Tech trend bleeds megacities, boosts heartland

Add Axios as your preferred source to

see more of our stories on Google.

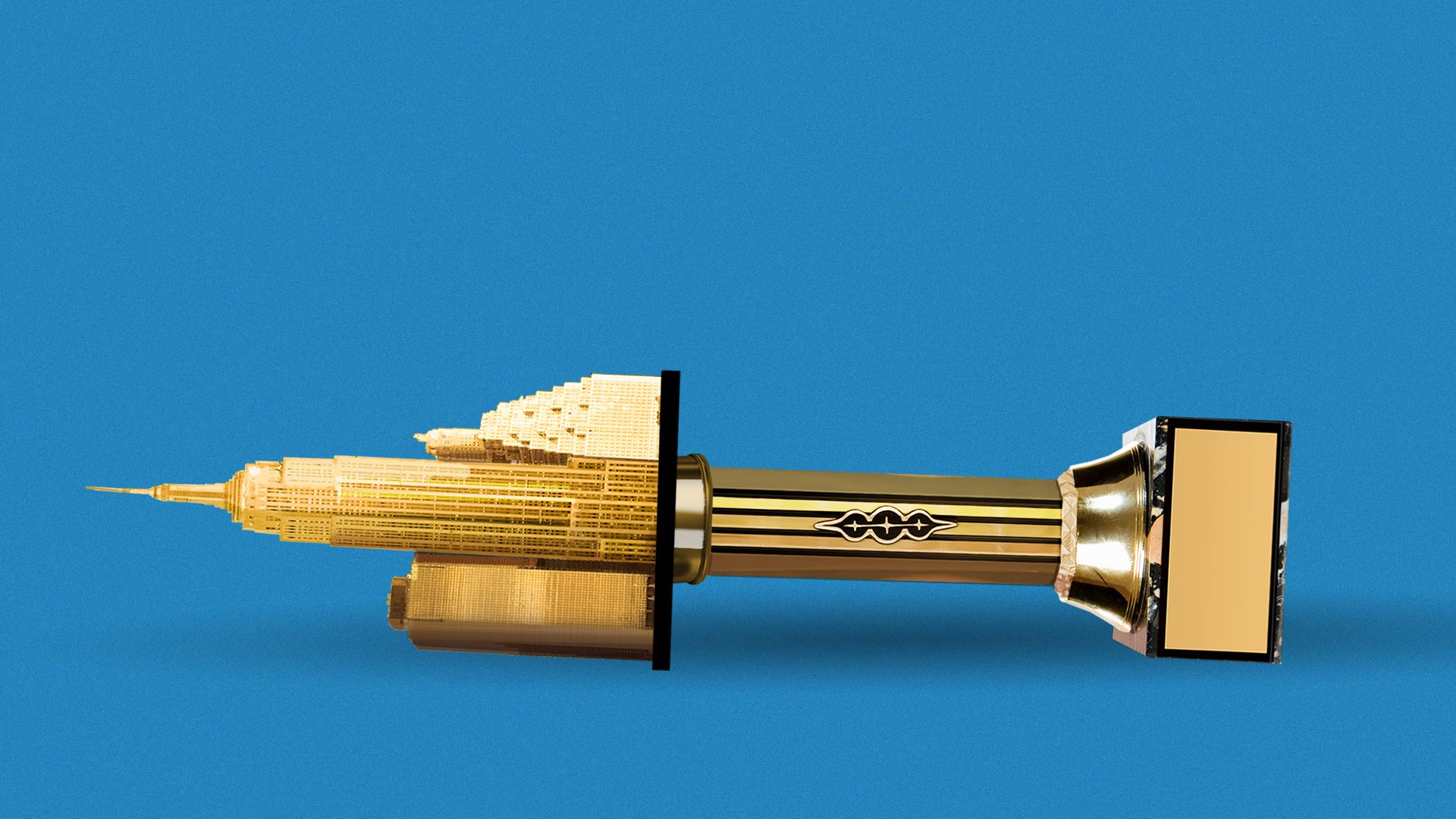

Illustration: Annelise Capossela/Axios

The top U.S. megacities boasting the highest economic growth and biggest talent-attracting companies may start losing people to other cities, thanks to the remote-work wave brought on by the coronavirus.

Why it matters: With more people finding long-term flexibility to work from anywhere, they have less reason to live in the most expensive cities like New York, San Francisco, Los Angeles and Seattle. That could create a wave of rising-star cities that have already begun to attract people looking for a better quality of life.

The big picture: In 2017, 90% of the nation's tech-sector jobs had concentrated in the top five innovation cities —Boston, San Francisco, San Jose, Seattle and San Diego — per a Brookings Institution analysis. That has created a growing gap between the thriving coastal metropolises and the rest of the country.

Driving the news: Big tech companies that have attracted hundreds of thousands of highly educated, high-paid workers to coastal job hubs are leading the shift to a more remote, dispersed workforce. And many workers are eager to take advantage of the flexibility.

- Mark Zuckerberg says half of Facebook's employees may be working remotely within the next decade. Twitter and Square employees have the option to work remotely indefinitely, CEO Jack Dorsey said.

- A Kung Group survey of venture-backed founders found that, on average, 70% of employees who previously worked from an office will be allowed to work remotely after COVID-19.

- A Bay Area Council survey found that a fifth of the region's companies plan to keep workers remote even after it's safe to open offices. Another survey by Blind found that two-thirds of tech workers would consider leaving the San Francisco area for remote work.

Reality check: The shift from major tech hubs to other places will not lead to a seismic demographic shift over night, and the workers eager to find affordable housing and more space are still likely to choose other sizable cities with strong economies and amenities.

- When the economy starts to recover, the largest employers are still going to dominate hiring — and those companies have already put sizable investments into San Francisco, Los Angeles, Seattle, and Washington, D.C.

- "Maybe they'll decide that their next office expansion isn't in New York City, it's in Dallas. But it will probably be within the top 20 markets," said Suzanne Mulvee, senior vice president of research and strategy at GID Real Estate Investments during an Urban Land Institute webinar.

Still, a redistribution of sought-after knowledge workers beyond the biggest five to 10 cities will go a long way in lifting up regions that have been left behind. It could also help reverse a decade-long brain drain from Heartland region cities like Kansas City and St. Louis, as well as post-industrial cities like Pittsburgh and Detroit.

- "Even if 10-15% of Big Tech employment begins to occur elsewhere, I do think it will have at minimum an incremental effect that will potentially tamp down some of the pressures in coastal superstars and benefit the next echelon of places," said Mark Muro of the Brookings Institution.

- If the beneficiaries of remote work expand to the next top 25 places, "that would be extremely helpful to other smaller places if cities in their state were truly vibrant," Muro said. "There's a cascading benefit."

Between the lines: Up-and-coming cities have long tried to attract companies to boost their economic fortunes and tax bases. Thanks to remote work, cities now have to focus on attracting workers.

- "This is what has changed: the tech workforce is up for grabs," said Patrick McKenna, founder of One America Works to connect tech talent with job opportunities outside of Silicon Valley. "It's like a jump ball for the workforce of the future."

The bottom line: Corporate headquarters are staying put — Google and Apple aren't about to close up their Silicon Valley campuses. But there will most likely be fewer people working there full-time.

- "They'll always be iconic symbols, but the composition of the workforce will be more distributed," said Jocelyn Kung, CEO of the Kung Group, an organizational strategy firm that works with tech companies.

- Kung said several of her clients are thinking about opening smaller offices in a few locations where talent concentrates in the remote-work era.