Axios Pro Rata

April 23, 2024

🦄 Coming attractions: Ali Ghodsi, co-founder and CEO of Databricks, is joining us for the Axios BFD event in San Francisco on May 14. Request an invite.

Top of the Morning

Photo illustration: Annelise Capossela/Axios. Photos: Arturo Holmes/Getty Images, Kevin Mazur/Getty Images for SKIMS

It's been over a year and a half since Kim Kardashian teamed with Carlyle vet Jay Sammons to launch SKKY Partners, a consumer-focused private equity firm, but the early buzz has given way to the slog of first-time fundraising.

By the numbers: SKKY only secured $121 million in capital commitments through late March, according to federal securities filings.

- That included nearly $80 million structured as a special purpose vehicle for a minority investment in Truff, a maker of truffle-infused hot sauces that is said to have been valued at around $250 million.

- SKKY is raising money via rolling closes, having officially launched fundraising in March 2023 without a formal end date. The SPV eventually will be incorporated into the main fund.

- Sources say that SKKY may have raised new money in the month since its securities filings, or is on the verge of doing so, but it's still a far cry from the $1-$2 billion goals being floated during pre-marketing.

Behind the scenes: The Boston-based firm's biggest problem is declining LP interest in consumer private equity, which is even more pronounced in a soft fundraising environment.

- Recall that Carlyle, Sammons' old firm, said last fall that it would stop consumer dealmaking altogether.

Zoom out: SKKY also has something of a double-edged sword in Kardashian.

- On the one hand, she has a demonstrated ability to build large consumer brands and can attract the sort of inbound interest that other dealmakers can only dream about. Skims, for example, is now worth $4 billion.

- On the other, she has a surplus of other demands on her time, and her celebrity could cause some institutional investors to flinch at presenting SKKY to stodgy investment committees (particularly those old enough to recall the Elevation Partners/Bono fiasco). Expect family offices to be more amenable.

- There also are questions about how SKKY would sell companies whose brands have been elevated by Kardashian — given that she'd be exiting — although the firm has been clear that her role is to be more as a traditional private equity adviser than as a brand ambassador or promoter.

- Fun fact: Kardashian's stake in the firm is partially held by a vehicle called Favorite Daughter Inc.

The bottom line: SKKY, which declined comment, has put together a strong team, according to both LPs and peers. But those investors can't really cook until they get more money in the pantry.

The BFD

Illustration: Tiffany Herring/Axios

The FTC yesterday sued to block Tapestry (NYSE: TPR) from buying rival luxury goods maker Capri (NYSE: CPRI) for $8.5 billion.

Why it's the BFD: This is a bit of a departure for Lina Khan's FTC, which often has worked in parallel with European antitrust regulators or even let Brussels take the lead.

- Both the EU and Japan cleared the Tapestry/Capri deal earlier this month.

- The FTC argues that a merger would create a dominant purveyor of "accessible luxury" handbags, and also reduce competition for consumer pricing and employee compensation.

Catch up quick: Tapestry is the parent company of Coach and Kate Spade, while Capri's brands include Versace, Michael Kors and Jimmy Choo.

- Tapestry announced the deal last August at $57 per share (65% premium at the time), with the $8.5 billion enterprise value representing around a 9x EBITDA multiple.

The bottom line: "Tapestry and Capri are among the largest makers of fashion and accessories in the U.S., but even a merger of the two would still be dwarfed by European rivals such as LVMH and Kering." — Richard Collings, Axios Pro

Venture Capital Deals

• Rippling, an SF-based employee onboarding company, raised $200m in Series F funding at a $13.5b valuation. Coatue led, and was joined by Dragoneer, Founders Fund, and Greenoaks. The company also launched a $590m tender for current employees, former employees, and early investors. axios.link/4b43s4A

🚑 Lumeris, a St. Louis-based value-based care enabler, raised $100m. Deerfield Management led, and was joined by Endeavor Health and insiders Kleiner Perkins, Sandbox Industries, BlueCross BlueShield Venture Partners, and JDLinx participated. lumeris.com

• Givebutter, an Austin, Texas-based nonprofit fundraising and CRM platform, raised $50m led by Bessemer Venture Partners. givebutter.com

• Pomelo, an SF-based international money transfer startup, raised $35m in Series A funding, per TechCrunch. Vy Capital led, and was joined by Founders Fund, A* Capital, and Afore Capital. axios.link/3UedJo7

