Axios Generate

August 19, 2020

Welcome back. Today's Smart Brevity count: 1,296 words, < 5 minutes.

And with a h/t to the Dr. Rock blog, this week marks 50 years since The Band released "Stage Fright," which provides today's intro tune...

1 big thing: Markets ponder GM's electric metamorphosis

Here's a 2020 moment for you: A Morgan Stanley note yesterday pegged the value of General Motor's nascent electric vehicle business at $20 billion, a tally well above the firm's assessment of GM's core gasoline-powered lines.

Why it matters: It signals analysts' view that revenues from EVs and battery tech are going to be a big thing despite what's now a tiny market share, but it's unclear who the long-term winners will be.

- Tesla now has a market capitalization of $362 billion (!) after its stock closed at an all-time high of $1,887-per-share Tuesday.

- Just yesterday the fledgling player Canoo, which is planning an untested subscription service and hasn't built anything yet, announced a $2.4 billion deal to go public.

- Several EV startups are raising lots of money, including the private Rivian, which raked in another $2.5 billion earlier this year, while the electric truck company Nikola Motor has seen its share price climb since it began publicly trading in June.

The intrigue: The note from Morgan Stanley's Adam Jonas comes amid buzz about the idea that GM might spin off its EV business into a stand-alone unit (an idea that Axios' Joann Muller explored recently).

GM is betting big on EVs, with plans to have 20 fully electric models by 2023.

Driving the news: GM's stock jumped earlier this week on the strength of a Deutsche Bank report Monday that suggested the value of a stand-alone EV unit could even be way above what Morgan Stanley estimates.

The Morgan Stanley note also concludes a spinoff is a good idea. "[T]he autonomy between the two units can liberate each other of various impediments to efficient capital allocation and talent development," Jonas writes.

What they're saying: A CNBC headline on the topic sums it up: "Wall Street pushes for GM to spin off its electric vehicle business."

The big picture: Morgan Stanley analysts assess the stock's value at $46-per-share, well above where it's currently trading, and their "bull case" is far higher.

- Their note — which acknowledges lots of uncertainty — is an attempt to size up the long-term potential of GM's EV technologies, notably the company's new "Ultium" battery and propulsion system, which it is using internally and as a product to sell to other automakers.

- They see opportunities and pitfalls — and a substantial revenue opportunity. With lots of caveats, the note sees $22 billion in annual revenue by 2030 and $74 billion in 2040.

Bonus: New cash for electric truck startup

Xos Trucks has raised $20 million to "grow operations and further scale production of the X-Platform currently used by customers Loomis and UPS, among others," the Los Angeles-based company said.

Why it matters: The company said new California regulations, which require more than half the trucks sold in the state to be zero emissions by 2045, is "further validating the market opportunity for Xos Trucks."

Investors in the new funding round include the mobility-focused VC firm Proeza Ventures and the BUILD Capital Partners.

Go deeper: Xos Trucks raises $20M to put more of its electric commercial trucks on the road (TechCrunch)

2. A new push to deploy carbon-sucking tech in the U.S.

Illustration: Rebecca Zisser/Axios

This morning is bringing new information about a proposal to build a large plant in Texas oil country that would directly pull carbon dioxide from the atmosphere.

Driving the news: Occidental Petroleum has teamed up with Rusheen Capital Management to advance plans by Canada-based Carbon Engineering to build a direct air capture plant in the Permian Basin — and eventually facilities elsewhere, too.

Occidental subsidiary Oxy Low Carbon Ventures and Rusheen, a private equity firm, have formed a company called 1PointFive to "finance and deploy" Carbon Engineering's technology in the U.S.

Catch up fast: Oxy and Carbon Engineering first proposed the Permian Basin facility last year.

Occidental, a large oil producer that uses injected CO2 to boost output, and Rusheen are existing investors in Carbon Engineering, which has also received funding from Bill Gates, Chevron and others.

Why it matters: It's a step toward building a plant that the companies say would be the world's largest direct air capture (DAC) facility, with the capacity to remove up to 1 million metric tons of atmospheric CO2 annually.

