Apr 10, 2017 - Technology

Wall Street has gone gaga for robot stocks

Add Axios as your preferred source to

see more of our stories on Google.

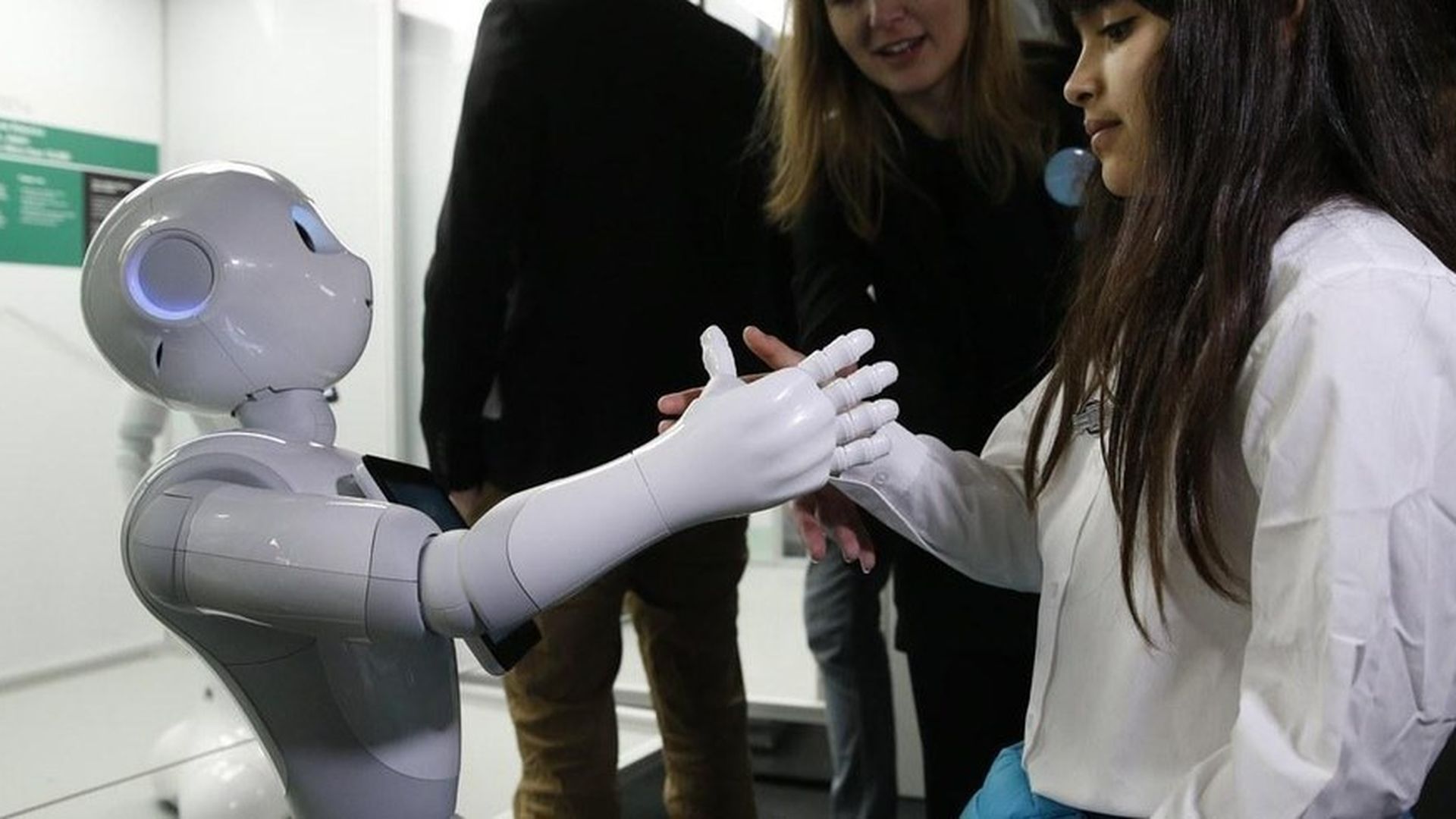