⚡ Exowatt, a Miami-based modular energy platform for data centers, raised $20m in seed funding from a16z, Atomic, and Sam Altman. axios.link/4aNLu6C

• Wilde Brands, a Nashville, Tenn.-based maker of snack chips from chicken breasts, raised $20m in Series A extension funding, per Axios Pro. KarpReilly led, and was joined by The Family Fund, Grey Space Group, Jack Harlow and Machine Gun Kelly. axios.link/4aKJyM5

🌎 Infogrid, a British provider of real estate decarbonization software, raised $13m co-led by Keyframe Capital and A/O. axios.link/3vTkovT

• PipeDream, an Austin, Texas-based underground logistics network, raised $13m in seed funding co-led by Starship Ventures, Myelin VC, and Cortado Ventures, per Axios Pro. axios.link/3QhljNv

🚑 Clarity Pediatrics, an SF-based provider of ADHD care for kids, raised $10m in seed funding. Rethink Impact led, and was joined by Homebrew and Maverick Ventures. axios.link/44ifEMX

⚡ Texture, a New York-based operating system for energy networks, raised $7.5m in seed funding from Equal Ventures, Lerer Hippeau, Abstract Ventures, and Day One Ventures. texturehq.com

• Octomind, a German web testing software startup, raised $4.8m led by Cherry Ventures. axios.link/3UvLSRq

🚑 Auxa Health, a New York-based health benefit navigation startup, raised $5.2m in seed funding led by Zeal Capital Partners. auxahealth.com

• Superlogic, a Miami-based rewards program marketplace, raised $7.6m from Amex Ventures, Sangha Capital, 10SQ Capital, Nima Capital, Actai Unicorn Fund, and Chainlink Capital. axios.link/3xIGv8J

🌎 Vitalfluid, a Dutch developer of an alternative to chemical pesticides and fertilizers, raised €5m from Future Food Fund, Graduate Entrepreneur Fund, Horticoop, and Innovation Industries. axios.link/3Jv8Dik

• FilmChain, a London-based payments startup for films and TV stakeholders, raised £2.8m. Holt IntersXion led, and was joined by Roca X, DeBa Ventures, TechAngels Romania, and HearstLab. axios.link/49LpXdx

• Veyor Digital, an Australian provider of construction logistics scheduling software, raised A$2.8m led by Investible. axios.link/3W8aTU3

• Continuum, a Chicago-based B2B reverse logistics startup, raised $1.7m in pre-seed funding. M25 led, and was joined by Cambrian Ventures and Clocktower Ventures. gocontinuum.ai

• OnePay, a WhatsApp-based payments processing startup based in Colombia, raised $1.3m from Qupa Ventures. axios.link/4d7vs9i

Private Equity Deals

• American Pacific Group invested in C.F. Stinson, a Rochester Hills, Mich.-based maker of textiles for commercial interiors. cfstinson.com

• Celebrity Coaches, a Hendersonville, Tenn.-based portfolio company of Allied Industrial Partners, acquired Moonstruck Leasing, a Nashville-based entertainment coach leasing company. celebritycoaches.rocks

• General Atlantic and XP Private Equity made minority investments in LiveMode, a Brazilian provider of distribution rights solutions to sports teams and leagues. livemode.net

• IK Partners acquired a minority stake in A-Safe, a British maker of industrial polymer safety barrier systems. asafe.com

🚑 Incline Equity Partners bought VMG Health, a Dallas-based compliance, strategy and advisory firm, from Northlane Capital Partners. vmghealth.com

• PAI Partners agreed to buy Audiotonix, British provider of professional audio mixing console and ancillary products, from Ardian (which retains a minority stake). audiotonix.com

Public Offerings

• Chabaidao, a Chinese bubble-tea maker, raised at least $300m in its Hong Kong IPO, but then saw shares fall 27%. Backers include Orchid Asia, Loyal Valley Capital, and CICC Capital. axios.link/4aLICHz

Liquidity Events

• Bridgepoint is seeking to sell Vitamin Well, a Swedish drinks maker that could be valued north of €2b, per the FT. axios.link/3xYOhLC

• Permira hired Morgan Stanley to sell its 50% stake in Grobest, a Taiwanese aquatic food provider that could be valued at around $1b, per Reuters. axios.link/3UbqRdx

• Klarna sold off the assets of Hero, an e-commerce expert platform, for $1.3m to Bambuser (STO: BUSER). It had paid $160m to buy Hero in 2021. axios.link/3Qdy1g8

