Jun 22, 2017

The Senate health bill is out. Here's your speed read

Add Axios as your preferred source to

see more of our stories on Google.

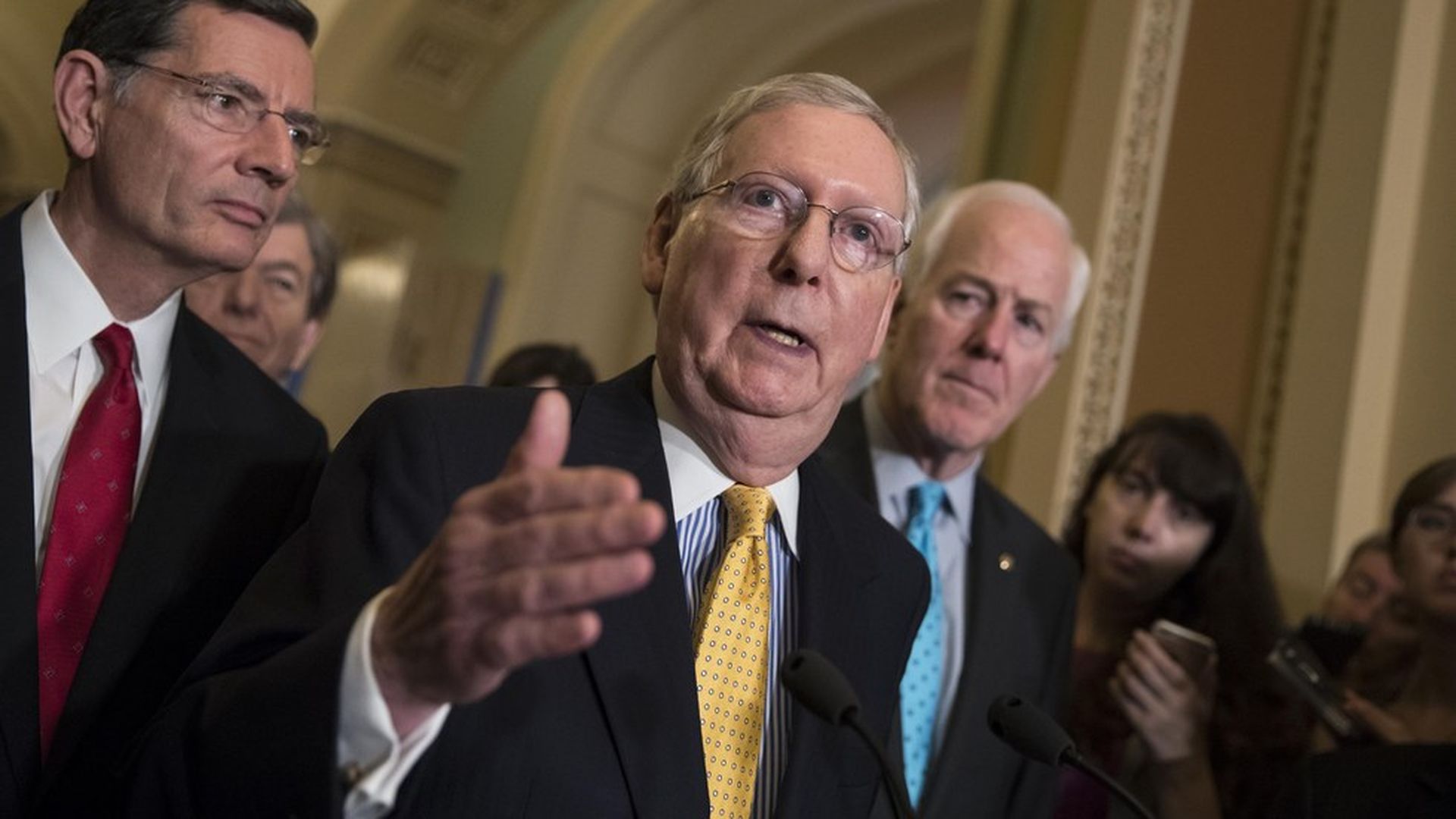

J. Scott Applewhite / AP

You can read it here, and a summary here. The highlights:

- Ends the Affordable Care Act's mandates and most of its taxes.

- Phases out its Medicaid expansion over three years, ending in 2024.

- Limits Medicaid spending with per capita caps, or block grants for states that choose them. The spending growth rate would become stricter in 2025.

- States could apply for waivers from many of the insurance regulations — though not protections for people with pre-existing conditions and coverage for young adults.

- The ACA's tax credits would be kept in place, unlike the House bill — but their value would be reduced.

- Funds the ACA's cost-sharing subsidies through 2019, but then repeals them.

Want more? Keep reading.

- There's a stabilization fund to help states strengthen their individual health insurance markets.$15 billion a year in 2018 and 2019, $10 billion a year in 2020 and 2021.There's also a long-term state innovation fund, $62 billion over eight years, to help high-cost and low-income people buy health insurance.

- The ACA tax credits continue in 2018 and 2019.

- After that, they'd only be available for people with incomes up to 350 percent of the poverty line.

- The "actuarial value" — the amount of the medical costs that insurance would have to cover — would be lowered to 58 percent, down from 70 percent for the ACA's benchmark plans. That's likely to reduce the value of the tax credits.

- All ACA taxes would be repealed except for the "Cadillac tax" for generous plans, which would be delayed.

- Medicaid spending growth rate under per capita caps would be same as House bill until 2025. Then it switches to the general inflation rate, which is lower than House bill.

- States would be able to impose work requirements for people on Medicaid, except for the elderly, pregnant women and people with disabilities.

- Children with complex medical needs would be exempt from the per capita caps.