Coronavirus pits hope vs. reality in stock market

Add Axios as your preferred source to

see more of our stories on Google.

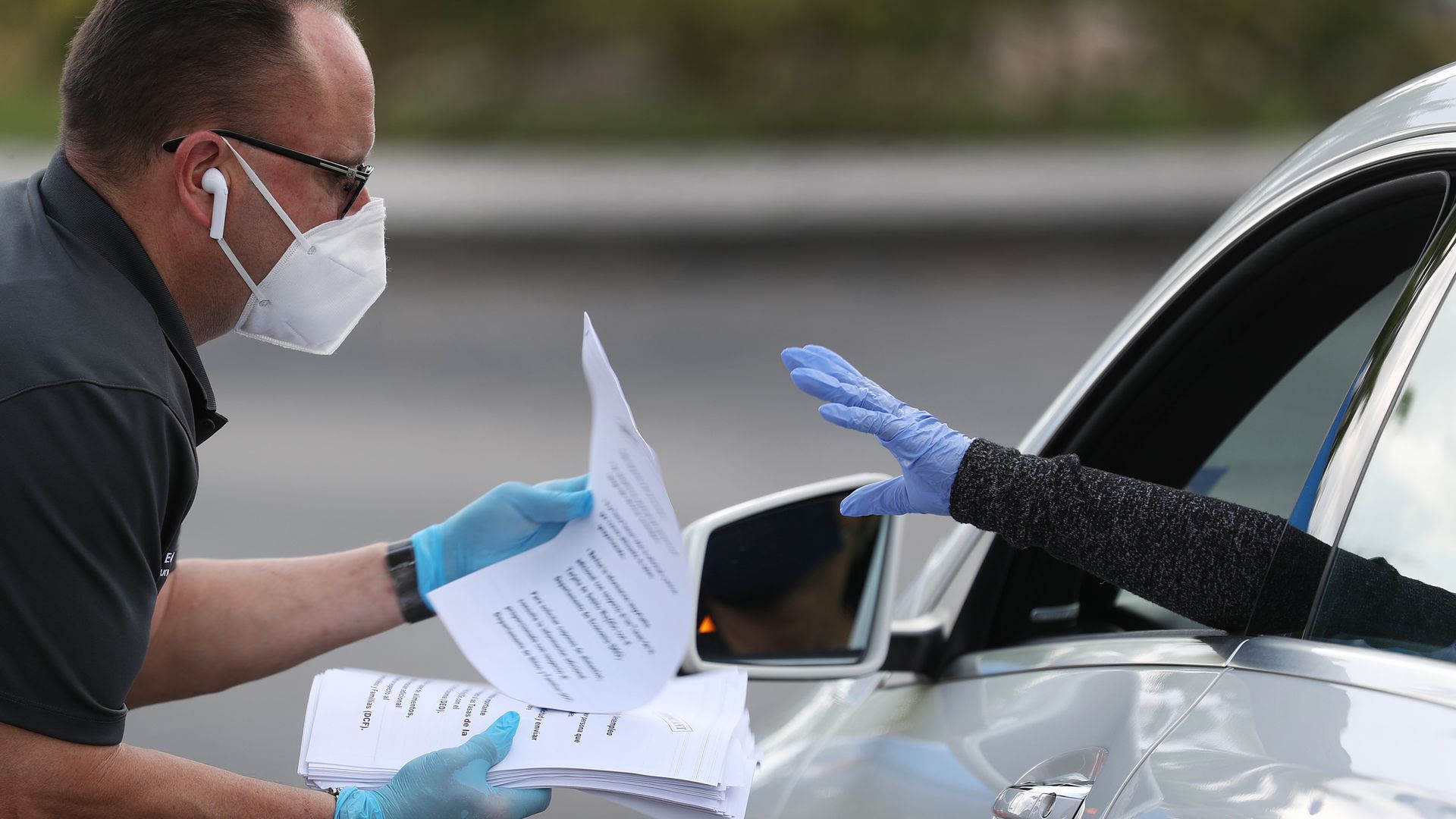

Eddie Rodriguez, who works for the city of Hialeah, Fla., hands out unemployment applications to people in their vehicles. Photo: Joe Raedle/Getty Images

After rattling off impressive gains over the past few weeks, the economic reality of the coronavirus outbreak may be starting to set in on the stock market after a spate of economic releases showed the damage the virus has already done.

Why it matters: Wall Street has been able to shake off most negative economic data as much of the damage was expected. However, the horrific decline in retail sales that followed the largest one-month drop in U.S. consumer sentiment ever recorded shows that the backbone of the economy has been badly hurt.

Driving the news: The S&P 500 fell 2.2% on Wednesday after data showed U.S. retail sales declined by 8.7% in March, more than double the previous record.

- The headline numbers likely mask even worse details. Wednesday’s report did not include changes in spending on services like hotel stays, airline tickets or movie theaters, and was lifted by a 26% increase in grocery store sales.

The big picture: "With clear signs of panic buying of necessities and the fact that lockdowns were introduced only around the middle of the month ... far worse is to come in April and the second quarter more generally," Michael Pearce, an economist at Capital Economics, tells AP.

Between the lines: "Wall Street right now has this big tug-of-war between hope and reality," Larry Adam, chief investment officer at Raymond James, tells Reuters.

- "We’re talking about hope we get beyond COVID-19, but in the meantime we get the reality of some of these numbers that highlight some concerns about the consumer."

The backdrop: The S&P has risen about 26% from its bear market low on March 23, lifted by hopes that U.S. monetary and fiscal stimulus will buoy the economy through the coming recession and on early signs that coronavirus cases were starting to peak in hotspots like New York.

What's next: Economists at Goldman Sachs forecast the economy will shrink by 34% in the second quarter (lower than JPMorgan's 40% expected decline), but also foresee good news on the horizon.

- "We expect the economy to begin improving in coming months, with the peak virus hit fading thanks to partial relaxation of shutdown orders, adaptation to social distancing, and wider antibody testing to identify those who are now immune."

- "While longer-lasting economic damage that delays the recovery is possible, so far the news has been mostly reassuring: most layoffs appear to be temporary and there has been no major uptick in bankruptcies at this early stage."

Go deeper: The coronavirus outbreak will forever change the world economy