Axios Capital

June 18, 2020

🎧 For 10 minutes this Monday morning — and every weekday thereafter — I'm going to be listening to "Axios Today," our flagship new podcast hosted by the great Niala Boodhoo. Then, in the afternoons, Dan Primack's "Axios Re:Cap" will have more of a business lens. Subscribe to them both!

Last week some readers asked me if I was pro-looting, given what I said about its positive economic consequences. I'm not, and this week I go deeper into the distinction between what is good economically and what is good morally. Plus, more about Robinhood and Hertz.

- The whole thing is 1,802 words, which will take you about 7 minutes to read.

1 big thing: God vs. mammon

Illustration: Sarah Grillo/Axios

Economics is rarely aligned with morality. That's one lesson from the looting example I wrote about last week: Looting is harmful to society, and is criminalized for good reason, even though it can have positive economic consequences.

Why it matters: The disconnect between economic and moral imperatives lies at the heart of the biggest issues facing America today, from the rising appeal of socialism to the question of how to deal with the coronavirus outbreak.

Driving the news: Those who want to reopen America and get the economy moving again are pitched against those who think the highest priority is to minimize the spread of COVID-19.

- A fragile consensus emerged early on that there was no real tension between the two imperatives — that unless and until the pandemic was brought under control, the economy could never return to its former health. The hope was that if the virus could be eradicated this summer, the economy could bounce back to its pre-pandemic state some time this fall.

- Today the virus is so widespread that there is no realistic chance of new cases dropping to near zero before a vaccine arrives. New cases are being found at a rate of about 24,000 per day, while about 700 people per day are dying. So now the economic question has changed.

The economy won't return to its former health any time soon, given the enduring prevalence of the coronavirus and the sobering fact that about 3% of Americans diagnosed with COVID-19 are likely to die of it.

- A PwC survey released this week found that fewer than half of employees say that safety measures like wearing masks or reconfiguring layouts will make them more comfortable returning to the office.

- Since a "V-shaped economic recovery" won't happen, the economic best-case scenario is now a partial bounceback in the face of continued health concerns. The more that the economy reopens, the stronger that partial bounceback — and the more lives that will be lost to the virus.

The bottom line: America has made its choice. While lockdown protocols vary from state to state, the broad trend is that constraints on commerce are being lifted even as the virus continues to kill thousands of Americans every week.

- The moral imperative has surrendered to the economic imperative. Any future lockdowns will likely be imposed only if a wave of hospitalizations and deaths threatens to imperil the nascent economic recovery.

2. A brief history of wishful thinking

Illustration: Sarah Grillo/Axios

America's increasing dissatisfaction with capitalism, and its concomitant embrace of socialism, is rooted in the degree to which inequality has increased in recent decades. When all new wealth is retained in the top 1%, the morality of wealth creation switches from good to bad.

- The promise that maximizing economic growth will "lift all boats" has proven hollow.

- The financial crisis of 2008-09 made for a highly unsatisfying morality tale. It devastated struggling borrowers with weak credit ratings, while leaving the financiers who created exploding monstrosities like synthetic CDOs relatively unscathed.

The big picture: Greed is sinful, yet is also the engine of capitalism.

- That deep tension has historically been reconciled with some version of Gordon Gekko's "greed is good" speech — elaborate reasons why the pursuit of profit is really in the best interest of all.

- Flashback: As far back as 1936, the great economist Joan Robinson described economics as a "plan for explaining to the privileged class that their position was morally right and was necessary for the welfare of society."

Why it matters: Greed — the desire for economic growth — creates perennial wishful thinking with respect to the anticipated consequences of that growth.

- What we're reading: Longtime China expert Orville Schell has a masterful overview of U.S. engagement with China in The Wire China.

Among the stated reasons for America to open up its economy to China:

- "As people have commercial incentives, whether it's in China or other totalitarian systems, the move to democracy becomes inexorable." — President George H.W. Bush

- "By joining the WTO, China is not simply agreeing to import more of our products, it is agreeing to import one of democracy's most cherished values, economic freedom. The more China liberalizes its economy, the more fully it will liberate the potential of its people... The genie of freedom will not go back into the bottle." — President Bill Clinton

- "The case for trade is not just monetary, but moral. Economic freedom creates the habits of liberty, and habits of liberty create expectations of democracy." — President George W. Bush

- "The fact is that a thriving America is good for China and a thriving China is good for America." — Secretary of State Hillary Clinton

The bottom line: America's engagement with China over the past 50 years has undoubtedly created wealth in both countries. It has also cost an estimated 3.4 million U.S. jobs, and has consolidated power within a brutal communist dictatorship that controls the lives of more than a billion people.

- From Nixon onwards, U.S. presidents have dreamed that money and wealth would inevitably be accompanied in China by a generous side helping of freedom and democracy. They have all been wrong.

