Axios Markets

May 02, 2019

Was this email forwarded to you? Sign up here.

Situational awareness:

- Beyond Meat will price its IPO at $25 a share, at the top end of its expected range. The company is offering 9.625 million common shares. (CNBC)

- Qualcomm stock fell about 3% in after-hours trading after the company delivered a below-expectation third-quarter sales forecast, citing weaker demand for smartphones in China. (Bloomberg)

1 big thing: The stock market has entered "The Twilight Zone"

Illustration: Aïda Amer/Axios

Typically, stocks rise because investors are buying them, increasing prices. But that's not what's happening in 2019. U.S. equity prices are soaring to record highs, with the S&P 500 up 17% and the Nasdaq up 21% in just 4 months. But not only are investors not buying, they're selling.

Stock funds have seen $4 billion of outflows so far in 2019, surpassing the $2.9 billion of outflows for all of 2018 when the S&P fell by 6%. This year's outflows included a drawdown of nearly $11 billion in just the month of March, according to data from Lipper, which tracks $49.1 trillion in assets globally.

What's happening? The strange phenomenon can partially be explained by investors moving away from traditional mutual funds at a historic pace, particularly in U.S. stock funds.

- "The negative investor sentiment about domestic equity mutual funds has been a long-term trend," Pat Keon, senior research analyst at Lipper, tells Axios. "The net outflows for this group have been worse over the last several years than even during the global financial crisis."

But that's only part of the story. Investors also are clearly wary of the historic stock rally, now pushing toward an 11-year bull run, and are nervous about global growth slowing. Equity funds have seen 11 straight weeks of net outflows, Lipper's data shows.

- Safe-haven fixed income funds, on the other hand, have seen $107.7 billion of inflows year to date.

The intrigue: The bond market is reflecting this worry, but stocks so far have not, largely because of company buybacks and low volumes, analysts say.

- U.S. companies have purchased $272 billion of their own shares so far this year, on pace to break 2018's record $1.085 trillion.

- There also have been less transactions overall, says Jim Paulsen, chief economist at the Leuthold Group, opening up the market to bigger price moves. That's allowing small buys to have big impacts.

The bottom line: The "Twilight Zone" state of affairs may actually be good news for stocks because it means investors aren't overconfident, say analysts at Bank of America-Merrill Lynch. In fact, sentiment is historically low, according to the bank's consensus indicator.

- "Historically, when our indicator has been this low or lower, total returns over the subsequent 12 months have been positive 92% of the time, with median 12-month returns of 18%," BAML analysts said in a note to clients.

But, but, but: It may just mean the stock market is pumped full of hot air.

2. Investors saved over $5 billion on fund fees in 2018

The cost of U.S. mutual funds and ETFs shrank last year by the second largest amount on record, saving investors $5.5 billion, according to a new study from Morningstar.

The price of investing has been falling precipitously since the creation of index funds, punctuated recently by negative-fee products that actually pay a small rebate for investing.

- "As awareness grows around the importance of minimizing investment costs, we have seen a mass migration to low-cost funds and share classes," said Ben Johnson, Morningstar's director of ETF and passive strategies research.

Morningstar's study found that in 2018:

- Investors are paying approximately half as much to own funds as they were in 2000, roughly 40% less than they did a decade ago and about 26% less than they did 5 years ago.

- Fees have fallen significantly for both active funds and passive funds.

What to watch: Fees have fallen across the board, but investors are choosing the very cheapest options. The least expensive 20% of funds saw net inflows of $605 billion, with the remaining 80% of funds experiencing net outflows of $478 billion. Of the $605 billion that flowed into the cheapest 20% of funds and share classes, 97% of net new money flowed into the least costly 10% of all funds.

3. Jay Powell's trouble with words

Markets were little moved by the Fed's decision to keep U.S. interest rates unchanged and the release of their accompanying statement yesterday, but Chair Jay Powell's word choice got things moving.

Driving the news: Recent weak inflation readings have backed traders' bets that the Fed will cut rates at least once this year, but Powell knocked that idea, saying the central bank sees the weakness as the result of "transitory" factors, such as lower investor fund fees (see above), lower apparel prices and airfares.

- The Fed's inflation target is 2%, and the U.S. core PCE rate fell to 1.6% in the first quarter.

