May 29, 2019 - Health

Analysts downgrade Mylan and Teva over opioids lawsuit

Add Axios as your preferred source to

see more of our stories on Google.

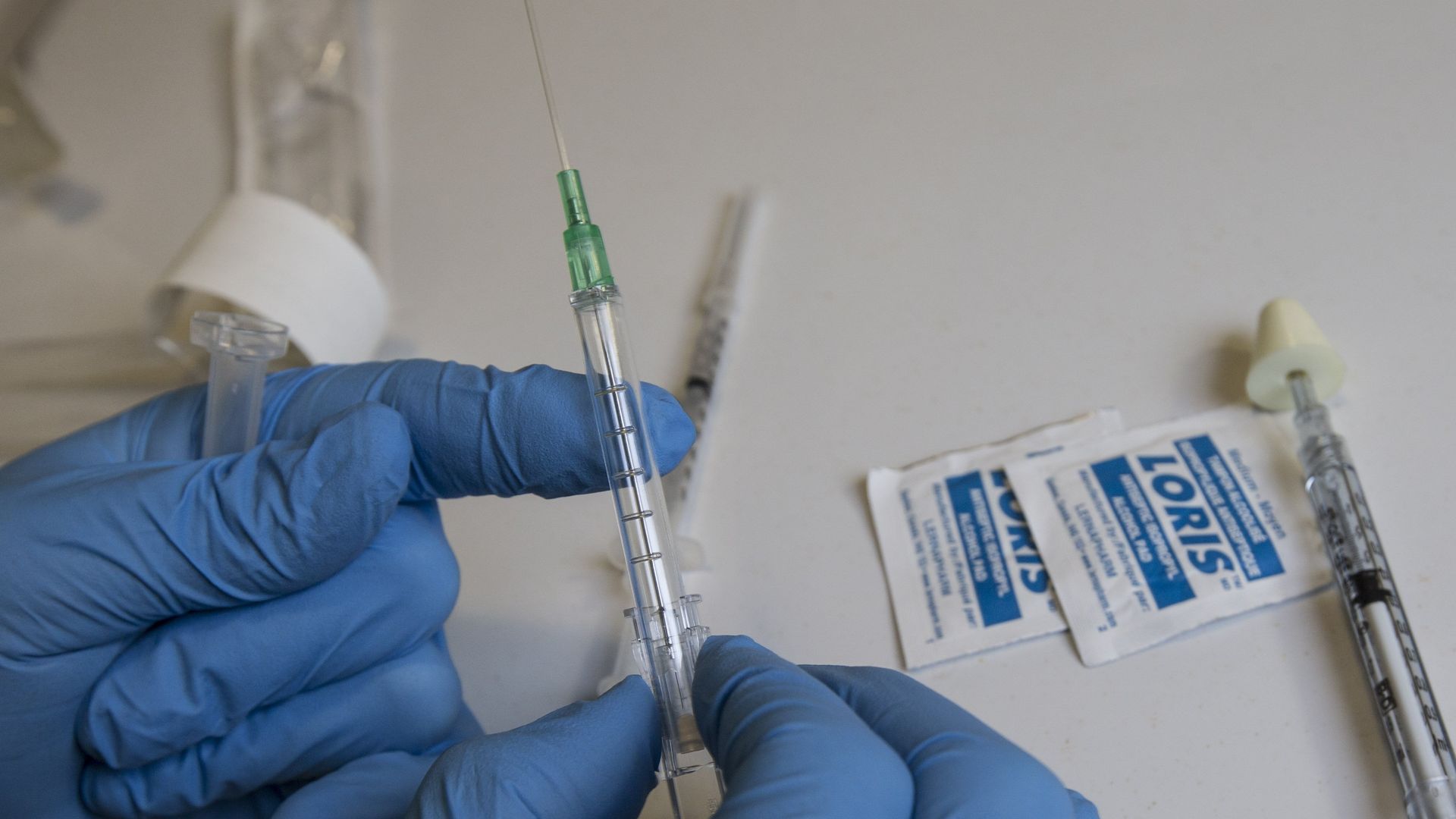

Naloxone, a medication used to treat opioid overdose. Photo: Bernard Weil/Toronto Star via Getty Images