Sep 13, 2021 - Economy

Media firms linked to Chinese billionaire settle SEC charges for $539 million

Add Axios as your preferred source to

see more of our stories on Google.

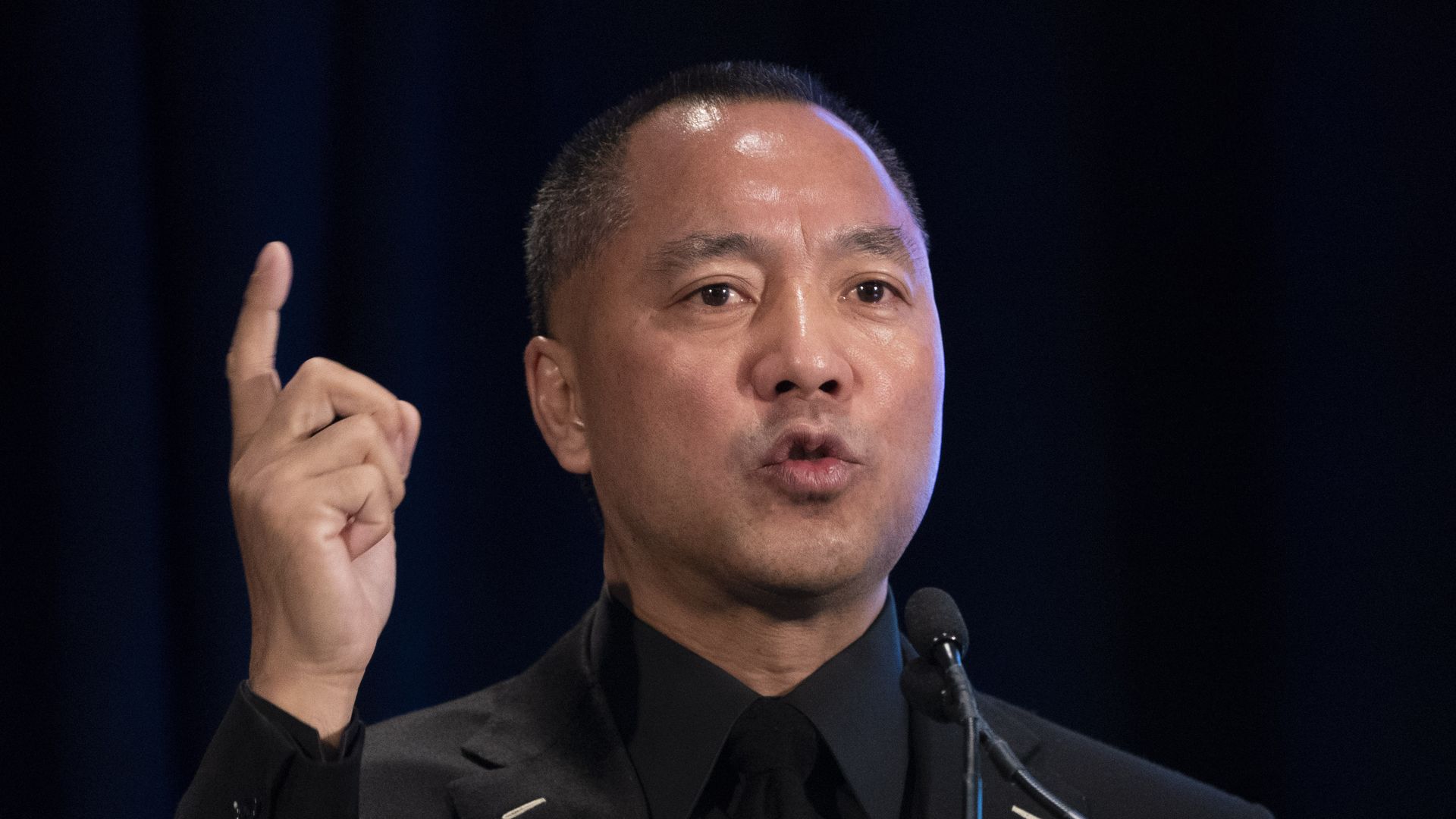

Guo Wengui holds a news conference on Nov. 20, 2018. Photo: Don Emmert/AFP via Getty Images