3. Hertz blinks

"They walked all the way up to the edge — and stopped." That's the verdict of Thomas Gorman, a partner at the law firm Dorsey Whitney and an expert on SEC enforcement, regarding Hertz's attempted sale of $500 million in new equity.

Driving the news: Hertz issued its prospectus on Monday, and then followed up on Wednesday with an update essentially saying, "Eh, never mind," after SEC chairman Jay Clayton made some pointed comments about the offering on CNBC.

Background: Hertz is the 48th most popular stock among Robinhood investors, ranking right between UCO and GUSH, which are both vehicles for making leveraged bets on the oil industry. Since the company is in bankruptcy, its stock will almost certainly end up worthless — but shareholders will see exciting volatility on the way to zero.

- That's made Hertz stock an excellent gambling vehicle.

What they're saying: Here's just one of the risk factors that Hertz put in its prospectus.

"As previously disclosed, on May 22, 2020, we filed voluntary petitions under Chapter 11 of the Bankruptcy Code... The price of our common stock has been volatile following the commencement of the Chapter 11 Cases and may decrease in value or become worthless. Accordingly, any trading in our common stock during the pendency of our Chapter 11 Cases is highly speculative and poses substantial risks to purchasers of our common stock... There is a significant risk that the holders of our common stock, including purchasers in this offering, will receive no recovery under the Chapter 11 Cases and that our common stock will be worthless."

Between the lines: More than 500 million shares of Hertz traded hands on June 8 alone, when the stock hit an intraday high of $6.25 per share. Given that every trade has a buyer and a seller, it's easy to see why Hertz would want to be the seller in some of these trades.

- The stock offering promised free no-strings-attached capital for Hertz that would doubtless have been very helpful in terms of getting through bankruptcy.

The bottom line: Clayton has focused on small investors since his arrival at the SEC. His staff would have had serious problems with this share issuance.

- While the SEC can't stop stock-market speculators trading the stock to each other on the secondary market, it can — and did — effectively prevent the sophisticated financiers who currently control Hertz from issuing new shares to the gamblers. Hertz might not like it, but even in bankruptcy it doesn't want to end up afoul of the SEC.

