Ukraine crisis clouds global EV rollout

Add Axios as your preferred source to

see more of our stories on Google.

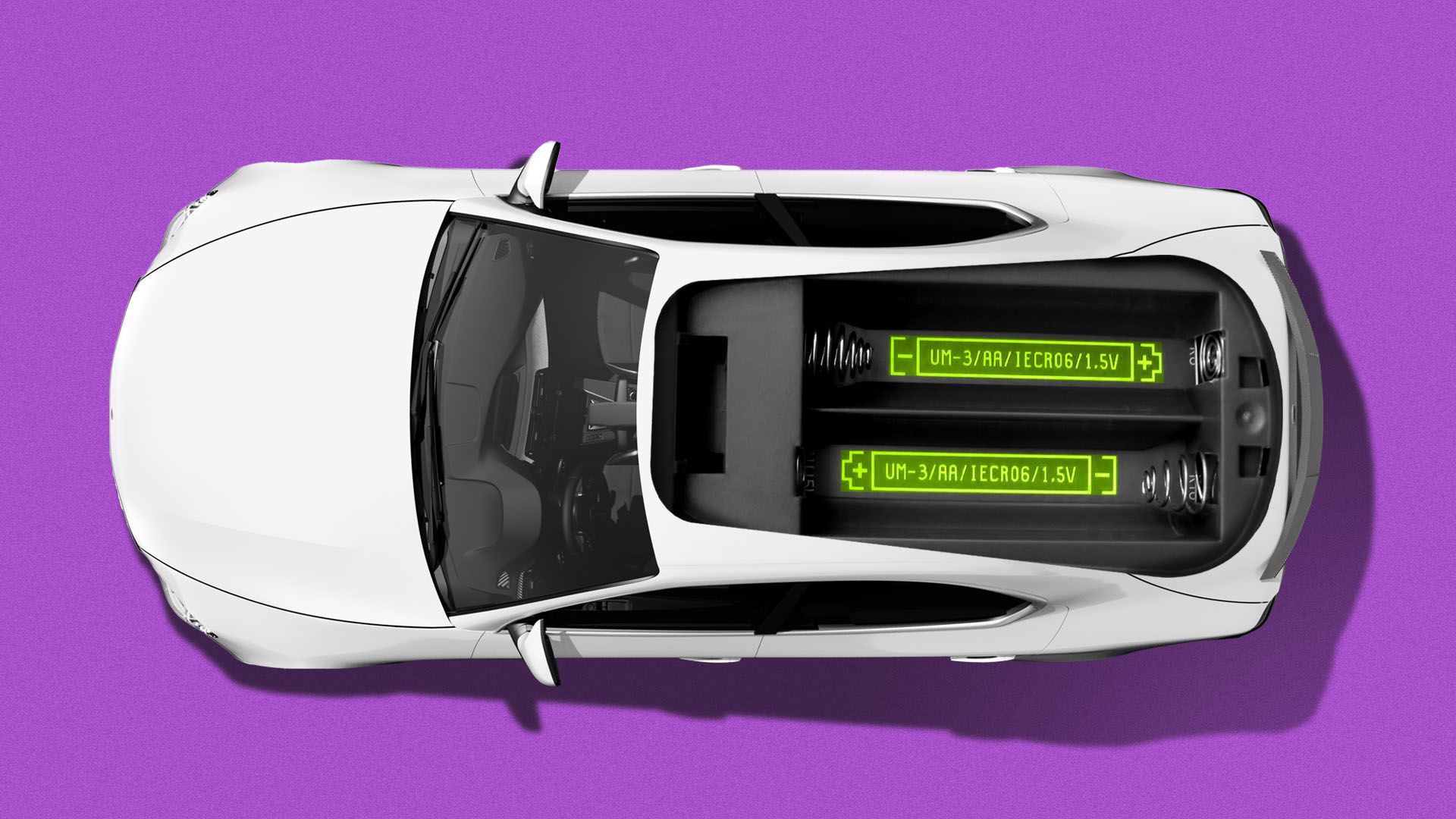

Illustration: Sarah Grillo/Axios

Electric vehicle makers in the U.S. and Europe are scrambling to manage threats to supplies of key battery materials and the global supply chain following Russia's invasion of Ukraine.

Why it matters: Russia supplies nearly half of the world’s palladium and roughly 10% of the market's supply of nickel, as well as large quantities of aluminum and copper — key ingredients in EV batteries.

- Sanctions and divestment efforts threaten those supplies — with some experts warning of potential "complete loss of Russian palladium."

- The potential disruption is yet another supply chain headache and inflation driver.

Driving the news: S&P Global Mobility this week dramatically reduced its outlook for light vehicle production this year and the next.

- The firm slashed its North American outlook for 2022 and 2023 by more than 1 million vehicles, from 32.4 million.

- The firm also cut its Europe forecast by 1.7 million vehicles this year alone — including 1 million directly caused by the Ukraine crisis.

- Worldwide, S&P lowered its production forecast by 2.6 million light vehicles in 2022 and 2023, to 81.6 million vehicles this year and 88.5 million next year.

By the numbers: Nickel prices have soared as much as 230%, and Tesla's "affordable" Model 3 has jumped from $2,000 to nearly $47,000.

- "Our worst-case contingency shows possible reductions up to 4 million units for this and next year," S&P Global Mobility's Mark Fulthorpe said in a statement.

Yes, but: "Competitive total cost of ownership, which is the key metric for fleet operators, is heavily dependent on fuel prices," Michael Bakunin, a managing director in the Power, Renewables and Utilities practice at FTI Consulting, tells Axios.

- "Oil prices have soared to highs not seen since the Great Recession of 2008. Thus, what has long been seen as a massive gap between internal combustion engines... and EVs is quickly fading."

Yes, and: It could get ugly out there for automakers — perhaps to the tune of 25 million fewer light vehicles produced globally by 2030.

- "As gas prices go up, people look to alternatives," says Brett Smith, director of technology for the Center for Automotive Research. "The fascinating alternative is EVs. The challenge is there’s not going to be a lot of production capacity."

What they're doing: Automakers making EVs have offered different responses to the crisis.

- BMW is reportedly prioritizing its EV production, and while the company said that it still expected to hit its EV production targets, it acknowledged that its profit margins would shrink.

- Rivian, of course, abruptly yanked its prices almost 20% higher, including for pre-order holders, before an outcry caused it to hit reverse.

Alan Neuhauser will co-author the Axios Pro Climate deals newsletter. Join the waitlist now.