Why higher education hates the new tax bills

Add Axios as your preferred source to

see more of our stories on Google.

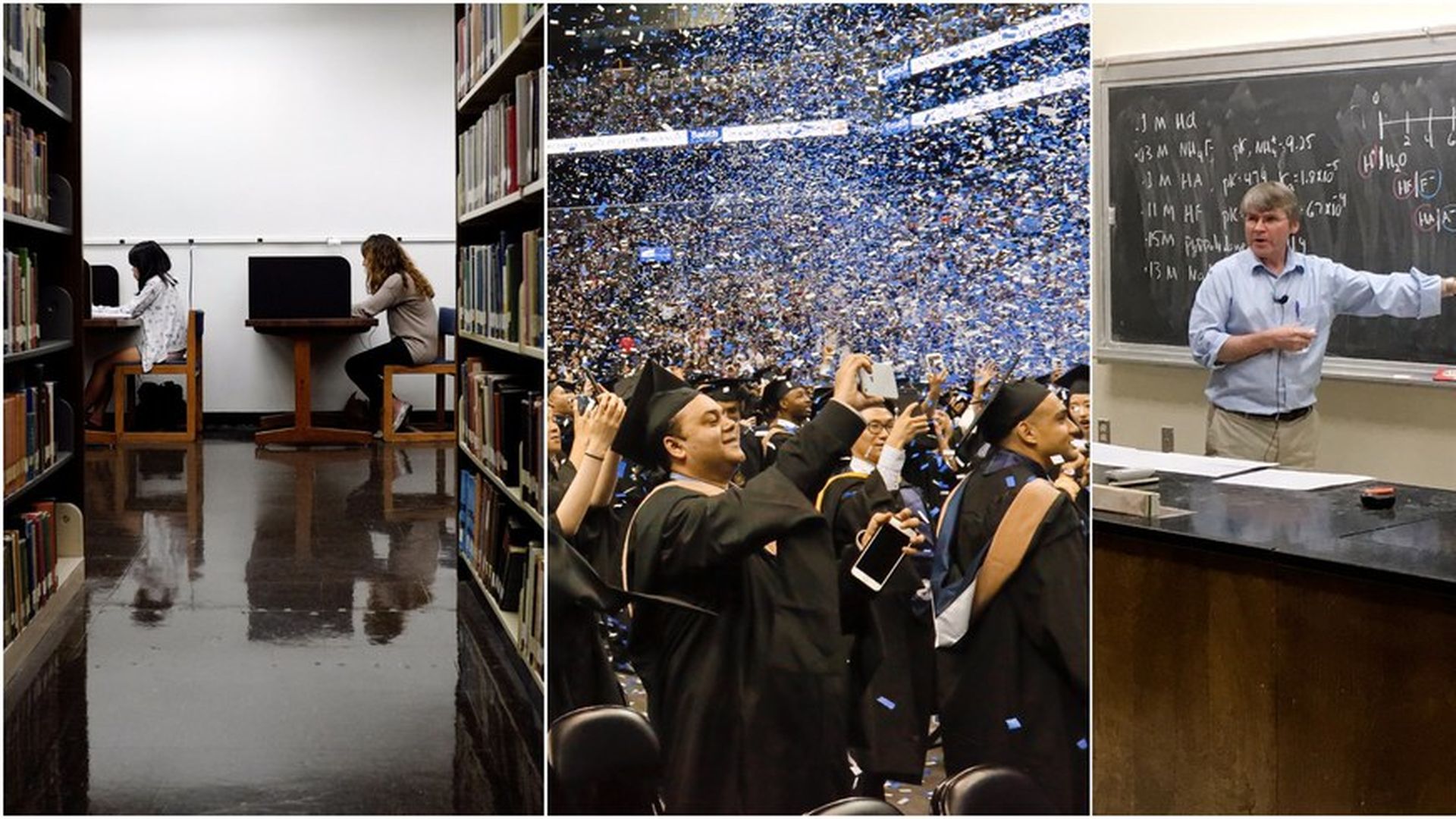

Photos: Bebeto Matthews, Jae C. Hong, Todd Richmond / AP

While the tax reform conversation has focused on tax cuts for the middle class and families, changes to higher education tax policies, primarily in the House bill, could cause many undergraduate, graduate and doctoral students to see a big tax hike.

Why it matters: Higher education will be a big issue when the House and Senate merge their tax cut bills into a final version. This is also a major partisan issue. 58% of Republicans said colleges and universities have a negative impact on society in a recent Pew survey, while 72% of Democrats said higher education had a positive impact.

What's in the bills

- Tuition waivers: In many schools, grad students and doctoral students have their tuition waived in exchange for teaching or heading up research at the university. The House tax bill would make that kind of waived tuition taxable just like regular income. Other scholastic grants and scholarships would not be taxed — only tuition waivers which are in exchange for work.

- University employees would similarly be taxed on any tuition waivers or benefits they receive for their children because they work at the university.

- Student loan interest: The House bill eliminates the student loan interest deduction, which has allowed graduates to deduct the amount they've paid in interest on their student loans.

- University endowments: Both the Senate and House bills propose an excise tax on private college endowments that are more than $250,000 per full-time student. The Senate bill also included a 20% excise tax on any endowments that are used to pay more than $1 million in executive compensation.

- State and local tax deductions: The House bill would limit the state and local tax deductions and the Senate would repeal it, which could cause some people to pay more in taxes depending on high their state and local taxes are. This could put pressure on those states to lower tax rates, which could then cut back on the amount of funding for public colleges and universities.

- Other: The House bill also eliminates the Lifetime Learning Credit and the Hope Scholarship Credit, which are smaller credits that aren't used as often as some of the other education tax credits.

The facts

- Nearly 70% of the 3.1 million high school graduates last year were enrolled at a college or university by October 2016, according to the Bureau of Labor Statistics. 59% of students who started on their bachelor's degree at a four-year university in 2009, completed their degree within six years, according to the National Center for Education Statistics.

- 25% of state spending goes toward K-12 education, and 15% goes toward higher education, according to the Center on Budget and Policy Priorities.

- The House bill could increase the cost of attending college by $65 billion over the next 10 years, according to the American Council on Education.

- The council found that more than 145,000 graduate students don't pay tuition, and could end up in financial trouble if they were forced to pay taxes on their tuition waivers.

- 12 million students used the school loan interest deduction in 2015, according to the IRS.

- The repealed higher education tax benefits could cost college students and their families $71 billion over the next 10 years, according to an analysis by Congress's Joint Committee on Taxation.

Go deeper: The GOP tax plan could lead to a brain drain