Play-to-earn gaming's fading champion and its newest contender

Add Axios as your preferred source to

see more of our stories on Google.

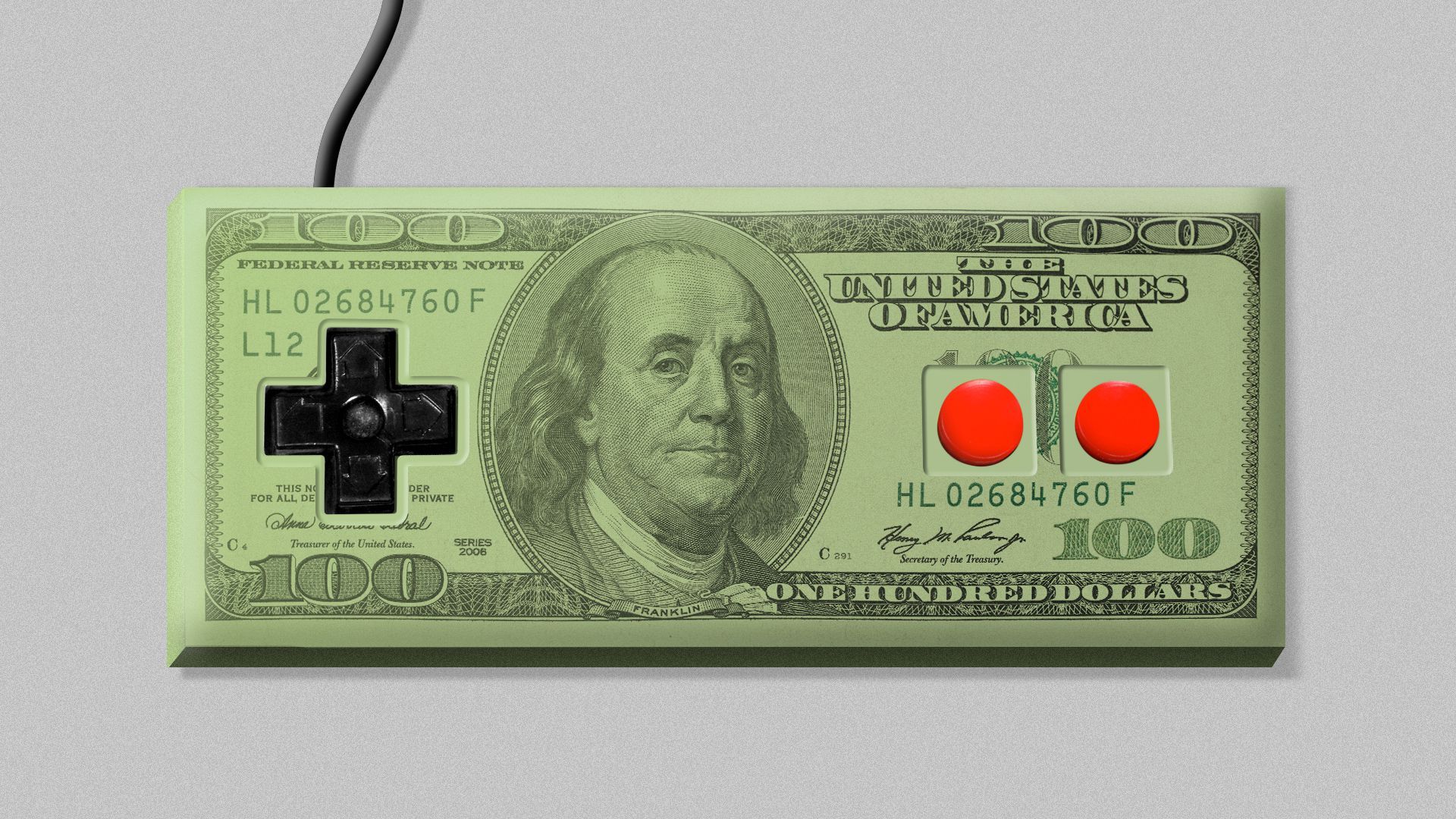

Illustration: Aïda Amer/Axios

Blockchain Brawlers, a new play-to-earn video game, is claiming to have driven hundreds of millions of dollars in trading volume in its first few days.

- Details: Based on some very rough analysis by Axios, players in the new game may have collectively earned as much as $23 million or so in its native BRWL token, based on average earnings reported by the game makers.

Why it matters: Play-to-earn (P2E) gaming is touted as the great onboarding for people to crypto. It offers the prospect of gamers actually owning the stuff they gather up in game to drive an in-game economy.

Yes, but: Economies are fickle beasts (see today's U.S. inflation reading). Game developers depend on players to reinvest their assets in the game.

- Most P2E players aren't playing for fun, but rather as a business proposition. Financial metrics like "Return on Investment" are being measured and can cause a game to sink or swim. Zelda never had that problem.

Perhaps more importantly, the worst unintended extremes of capitalism have permeated P2E games. The owners of assets have leverage on the players, many of whom are earning below minimum wage in developing countries.

- How it works: If it works, a P2E game creates something like a real economy, where people earn, consume and invest, but in video games, not terra firma.

State of play: Investment in the sector has been hot lately. One new project attained a $150 million valuation (in real dollars) in its first investment round.

Threat level: P2E worked great, particularly with one game, Axie Infinity (whose treasury clocked $1.3 billion in revenue last year), until profits took a dive in early December that it has never recovered from, as Token Terminal shows.

- Remember that in P2E, players usually buy one or more non-fungible tokens (NFTs) that represent characters in the game. The character is needed to play the game.

- As users played Axie Infinity, they could earn various items and tokens. One of those tokens was crucial, SLP, which stood for "Smooth Love Potion," which allowed players to "breed" their Axies.

- So, as long as Axies had real value, SLP had real value. That was the relationship.

But Axie ran into a problem.

- It was so lucrative that people with more Axies than time would lend them to people who had time to play, and they would split the earnings, providing passive income for Axie owners.

- Users on both sides began to cash out their income and not reinvest it in the game, driving down the value of the in-game coins including its crucial SLP, which stood for "Smooth Love Potion." (See next chart.)

What they're saying: There were those who suspected the model couldn't last.

- "Either the game has to be fun and people are willing to play and lose money," Jeff Dorman of the investment firm Arca, tells Axios, "Or someone needs to subsidize the winners (advertisers, land sales, something)."

- But the slip may just be the sector's growing pains.

- "We remain bullish on P2E because we fundamentally believe that players desire to share in the economic upside of the games in which they participate," Stephen McKeon, partner at Collab+Currency, a crypto venture fund, told Axios.

The bottom line: Blockchain Brawlers is one of a slew of games looking to iterate on Axie's model, hoping they can make it work better, longer.