More broadly, the new licensing deal with 1PointFive and Carbon Engineering for the Permian plant in Texas is the "first step toward their aspiration to deliver this technology on an industrial scale throughout the United States," they said.

Where it stands: DAC is among the nascent negative emissions technologies attracting more attention as a way to help avoid runaway global warming. But that's if — if! — it can eventually be deployed at a major scale (1 million tons annually is a drop in the bucket).

The big picture: A UN-led scientific report in late 2018 concluded that plausible pathways for holding temperature rise to 1.5 degrees Celsius above preindustrial levels require atmospheric CO2 removal methods in addition to steep emissions cuts.

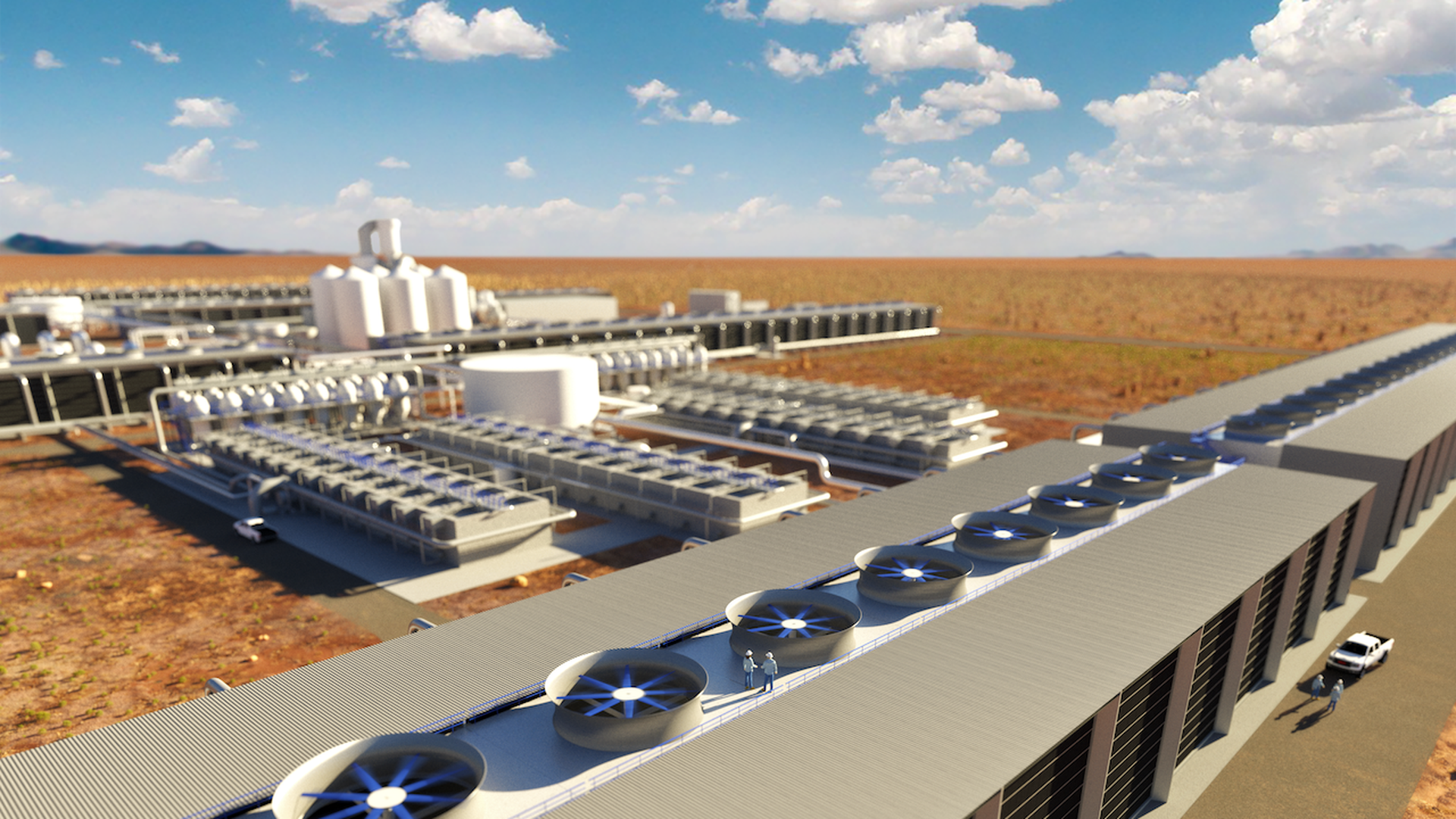

Bonus: Imagining the direct air capture plant

Image courtesy of Carbon Engineering

The companies released an illustration to provide a sense of what the Permian Basin facility will look like. It will have a "land footprint of approximately 100 acres," they said.

3. Trump weaponizes California's power crisis

President Trump is trying to use California's electricity woes as a political cudgel against Democrats nationwide heading into the election.

Driving the news: Trump, via Twitter Tuesday, blamed Democrats for rolling blackouts in recent days, claimed he "gave" the U.S. "energy independence," and that "The Bernie/Biden/AOC Green New Deal plan would take California’s failed policies to every American."

Reality check: The nonprofit California Independent System Operator, which manages the state's power grid, is not a political entity.

"There wasn’t any party affiliation or other kind of input" into the rolling blackouts imposed Friday and Saturday, Steve Berberich, the group's CEO, told reporters Tuesday, per multiple reports.

Also, the U.S. isn't "energy independent," although the shale boom over the last decade-plus has made the U.S. a net exporter of petroleum products.

The big picture: However, grid managers in California are grappling with how to manage the state's increasing use of solar power and move away from natural gas, as Greentech Media explores here.

And Joe Biden's platform calls speeding the transition away from fossil fuels nationwide, though he didn't specifically endorse the sweeping congressional Green New Deal resolution.

