The next eight retailers at risk of Sears' fate

Add Axios as your preferred source to

see more of our stories on Google.

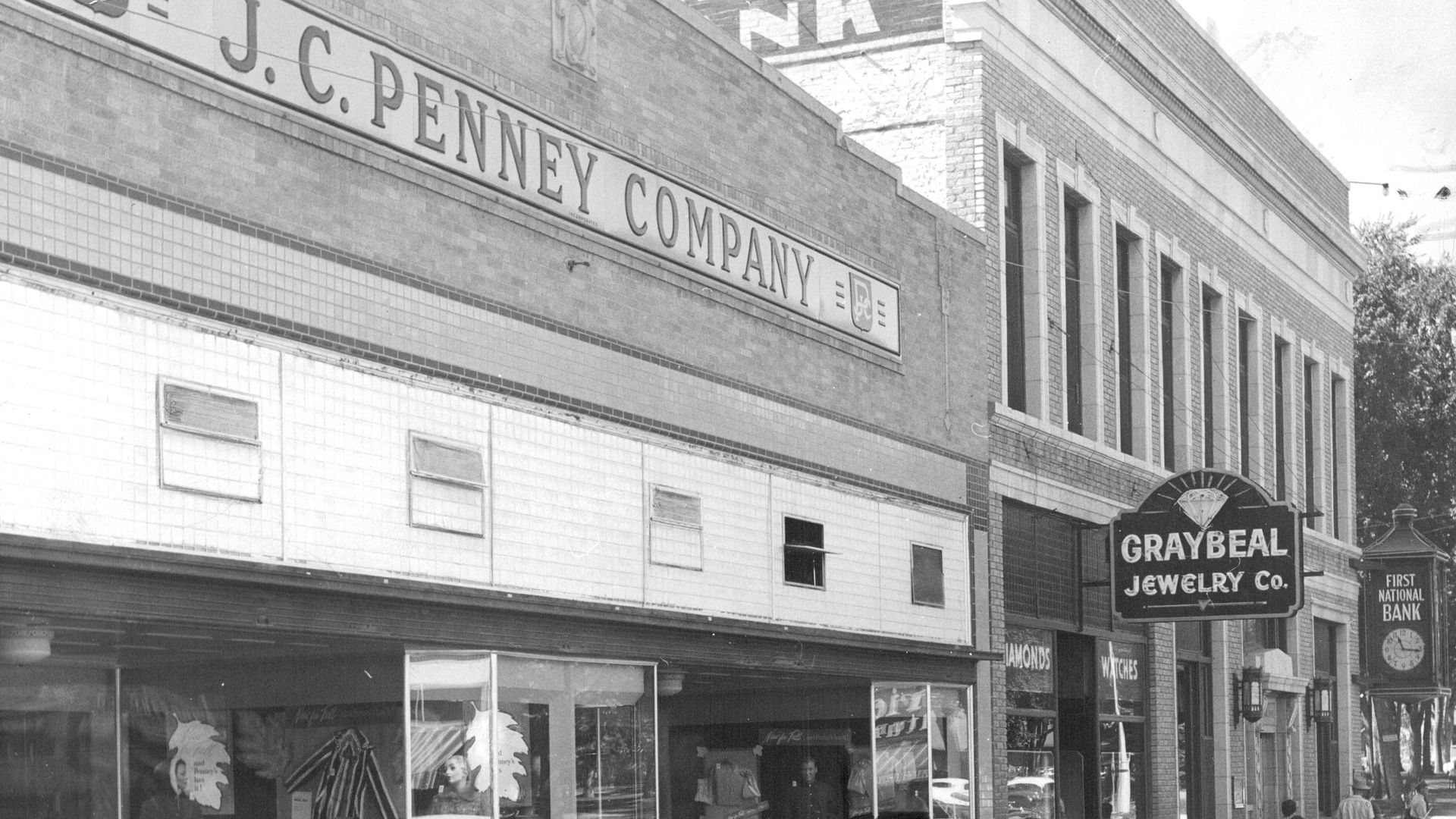

J.C. Penney, 1957. Photo: The Denver Post via Getty Images

We've chronicled the fall of Sears — how its deliberate sluggishness killed the Amazon of the 20th century. But Sears is not alone.

What’s next: The next eight retailers at risk of Sears' fate are J.C. Penney, Neiman Marcus, J. Crew, 99 Cents Only, Hudson's Bay, Pier 1 Imports, Fred's Pharmacy, and Rite Aid, argue Retail Dive's Ben Unglesbee and Cara Salpini.

The big picture: They cite a toxic combination of high debt, weak sales and bloat. The debt of all except Pier 1 and Rite Aid is mostly related to private equity deals.

- J.C. Penney and Neiman Marcus have $4 billion in debt each, and Penney has cut 1,000 jobs in 2018 alone.

- Hudson's Bay, the Canadian titan, has $3.8 billion in debt and has been selling off valuable brands, piece by piece — just as Sears did in the years leading up to its demise.

- J. Crew has $2 billion of debt, sales are tanking and it's operating at a loss.

"These companies are all struggling with how to adapt to a market in which there is no longer a middle," says Louis Hyman, a business historian at Cornell University. "Americans want either cheap or luxury. ... J. Crew is never going to be a luxury brand, and it can't compete with Target."

- "Private equity has different expectations for these firms than perhaps is possible," Hyman says.

Yes, but: In bankruptcy, any of the eight could re-engineer their financials and stay afloat, says Neil Saunders, managing director of GlobalData Retail. "Most of the brands are well-known and have some value. As such, I don’t think any of them will disappear entirely even if they enter bankruptcy."