4. Oil prices shake off Venezuela bounce

Oil prices fell on Wednesday as the fears of an escalation in Venezuela's political crisis faded, and U.S. inventories posted a surprise increase, adding to global supply. Crude prices have largely wiped out the politics-driven rally that began on April 22 after the US decided to end sanctions waivers for countries importing Iranian oil.

What's happening: U.S.-backed Venezuelan President Juan Guaido attempted to seize power from Nicolás Maduro on Tuesday, but has not been able to declare victory.

- Whether or not the push to oust Maduro succeeds will "depend on the opposition’s ability to win over enough of the armed forces," writes Allison Fedirka, an analyst at Geopolitical Futures. "There are signs that members of the military are publicly supporting Guaido, but it hasn't yet reached a critical mass."

Fund managers have told Axios that they are starting to lose faith in the opposition's ability to topple Maduro alone, given an apparent increase of support from Russia, China and Cuba.

Oil traders look to be coming to the same conclusion.

What they're saying:

- "We believe it will not be a quick fix to turn the state of the domestic oil industry around even with a new regime," commodity analysts at ING said in a note to clients.

- "We simply don't know what is happening on the ground," Helima Croft, global head of commodity strategy at RBC Capital Markets told CNN. "I would be cautious about saying we are in the final chapter."

The bottom line: If Maduro goes, it will likely take years until Venezuela's oil production is operating at anywhere near its previous capacity (it is currently producing oil at a 70-year low). And it's looking less likely Maduro is going.

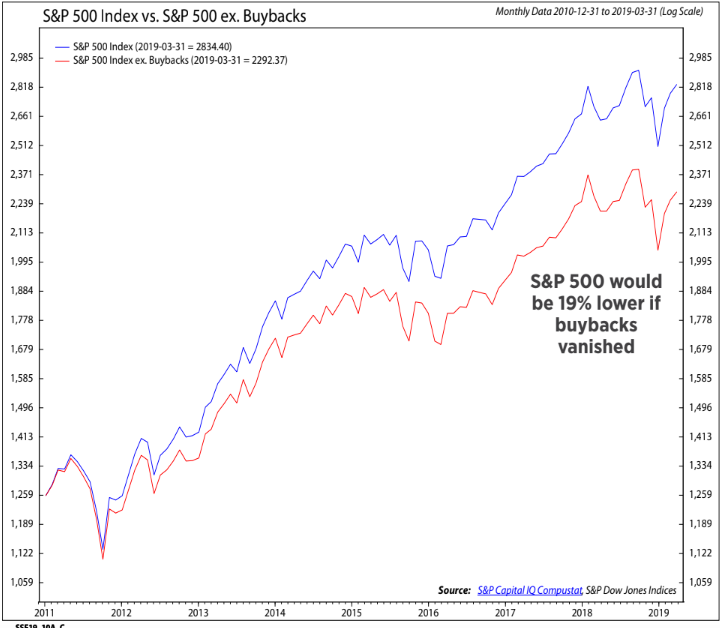

5. What the S&P 500 would look like without buybacks

Buybacks have been a major part of the stock market's run, not just in 2019, but over the past decade. Since 2010, companies have bought back $3.5 trillion of their own shares. According to calculations by Ed Clissold, chief U.S. strategist at Ned Davis Research, the S&P 500 would have risen 19% less during the time period if not for buybacks.

- Clissold's methodology was simply subtracting the monthly dollar amount of net repurchases from the dollar return in the S&P 500.

Note: A company's stock performance is obviously a major motivation for buying back shares in the first place. While it's clearly impossible to determine what decisions a company would have made in a hypothetical situation in which it could not buyback stock, it's an interesting thought exercise. Don't @ me.

6. "This is the stupidest idea I've ever seen"

