Apr 27, 2019 - World

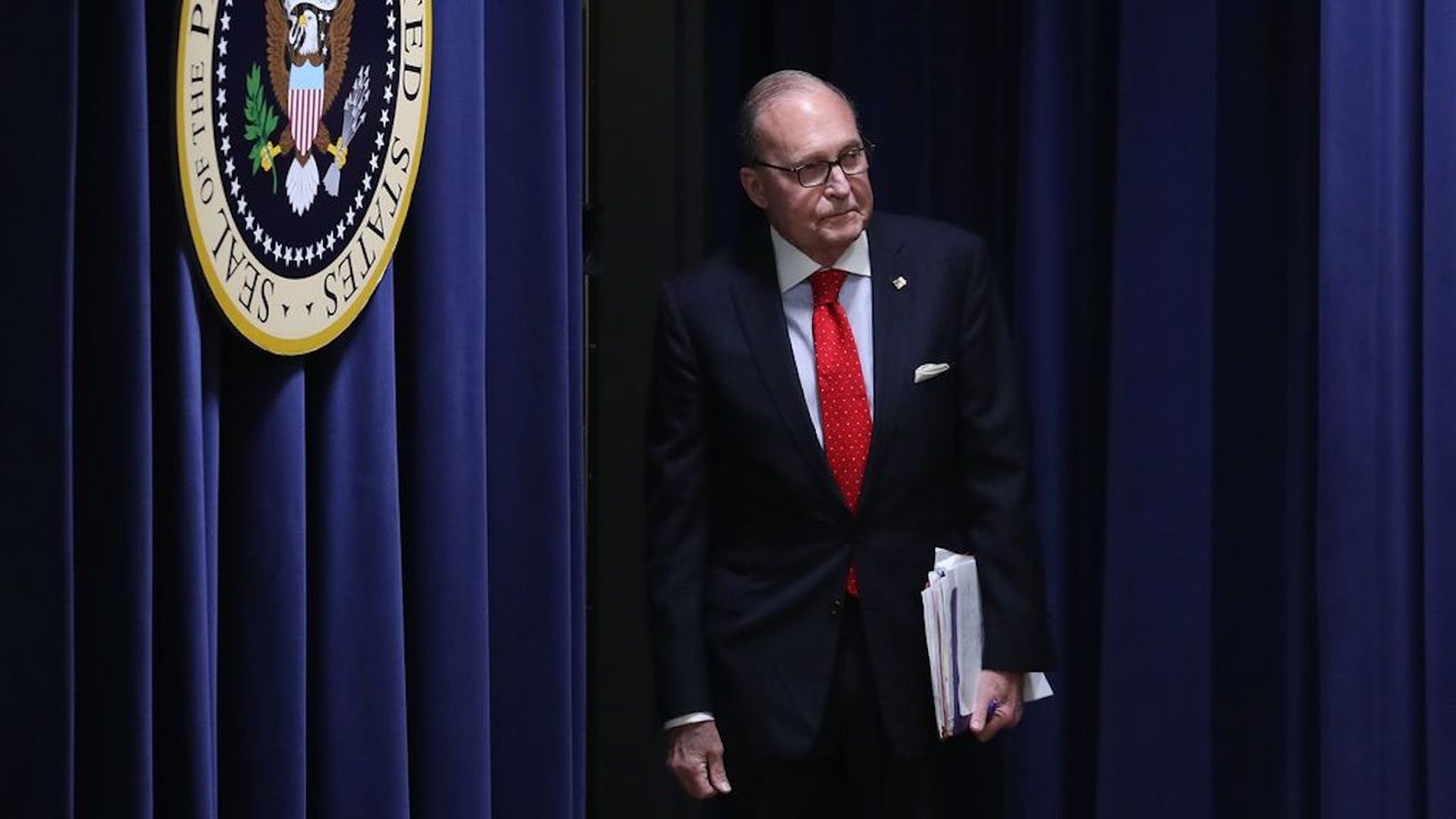

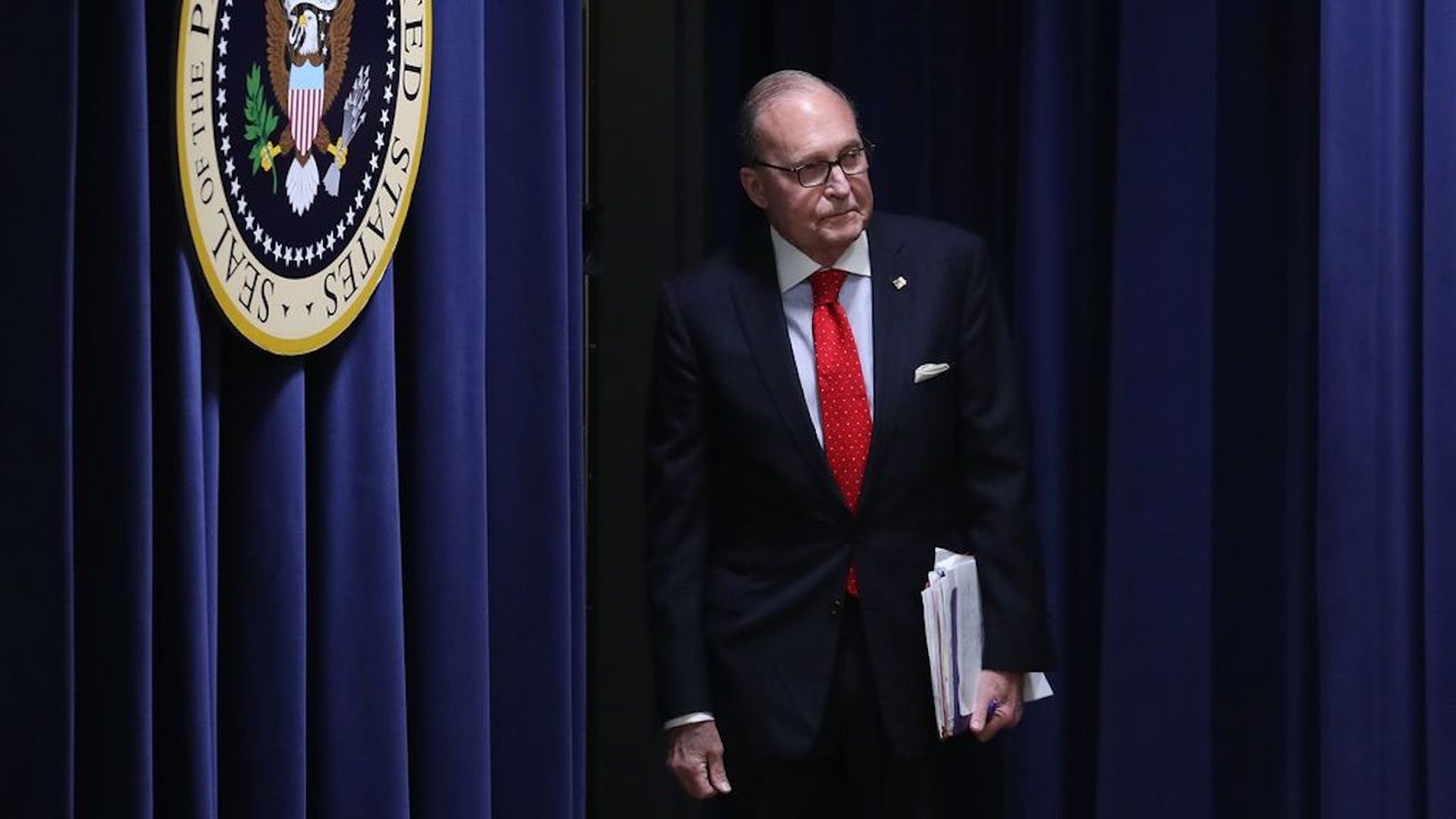

Larry Kudlow: U.S. in position of leverage for upcoming trade talks

Add Axios as your preferred source to

see more of our stories on Google.

Larry Kudlow. Photo: Mark Wilson/Getty Images

Add Axios as your preferred source to

see more of our stories on Google.

Larry Kudlow. Photo: Mark Wilson/Getty Images