The coronavirus is exposing the holes in employer health insurance

Add Axios as your preferred source to

see more of our stories on Google.

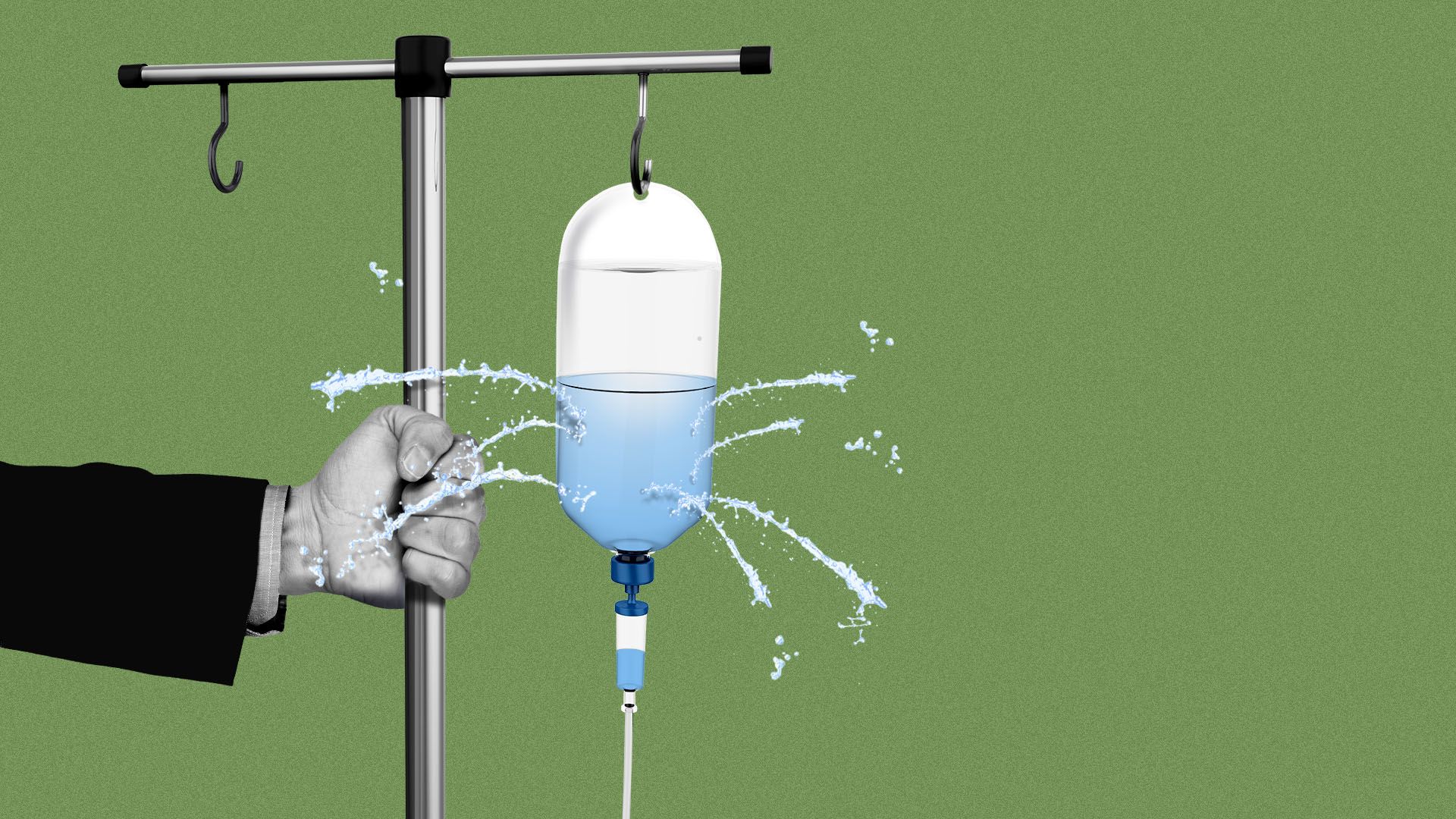

Illustration: Sarah Grillo/Axios

A record 3.3 million people filed for unemployment in one week, in the wake of the coronavirus outbreak, but people didn't just lose their jobs. Many also lost the health insurance that came with the job.

Why it matters: U.S. workers, even those who feel relatively secure in their health benefits, are a pandemic away from falling into the ranks of the uninsured.

Many of the people losing their jobs right now may not have had coverage to begin with — which would make the coronavirus-related disruption smaller, but still highlights the very large holes in this system. Industries like retail, restaurants and hospitality, as well as small businesses, are less likely to offer coverage

- The concern: People who get the virus but don't have insurance are susceptible to high medical bills, or even death if they avoid or are denied treatment.

The big picture: People who lose their jobs have some options.

- COBRA: This option allows people to keep their employer coverage for up to 18 months, which is good for those who are getting treatment and don't want to switch doctors. However, people have to pay the full insurance premium — an average of $1,700 a month for a family plan — which will be unaffordable for most of the newly unemployed.

- Medicaid: State Medicaid agencies determine eligibility on current income, so this may be the easiest, lowest-cost way for people to get health coverage.

- Affordable Care Act plans: The health care law created marketplaces for coverage, and people who lose their jobs can sign up outside the standard enrollment window. People may be able to get subsidies, depending on income.

- Short-term plans: These stopgap plans, promoted by the Trump administration, provide some coverage but often don't cover major hospitalizations.

Yes, but: All of these options have their own administrative hurdles.

The bottom line: "The ACA made health insurance more recession-resistant, but ... there's still significant disruption when you lose your job," said Cynthia Cox, a health insurance expert at the Kaiser Family Foundation.