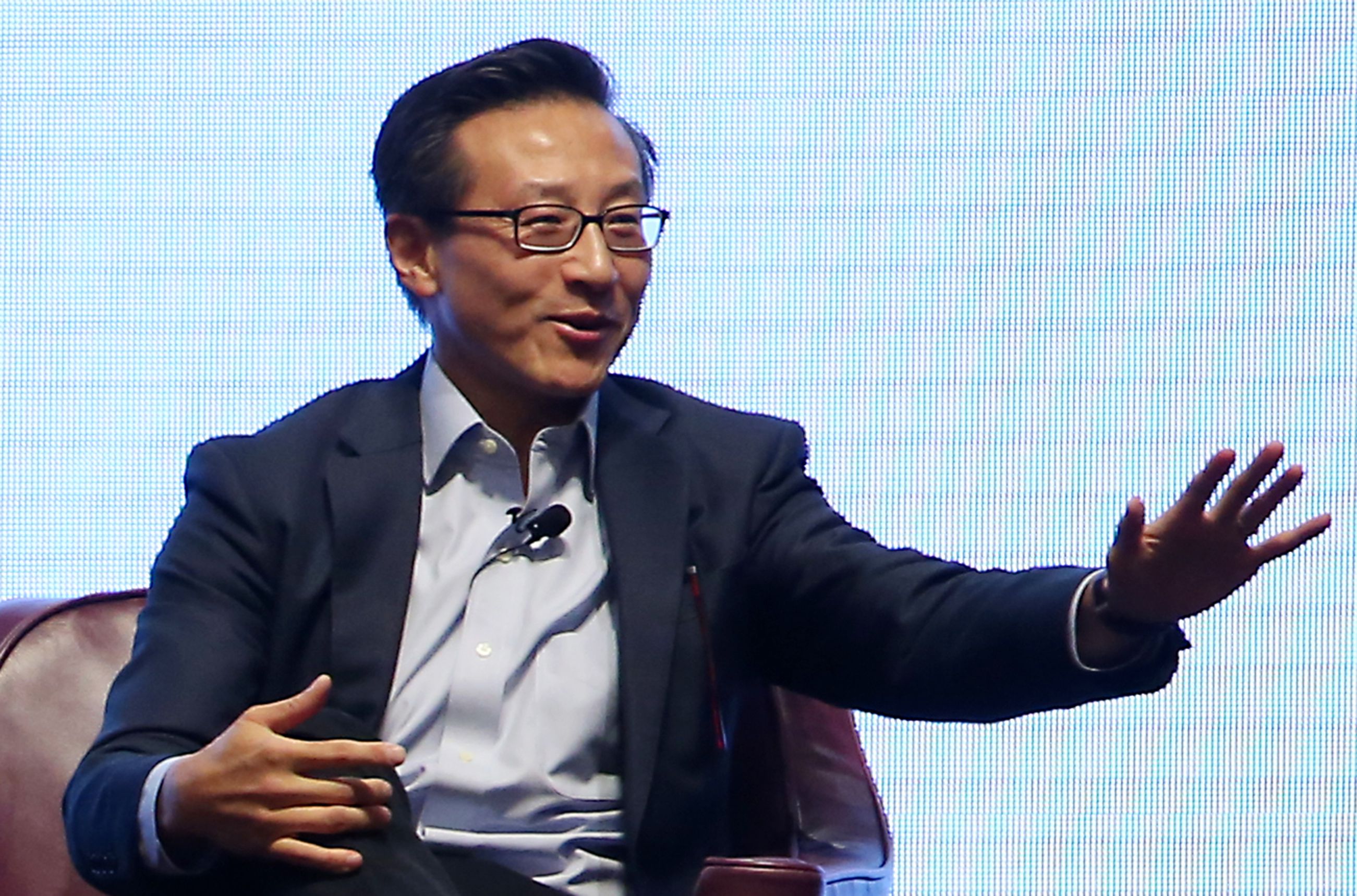

Alibaba's billionaire co-founder Joseph Tsai spoke to an audience at ICI's annual gathering Wednesday about the humble origins of its payment service, Alipay, which is now Ant Financial.

"We started an escrow service called Alipay where the consumer would just send their money to us, Alibaba."

"When this thing first started, I thought 'This is the stupidest idea I've ever seen.' I just couldn't fathom that people would entrust their money with us. But that was the only solution. Nothing else worked.

"And through that we created a payments business and from a payments business now Ant Financial is a diversified financial services type business with not just payments, but also consumer loans, SME loans, money market funds, distribution of other mutual funds and insurance products.

"So it's now grown into a much bigger business but it started as an escrow service."

Ant Financial says it now boasts 1 billion global users in 54 markets and its flagship Tianhong Yu'e Bao money-market fund has more than 588 million users alone. At $150 billion, it's the highest valued fintech company in the world.

Sign up for Axios Markets

Stay on top of the latest market trends and economic insights