Dec 17, 2019 - Economy

The venture capital party is not over

Add Axios as your preferred source to

see more of our stories on Google.

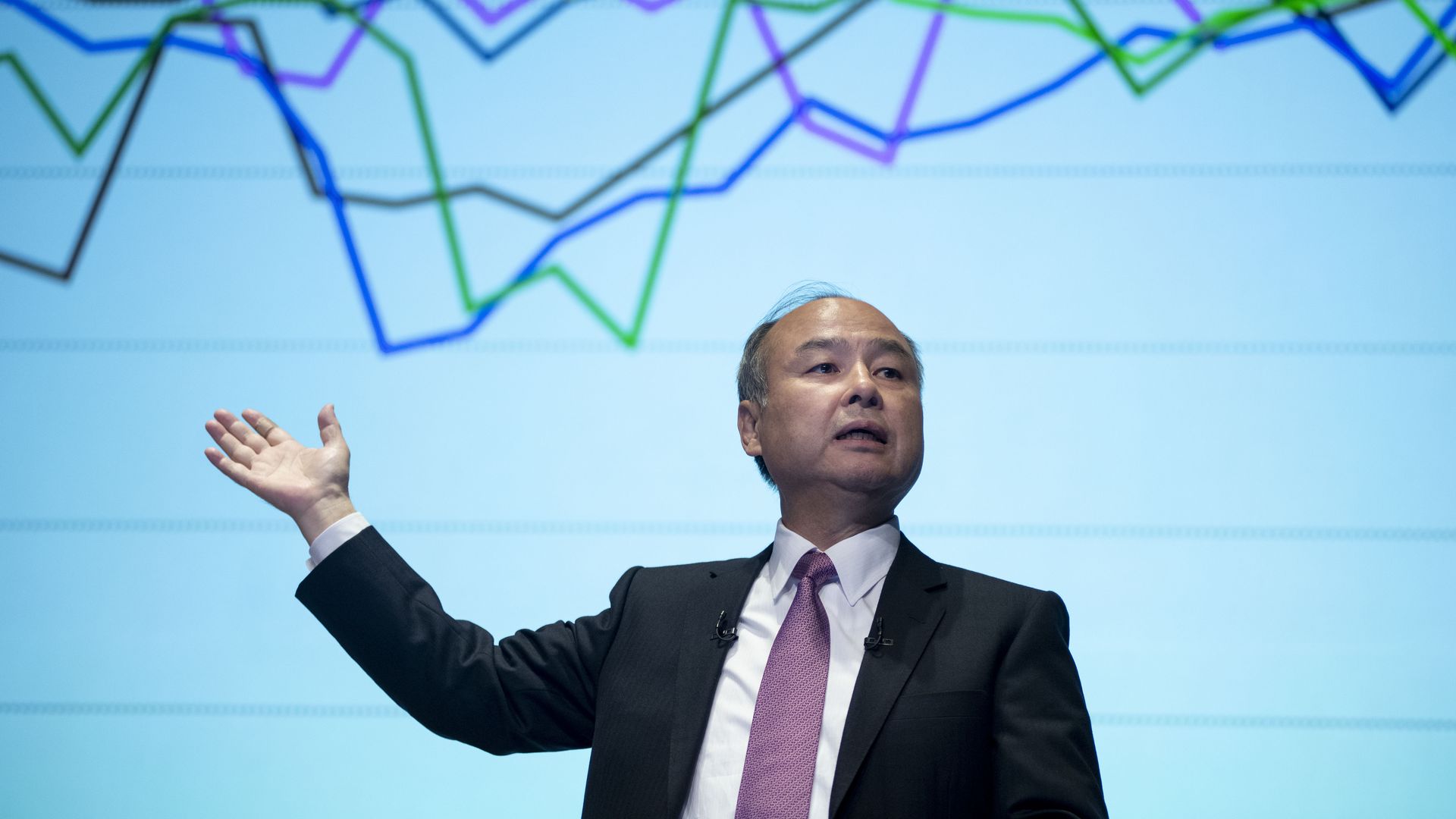

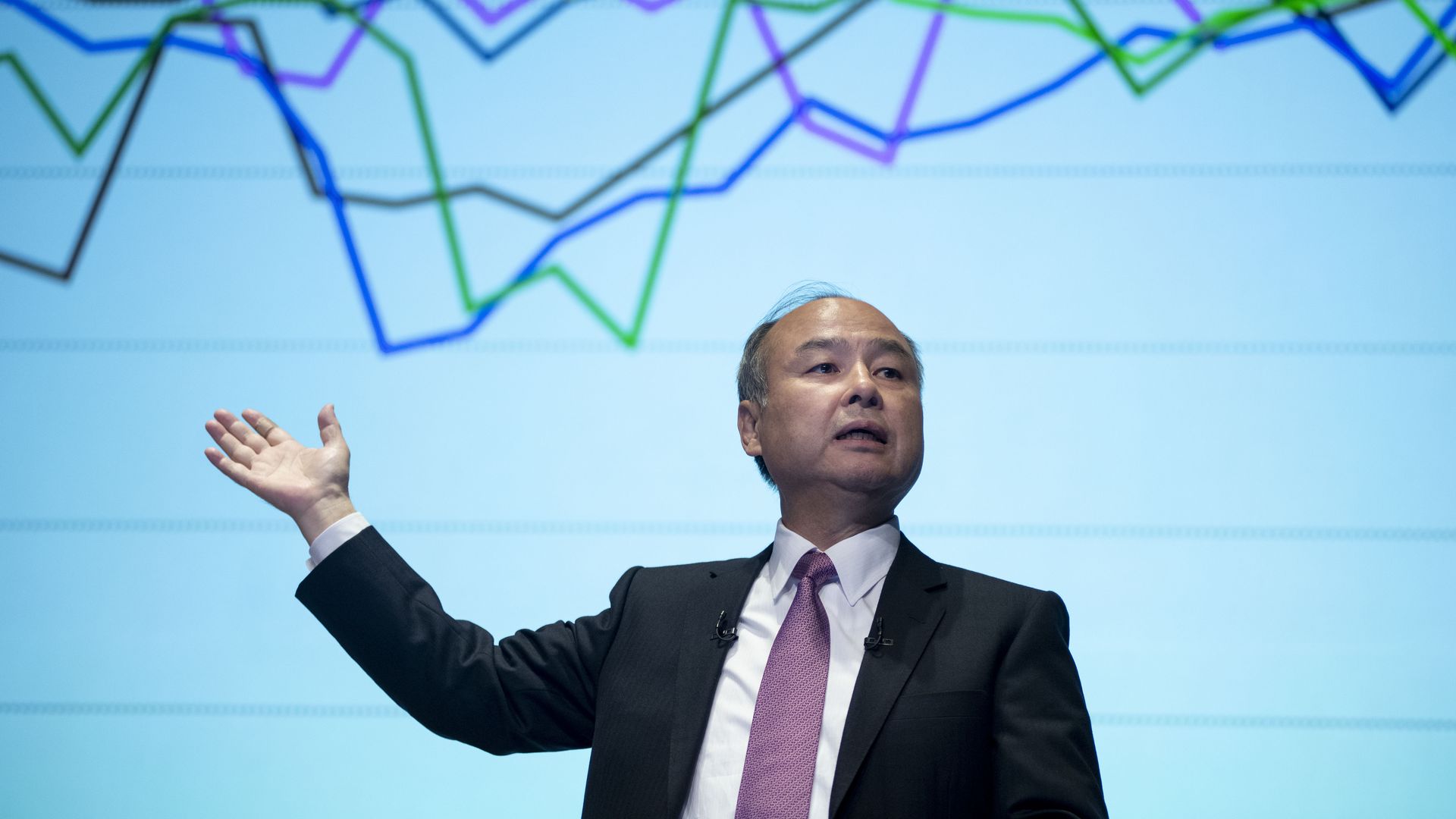

SoftBank chairman and CEO Masayoshi Son. Photo: Alessandro Di Ciommo/NurPhoto via Getty Images

Add Axios as your preferred source to

see more of our stories on Google.

SoftBank chairman and CEO Masayoshi Son. Photo: Alessandro Di Ciommo/NurPhoto via Getty Images