Where it stands: "The exact root of California’s rolling blackouts is still unclear as more power outages loom, and that's allowed everyone to point fingers," Politico reports.

The piece notes experts have "cited a litany of potential causes," including "ballooning demand, inadequate transmission, an overreliance on renewable energy and natural gas plant challenges during hot weather."

4. Catch up fast: Election edition

Policy: "The Democratic National Committee this week quietly dropped language calling for an end to fossil fuel subsidies and tax breaks from its party platform." (HuffPost)

Money: "Self-identified 'climate donors' are a new phenomenon in the 2020 election and are working overtime to show candidates that campaigning to eliminate emissions from fossil fuels pays — in cash. (New York Times)

Advertising: "America’s biggest oil and gas lobby group is ramping up its advertising spending ahead of the November election to persuade voters that natural gas is a climate-friendly fuel, according to ad buying data." (Reuters)

5. How to change the "unsustainable" materials path

The global rate of materials extraction is "unsustainable" and there's a need to untether economic growth from consumption, per a new public report from the consultancy Wood Mackenzie.

Why it matters: It argues major industries should embark on a "materials transition" — a phrase akin to the now-common term "energy transition" used to describe movement toward climate-friendly sources.

Those industries include construction and infrastructure, which is a major driver of the use of non-metallic minerals (check out the chart above).

What to watch: The report uses the plastics and packaging sector as a case study for how a transition toward a more sustainable system can occur.

It envisions a future with tougher rules and big investments, compared to current trends, in chemical and mechanical recycling.

By the numbers: Wood Mackenzie analyzed the future of major packaging plastics: polyethylene, polypropylene and polyethylene terephthalate.

- In its "current path" scenario, recycling rises from 17% to 38% in 2040. On a more sustainable path, that would rise to 67%.

- "By 2040, this results in an additional 53 million tonnes of packaging plastic prevented from going into landfill, energy recovery or unmanaged waste streams...Cumulatively, from 2020 to 2040, this rises to 382 million tonnes."

Sign up for Axios Generate

Untangle the energy industry’s biggest news stories