Why new coronavirus stimulus talks are at a "dead end"

Add Axios as your preferred source to

see more of our stories on Google.

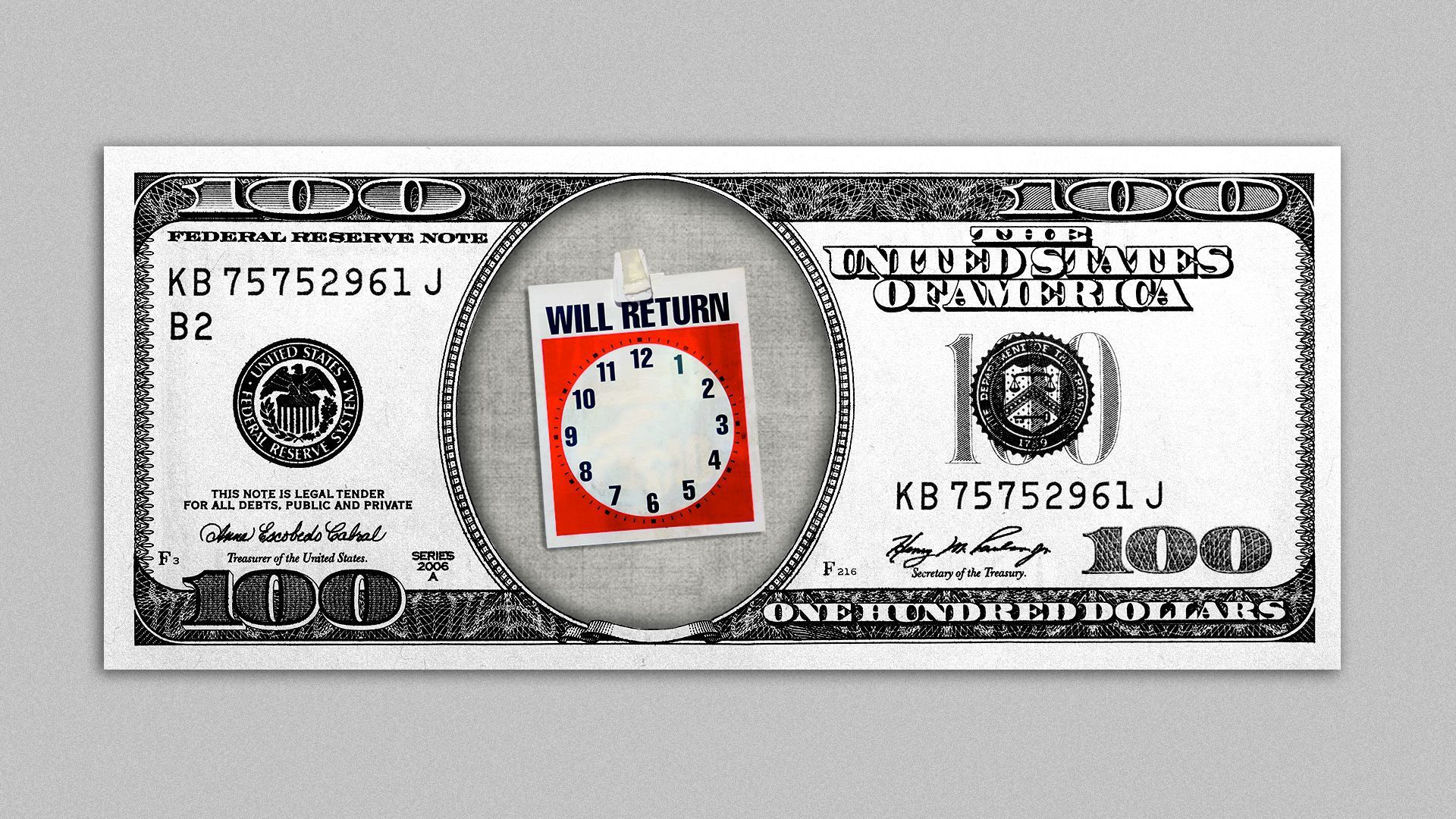

Illustration: Aïda Amer/Axios

Senate Republicans last week tried and failed to pass a slimmed down stimulus bill that would have included new money for small businesses, schools and $300 in additional weekly unemployment benefits.

Driving the news: Negotiations are now at "a dead-end street,” Kansas Sen. Pat Roberts said following the bill's failure, and Florida Sen. Marco Rubio said plainly, "Congress is not going to pass another COVID relief bill before the election." In fact, we're about two weeks away from a potential government shutdown.

Why it matters: Spending is decreasing, job gains are slowing and many small businesses warn that without more assistance from the government they will run out of cash before year-end and have to shut down for good.

How it happened: Not only has the stock market boomed, U.S. data have been improving notably since May. There have been millions of jobs added and V-shaped rebounds in manufacturing and services sector reports.

- The Axios-Ipsos poll has shown little change among respondents' ability to pay their rent or mortgage and afford household goods in the past two months.

- And the percentage of reported layoffs, furloughs and permanent job losses at the end of August was the lowest since mid-March — though it's only one percentage point below recent levels.

What it means: "Right now there’s not a lot of evidence we need [another stimulus bill] imminently," Jim Paulsen, chief investment strategist at the Leuthold Group, tells Axios.

- "It’s not just the stock market, it’s the data coming out every day — ISM, industrial production, housing, take your pick."

- "If the data rolls over they’ll pass that thing in a heartbeat."

Yes, but: Economists warn the improving data mask a lingering deterioration of the economy. Things are better than they were in March and April but still far from where they were in 2019 or the beginning of the year.

- The fact that more aid is not coming will be internalized by households that will pare their budgets and by state lawmakers who will begin laying off workers and cutting programs, Julia Coronado, president of MacroPolicy Perspectives, tells Axios.

- "There's a lagged effect. It could unfold over weeks to months. But it's pretty clear that it’s going to be hard for the economy."

Between the lines: With new spending from Congress looking unlikely, there could be more pressure on the Fed to provide additional easing, and Wednesday's policy meeting becomes much more meaningful to the market.

Go deeper: Government shutdown looms over Congress