4. Robinhood's game design

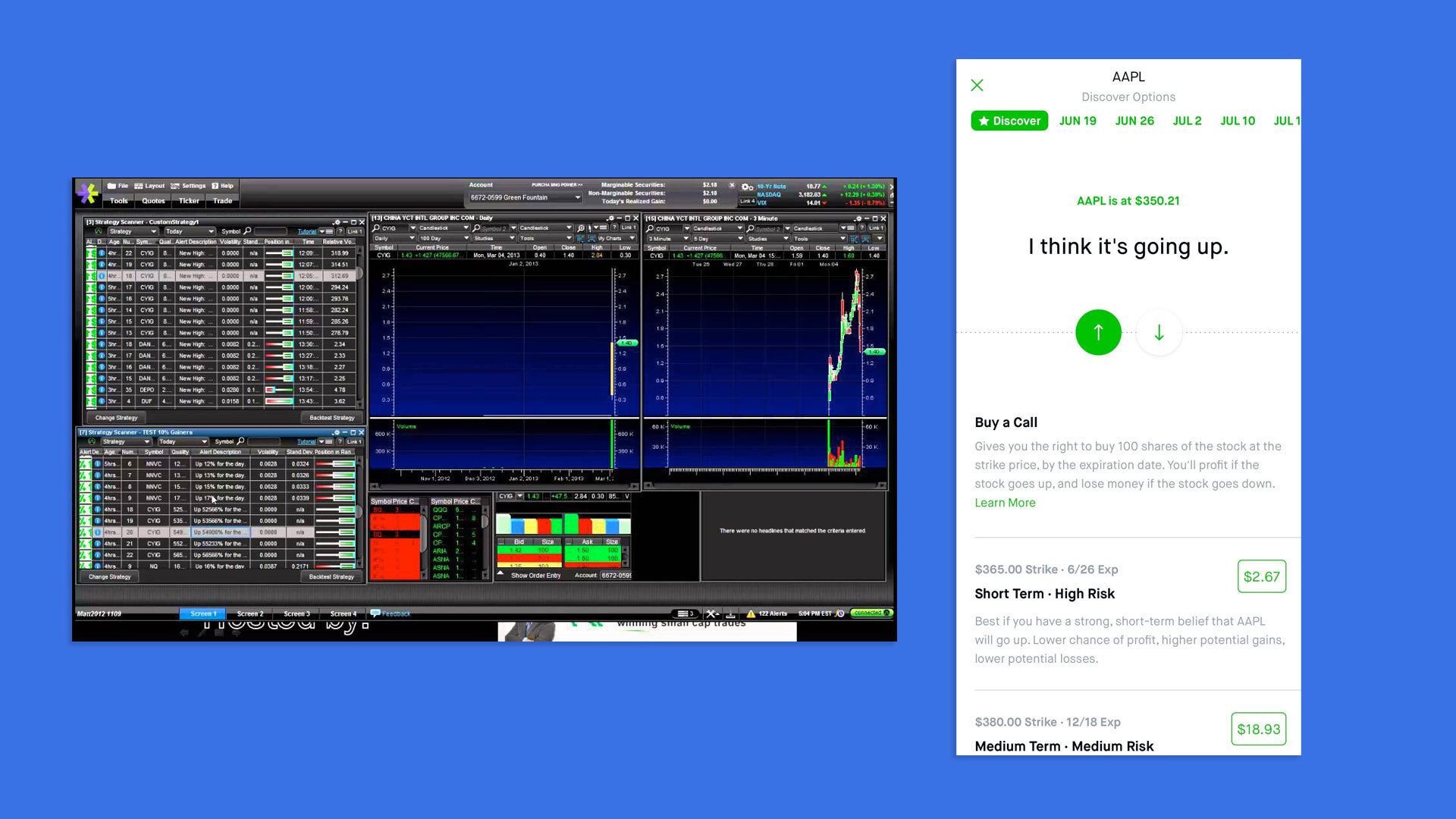

The options trading interfaces on E-Trade (L) and Robinhood (R). Illustration: Axios

To understand why Robinhood is so popular, it's best to think in terms of game design.

Why it matters: While other brokerages sell ultra-sophisticated investing tools or boring things like retirement planning, Robinhood makes an addictive mobile-native game. As Matt Levine wrote in November:

"You can analyze Robinhood as a mobile gaming company. It makes an app that you can download to your phone, and then you can play a game on the app. As with many mobile games, there are in-app purchases, and you can end up spending a lot of money on the Robinhood game. The game is of course a stock-trading game. The purchases are stocks."

What they're saying: Noah Brier, of the indispensable Why Is This Interesting daily newsletter, this week compared E-Trade's option trading interface to Robinhood's.

"The former makes options look like a very serious thing you can lose a lot of money on. The latter resembles rating a YouTube video."

The bottom line: When a professional investor like Leon Cooperman says that the Robinhood mania will "end in tears," he's absolutely right on a literal basis: Bad design decisions might well have cost a young man's life. But if what he's talking about is total investment returns, he could be making a category error. People are attracted to games because of the enjoyment of playing them much more than because of the pleasure they get from any winnings.

Bonus: Another WITI quote

Illustration: Eniola Odetunde/Axios

"Black people are the center of global attention at this very moment. This is what it must feel like to be a blond-haired blue-eyed woman. As corporations trip over themselves to court us, and try to one-up each other, Black pain is the new campaign."— Chuck Welch of brand strategy consultancy Rupture, in Wednesday's Why Is This Interesting

5. Coming up: Juneteenth

Photo: Bastiaan Slabbers/NurPhoto via Getty Images

Tomorrow is Juneteenth, a holiday that commemorates the day the last enslaved black Americans were told they were free, Axios' Courtenay Brown writes.

Why it matters: Juneteenth has been celebrated for more than 150 years. But only now, amid weeks of protests over systemic racism, is corporate America acknowledging the holiday.

Some 200 companies have made Juneteenth a paid holiday, per this list.

- For some, like Twitter and Nike, the move is permanent.

- JPMorgan Chase, the country's biggest bank, says it will close Chase branches early tomorrow. General Motors will hold moments of silence for 8 minutes and 46 seconds.

- Amazon and Google are encouraging all meetings to be canceled. Facebook told TechCrunch it will "encourage employees to engage in a day of learning."

States like New York are making Juneteenth an official paid holiday for government employees this year (it isn't a federally recognized holiday).

The bottom line: "It will be inadequate alone," Kevin James, a dean at North Carolina A&T State University, told CBS News of efforts to acknowledge Juneteenth.

- "But it does say that a company is willing to take a step that aligns with the sentiments of black America," says James.

6. Building of the week: MoMA, New York

Photo: Lucie Rebeyrol

The Museum of Modern Art in New York is the work of many great architects, from Philip Goodwin and Edward Durrell Stone (1939) to Philip Johnson (1969), César Pelli (1984), Yoshio Taniguchi (2004), and most recently Diller Scofidio + Renfro (2019) incorporating some spaces in a new tower by Jean Nouvel.

- What they're saying: Architect Elizabeth Diller hailed her creation as "a contiguous, free public realm that bridges street to street and art to city."

- Yes, but: The "free public realm" has recently been covered in various shades of forbidding plywood. While arts organizations like the Public Theatre have welcomed protesters into their lobbies and provided them with shelter, water and restrooms, art museums have generally taken the opposite tack.

What we're reading: Architect Florian Idenburg has called out MoMA and other museums for boarding themselves up during the current protests. "Why did most of New York's largest museums botch this?" he asks in a column in Artnet.

- The silver lining: Plywood naturally attracts striking and powerful street art, just as the Berlin Wall did. When this temporary layer is removed, it could become an exhibit in its own right.

Sign up for Axios Capital

Learn about all the ways that money drives the world