Mar 2, 2018 - Economy

Weinstein Co. bailout deal reached

Add Axios as your preferred source to

see more of our stories on Google.

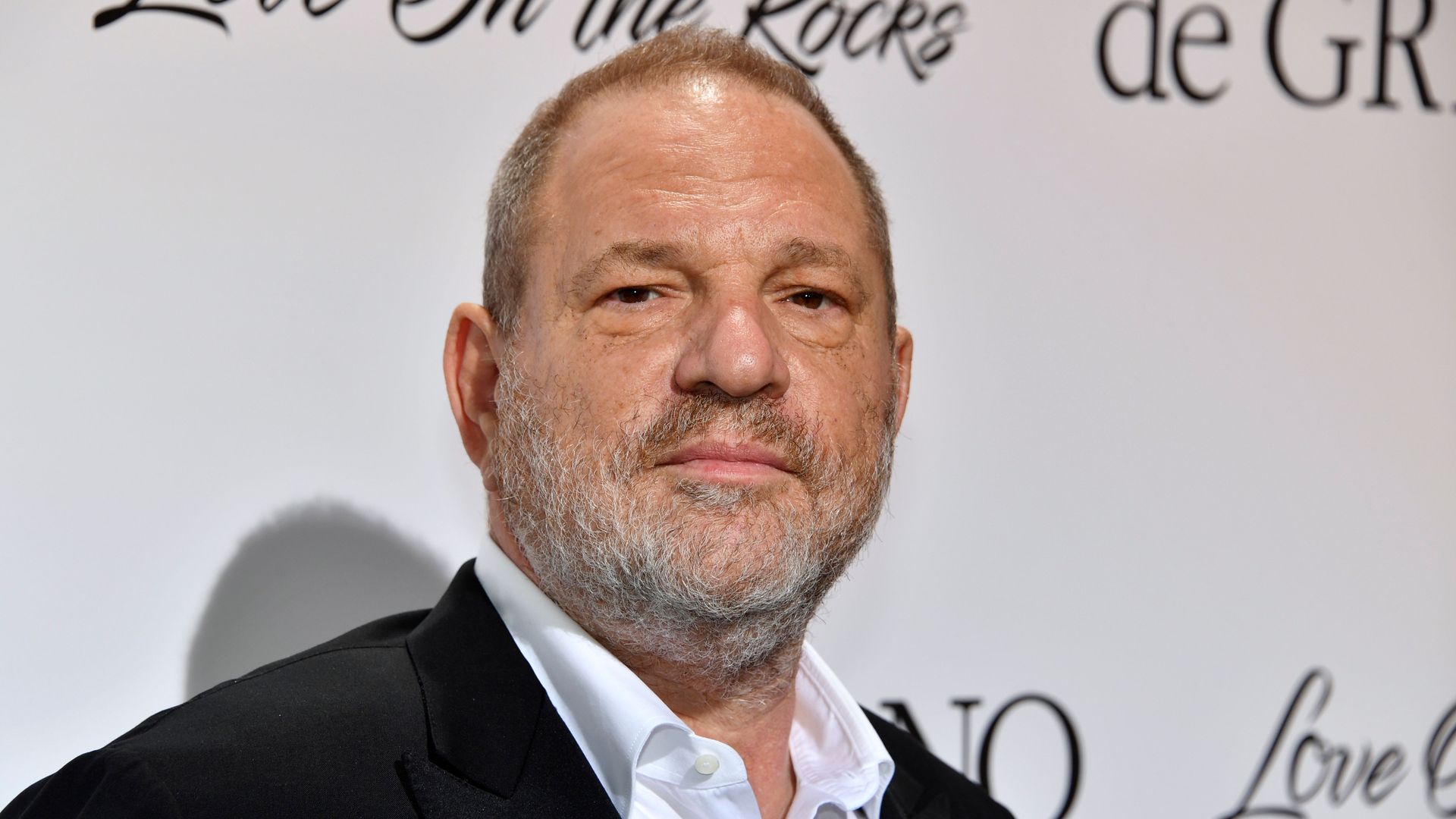

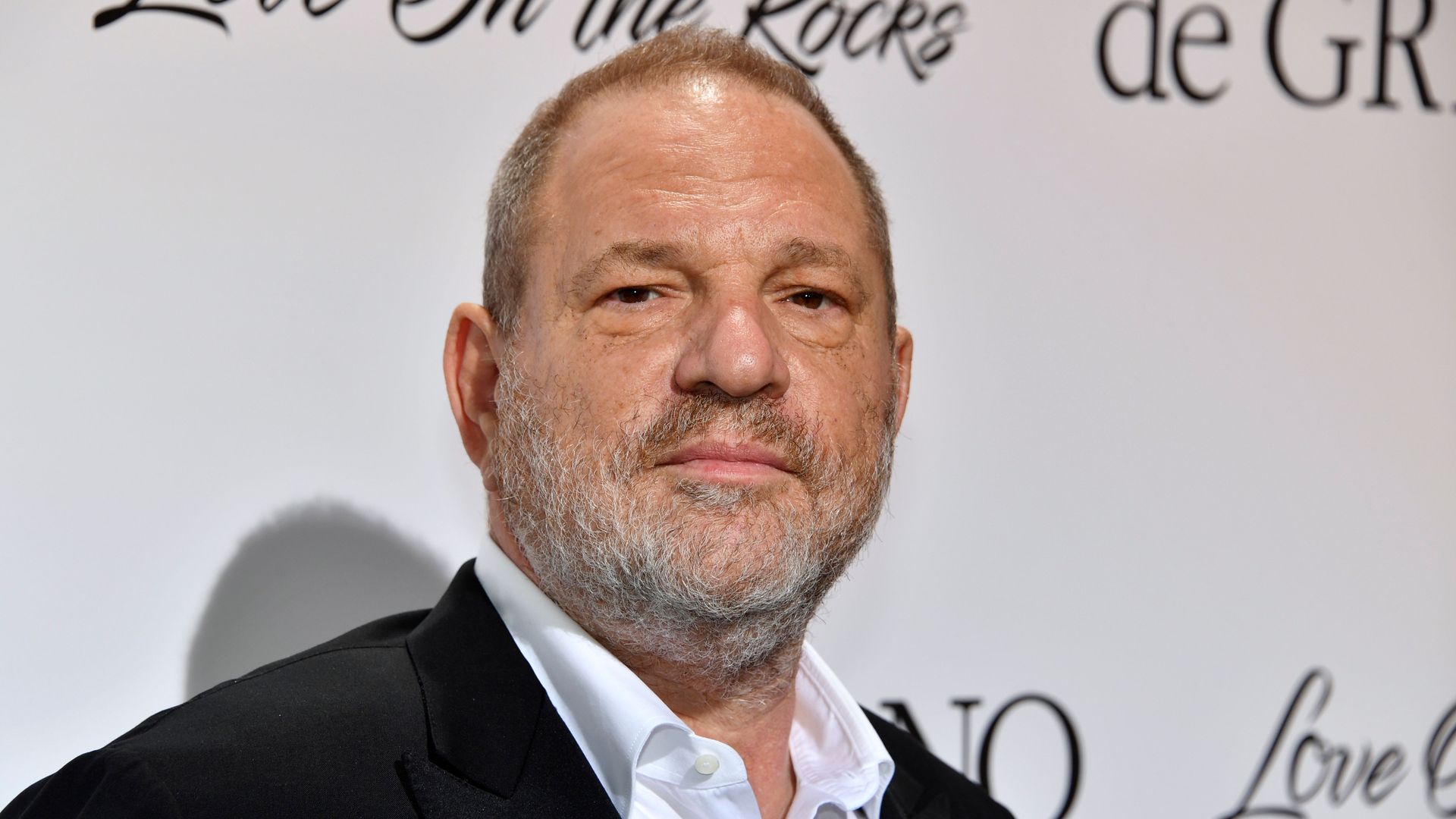

Harvey Weinstein. Photo by Yann Coatsalious/Getty Images

Add Axios as your preferred source to

see more of our stories on Google.

Harvey Weinstein. Photo by Yann Coatsalious/Getty Images