Jun 27, 2017 - Politics & Policy

The good news/bad news for Senate Republicans

Add Axios as your preferred source to

see more of our stories on Google.

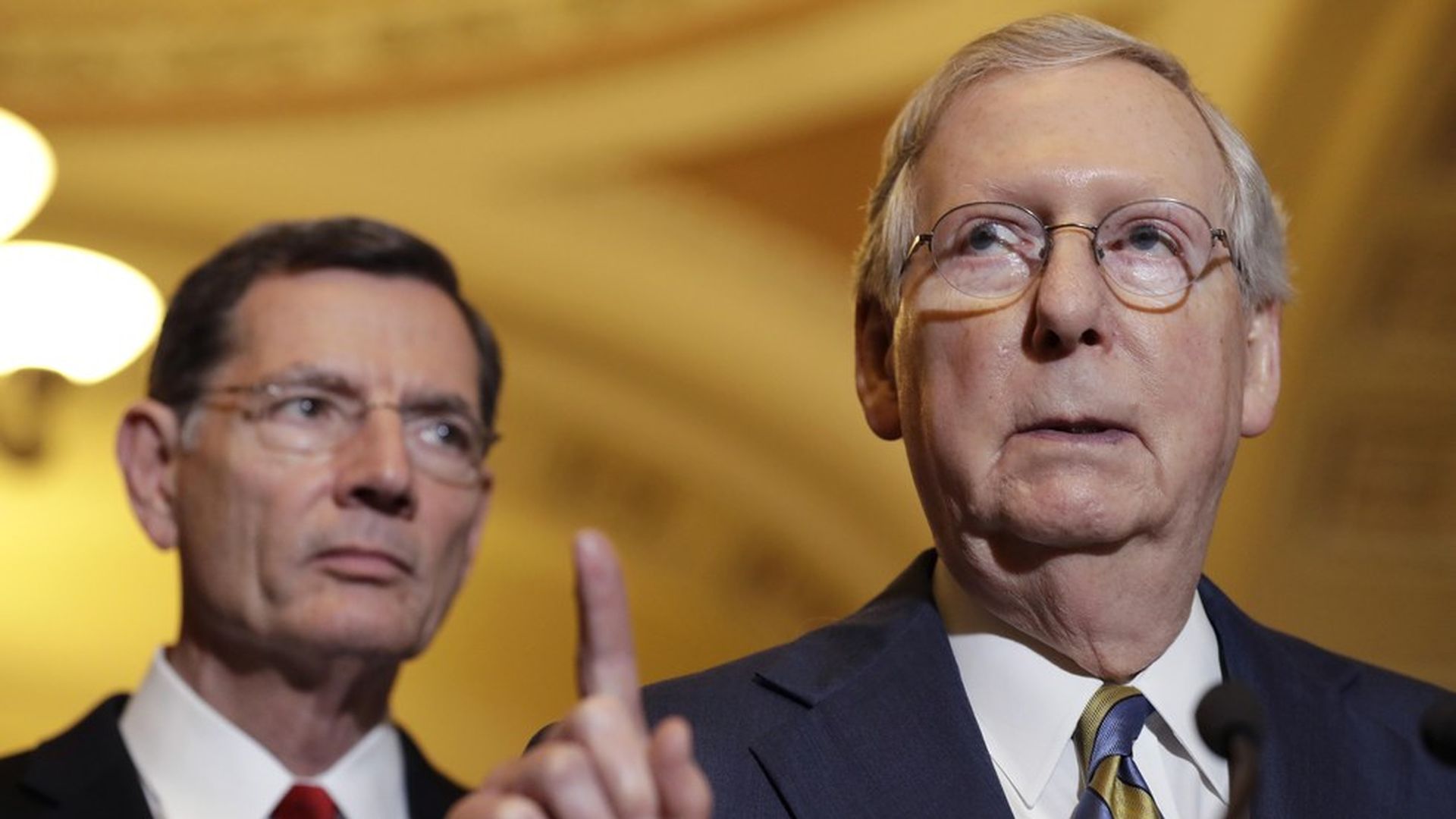

Jacquelyn Martin / AP

Add Axios as your preferred source to

see more of our stories on Google.

Jacquelyn Martin / AP