Evergrande isn't alone

Add Axios as your preferred source to

see more of our stories on Google.

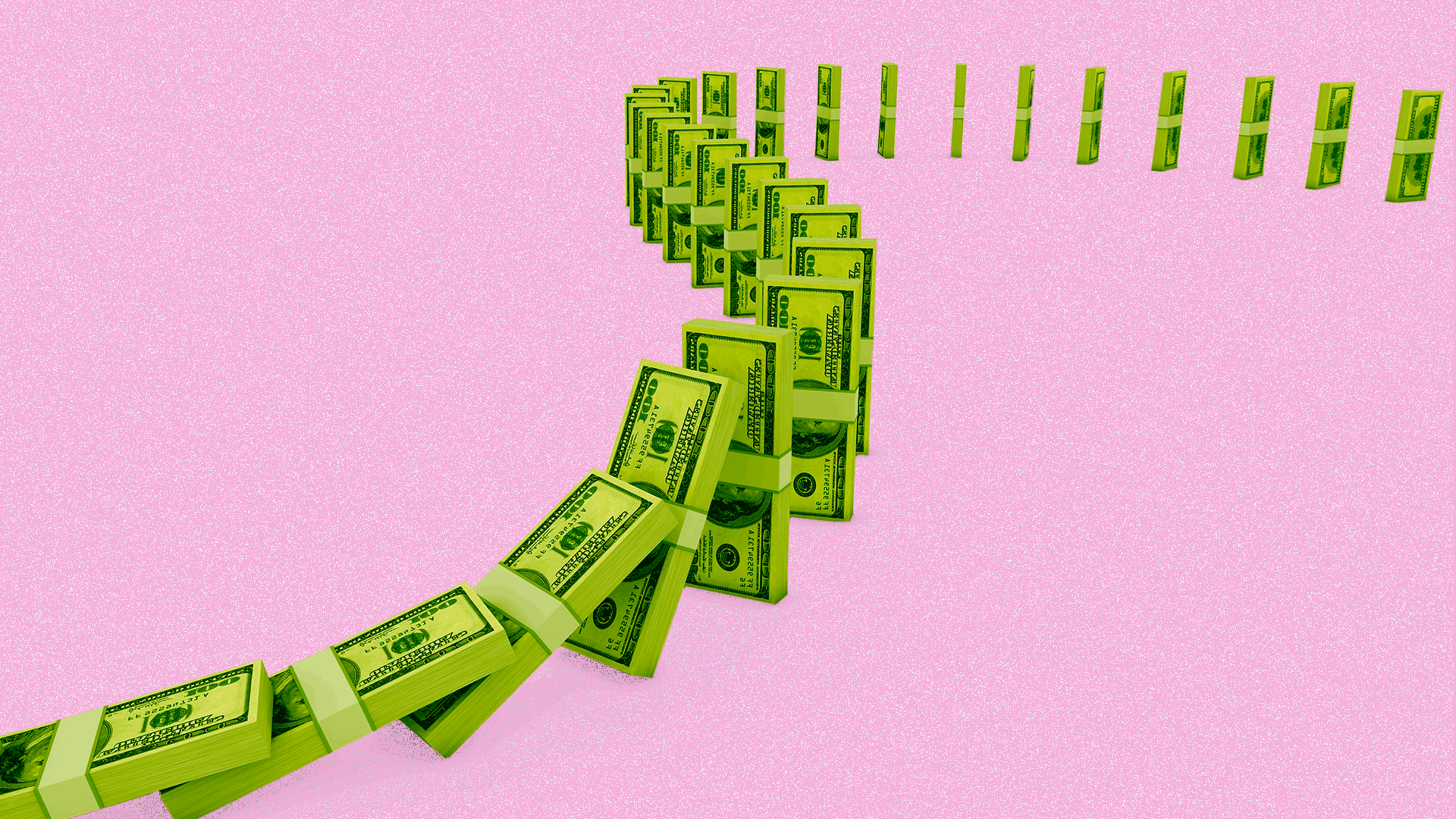

Illustration: Aïda Amer/Axios

China Evergrande’s debt problems aren’t an anomaly. Signs of stress are piling up in China’s real estate development sector, and more companies are signaling they may not be able to pay back their debt.

Driving the news: Fellow builder Modern Land asked its bondholders if it could delay a bond payment by three months, and Sinic said it will likely default next week, Reuters reports.

- That’s after Fantasia Holdings last week missed a payment altogether.

Why it matters: Widespread distress in the Chinese property market could bleed into other areas of its massive economy, as well as negatively impact the global markets for commodities and raw materials.

- Watch for a domino effect among the builders.

- Each company that acknowledges it can’t make debt payments makes it a little more palatable for others to join their ranks, Aayush Sonthalia, portfolio manager for emerging markets debt at PGIM Fixed Income, tells Axios.

State of play: Repayment is in doubt for any bonds issued by Chinese property developers that have lower credit ratings and an upcoming maturity, Sonthalia adds.

- One reason: Chinese banks have tightened their lending standards. If a company doesn’t pass the “three red lines” test, it may not be able to get money to refinance.

- On top of that, weak property sales data was just released. That's not a good sign for the developers’ ability to shore up their balance sheets.

The impact: The sell-off across the bond market has been broad. Even higher-quality investment-grade bonds backing Chinese developers are now trading in the 80 cents on the dollar area, Santhalia says.

What we're watching: The Chinese government's next move.

- "Our view is that by the end of this year, we're going to see some further loosening of monetary conditions and possibly some fiscal support as well. The economy is so dependent on the sector ... they don't want a complete collapse," Santhalia adds.