but are also eager to get into China.

Speaking of China...

- Chinese startup Toutiao raised $2 billion in funds at over $20 billion valuation: Sources tell Reuters, "Its valuation has leapt around forty-fold within three years - it was valued at just $500 million in June 2014 - as customized news feed models become increasingly popular with China's highly mobile population."

- Toutiao's target: A person close to the company told Reuters that "with about 100 million daily active users as of the first quarter, Toutiao is targeting annual revenue of $2.5 billion for 2017."

- Our thought bubble: That's an extremely high valuation for a media platform that's also being challenged for copyright infringement by its biggest competitors.

5. Streaming's high school cafeteria

The streaming market is booming, and it's getting competitive. Soon there will be more platforms than consumers can watch and afford and distributors won't be able to cut deals with them all.

- This pressure has caused likeminded TV networks, (entertainment, lifestyle, sports, etc.) to either compete against one another for distribution deals or come together in order to compete for better deals collectively (think Discovery/Scripps merger). It's an interest-based power struggle that resembles groups in a high school cafeteria. (Tech nerds, drama/entertainment kids, sports jocks, etc.)

- Why it matters: Axios' Dan Primack put it best in his Pro Rata newsletter last week: "Hopes for a 'skinny bundle' are fast being replaced by a fat streaming bill. At some point consumers will demand a consolidated option that looks a lot like digital cable." Until that type of broader "digital cable" option exists, likeminded networks are going to have to either team up or compete against each other for the best distribution deals possible.

- Go deeper: Full breakdown of the streaming market by groups.

6. Experts weigh in: Can BAMTech save ESPN?

When Disney CEO Bob Iger announced last week that the company poured another $1.58 billion into owning 75% of BAMTech — the streaming technology provider worth over $3 billion — it was clear that he saw that acquisition as the key to salvaging ESPN's cord-cutting problem. Some experts see it differently.

- BAMTech, currently co-owned by Disney, NHL, and Baseball Advanced Media, powers some of the biggest OTT streaming services in America like MLB.TV, HBO Now, and WWE. Iger hopes it will give Disney access to a data-based platform that will transform the way it can sell ads, service content, and connect with consumers.

- Why it matters: Disney has been behind some of its competitors in transitioning into a digital-first, direct-to-consumer business model. One of the biggest rivals of Disney's ABC and ESPN — CBS — has had a streaming network for nearly three years. Plus most of the major sports networks have been operating on streaming networks for years as well. And even now that Disney is launching a streaming service, there's no guarantee that consumers will be willing to pay for it.

So, will BAMTech be enough to save ESPN, which has lost 12% of its subscriber based in six years? Read more from top analysts in the Axios stream.

p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 14.0px 'Helvetica Neue'; color: #14171a; -webkit-text-stroke: #14171a; background-color: #e6ecf0} span.s1 {font-kerning: none}

p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 14.0px 'Helvetica Neue'; color: #14171a; -webkit-text-stroke: #14171a; background-color: #e6ecf0} span.s1 {font-kerning: none}

7. 1 sad thing: The print cliff

Print ad revenue in the U.S. was down 17% between Q2 2016 and Q2 2017, per Standard Media Index's latest total ad spend report. That's more than double what it was compared to the prior yearly loss of 8%. Newspaper revenue was down 20%, compared with 4.3% the prior year. Magazine revenue was down 16%, compared with 9.6% the year before.

Here's the full breakdown:

Q2 2016 - Q2 2017 ⬆️ Total: +3.8% YOY Digital: +11% Broadcast: +4% ⬇️ Print total: -17%Newspapers: -20% Magazines: -16% Cable: -4% Radio: -4% Out of Home: -1%

Q2 2015 - Q2 2016 ⬆️ Total: 5.1% Digital: 16.6% Out of Home: 10.0% Cable: 4.5% Radio: 0.4% ⬇️ Print total: -8%Newspapers: -4.3% Magazines: -9.6%Broadcast TV: - 1.6%

Sign up for Axios Media Trends

Sara Fischer’s inside look at the forces reshaping media.