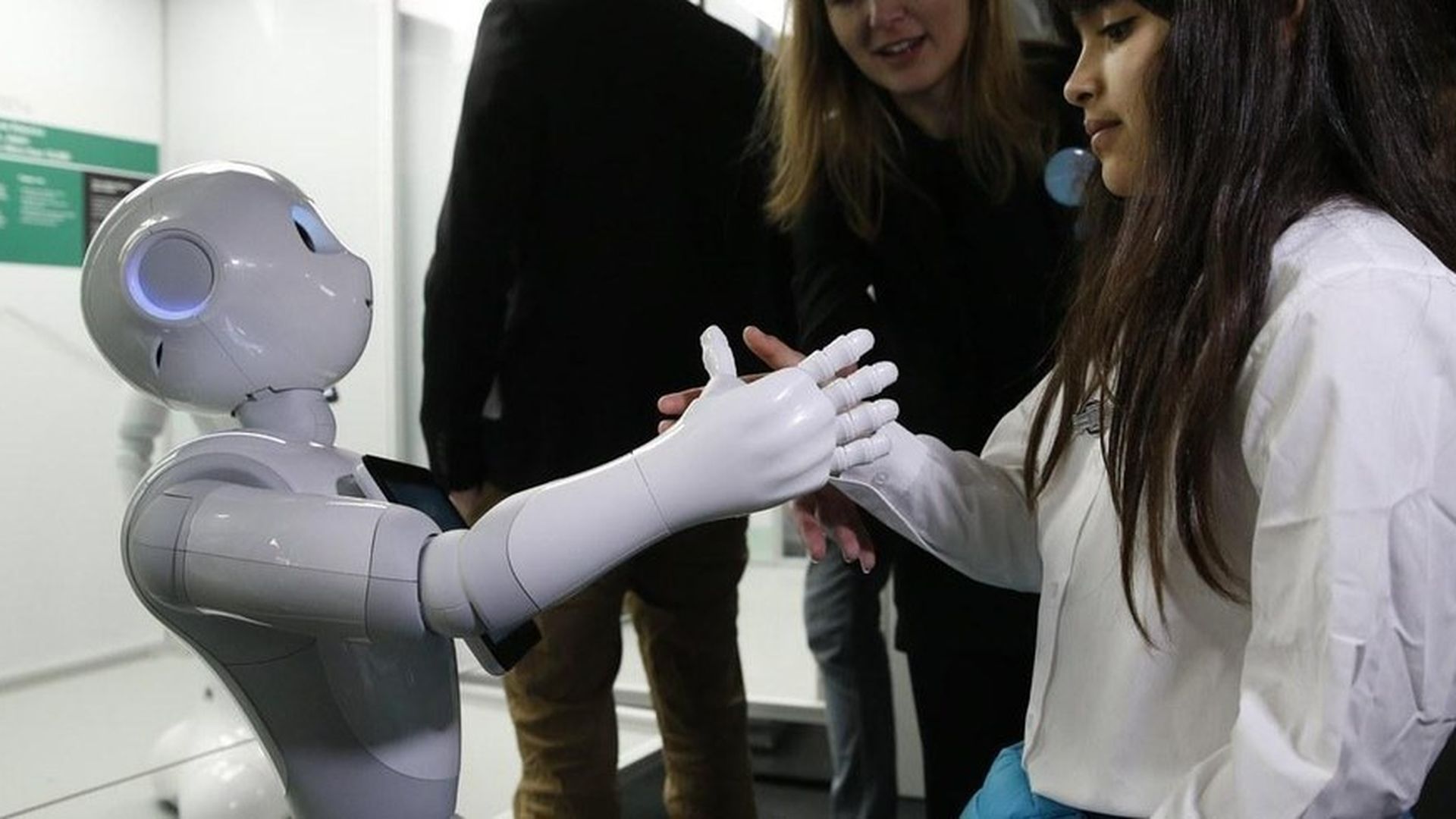

Alastair Grant / AP

Add Axios as your preferred source to

see more of our stories on Google.

Alastair Grant / AP