🚑 Main Capital agreed to sell Enovation, a Dutch health care SaaS company, to Legrand (Paris: LR), per Axios Pro. axios.link/3Jw8Vpe

• Synapse, a banking-as-a-service provider, filed for Chapter 11 bankruptcy protection and agreed to sell its assets to SoftBank-backed TabaPay. Synapse had raised over $50m from firms like a16z, Trinity Ventures, and Core Innovation Capital. axios.link/4aIxJ9u

More M&A

• Descartes (TSX: DSG) acquired Aerospace Software Developments, an Irish provider of customs and regulatory compliance solutions, for $61m. asd.ie

• Embracer, a listed Swedish gaming group, plans to split into three listed companies and said it's secured a $900m loan. axios.link/4d4DU9f

• Infinite Reality, a metaverse company seeking to go public via SPAC, acquired the Drone Racing League for $250m. axios.link/3JB8gm8

• Jana Partners is asking Wolfspeed (NYSE: WOLF), a Durham, N.C.-based silicon carbide maker with a $2.8b market cap, to explore a possible sale, per Reuters. axios.link/3QgcOCa

• JD Sports Fashion (LSE: JD) offered to buy Hibbett (Nasdaq: HIBB), a Birmingham, Ala.-based athletic clothing retailer, for around $1.08b. axios.link/3QeAS8I

Fundraising

• 14Peaks Capital, a Swiss VC firm led by Edoardo Ermotti, raised $30m for its debut fund. axios.link/3U9I1rV

• Vestar Capital Partners raised a $1.2b, single-asset continuation fund for its stake in Circana, a Chicago-based market research firm, co-led by Blackstone Strategic Partners and HarbourVest Partners. www.vestarcapital.com

It's Personnel

• Mike Ebeling joined Empris as a partner. He previously was with Goldman Sachs Private Equity. empris.co.uk

• Kegan Greene and Rob Freiman both stepped down as co-heads of fintech investment banking for Jefferies Group, per Bloomberg. They joined in 2022 from Houlihan Lokey. axios.link/3xRjhNN

• Orlando Knauss joined PJT Partners as a partner focused on industrials deals, per Bloomberg. He previously was with Bank of America. axios.link/3WcF0K6

• Sean Lynch is leaving Barclays for to become a tech banker at UBS, which is opening a Menlo Park, Calif. office, per Bloomberg. axios.link/3WaYIGj

• CoVenture Management promoted Michael Breitstein to partner. coventure.vc

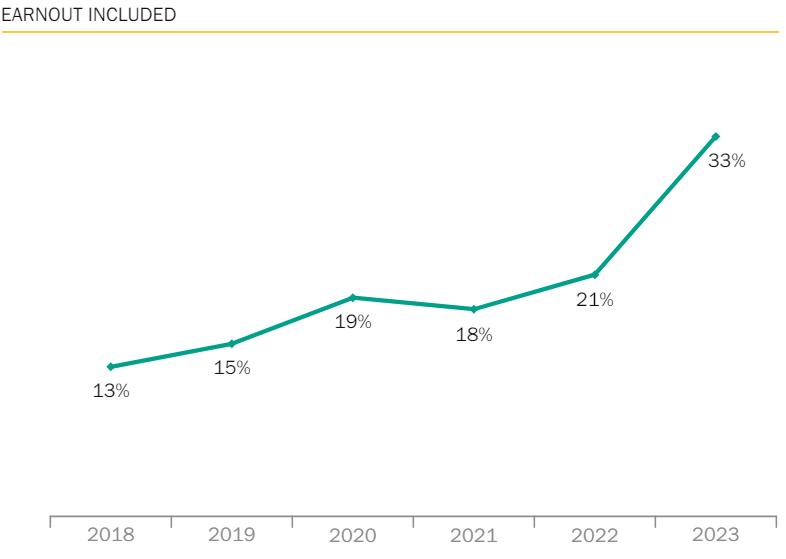

Final Numbers: Earnouts (non-life sciences)

Earnouts have long been a staple of life sciences acquisitions, but they're becoming much more prevalent in other sectors, according to the latest SRS Acquiom Deal Terms Study.

- 33% of non-life sciences deals in 2023 included an earnout provision, a 50% year-over-year increase. The median earnout potential of the closing payment was 32%, up from 30%.

- Of that cohort, 35% were single-trigger (typically revenue) and 65% were double-triggers.

Thanks for reading Axios Pro Rata, and to copy editor Bryan McBournie! Please ask your friends, colleagues, and hot saucers to sign up.

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.