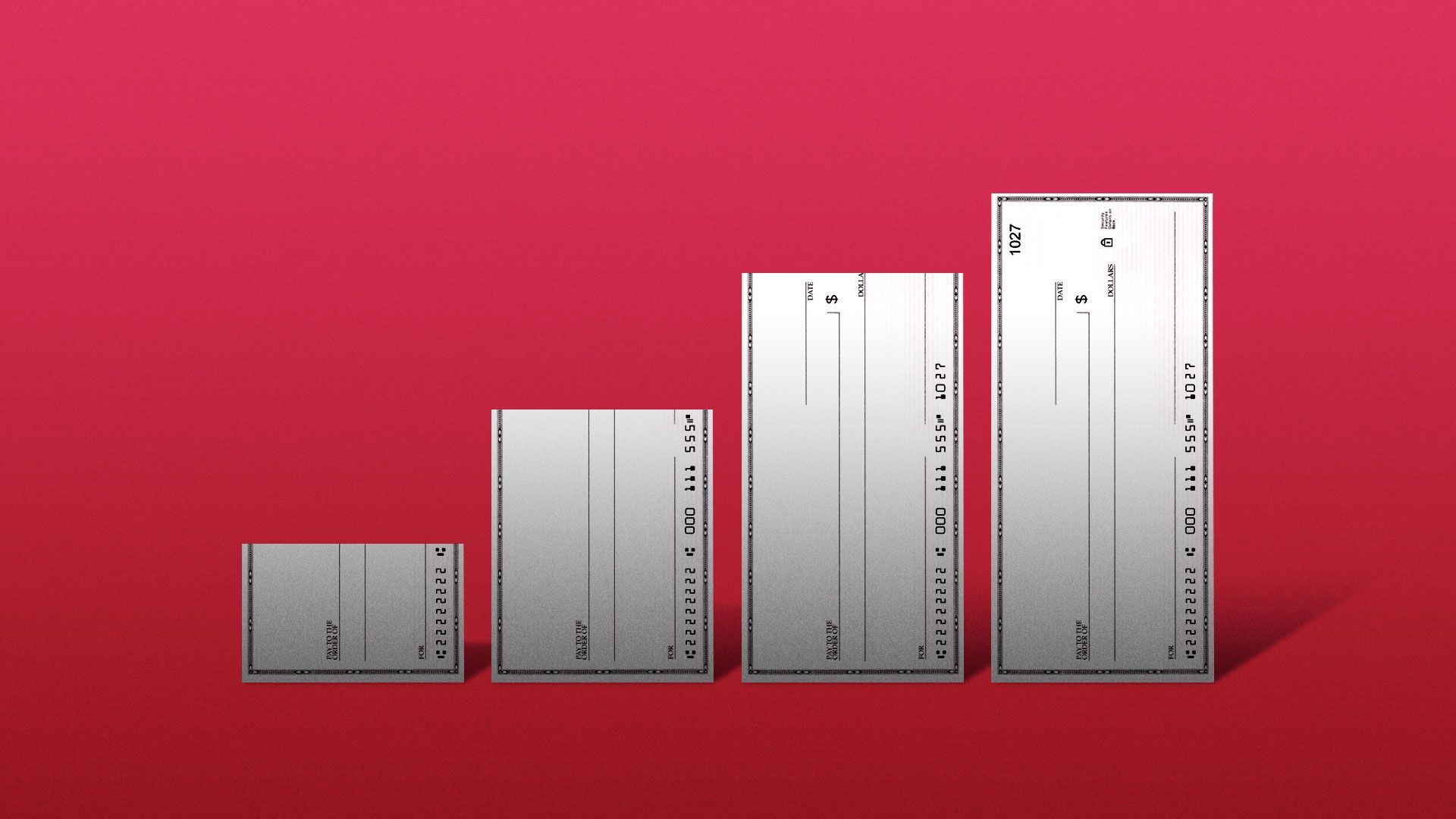

May 12, 2021 - Economy

Data: Stimulus checks played key role in boosting low-income families' cash balances

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Eniola Odetunde/Axios

Add Axios as your preferred source to

see more of our stories on Google.

Illustration: Eniola Odetunde/Axios