Axios Pro Rata

February 21, 2019

Hey D.C. readers: Join Axios tomorrow morning at 8:30am for a conversation on improving and expanding education in America. Guests include Oregon Gov. Kate Brown, New Hampshire Gov. Chris Sununu, actress Jennifer Garner and Save the Children CEO Mark Shriver. RSVP here

Top of the Morning

Chicago-based private equity firm GTCR this morning announced an agreement to buy insurance broker Assured Partners from Apax Partners at a reported enterprise value of $5.1 billion (including debt).

Why it matters: Because mid-market insurance is exhilarating.

No? Okay, tough crowd. How about because GTCR previously owned AssuredPartners between 2011 and 2015, and today's news is part of a growing trend of private equity repurchases.

- Just last week, Hellman & Friedman agreed to buy back a majority stake in German online classifieds company Scout24 for around $6.4 billion.

"Private equity firms can't own things forever, so we did embark on a sale process after we worked with management to get the company to a place that far exceeded our original underwriting plans," says Aaron Cohen, a GTCR managing director. "It felt like a natural evolution and allowed management to obtain some liquidity... but we have sort of regretted it since then."

One driver of private equity repurchases, even at higher valuations, is that the investments are largely de-risked. The once and future owner usually knows the management, the sector and where skeletons might be buried (in fact, it might have done the digging).

- In this case, Cohen says that GTCR's original stewardship helped AssuredPartners build out its infrastructure (new offices, etc.) while Apax better "professionalized" the company (hiring heads of IT, etc.). Now GTCR wants to help AssuredPartners expand its specialty verticals via M&A.

Back to excitement: Much of the mid-market brokerage space remains in private equity hands, even though companies like AssuredPartners are certainly large enough to list. The primary reason is that the sector's financial profile is perfectly constructed for PE, with high recurring revenue and cash-flow, plus a diversified revenue and producer base.

- Cohen believes there are up to eight such PE-backed companies capable of being public, but says private equity likely bestow higher valuations than would public traders.

- Just this morning, Aquiline Capital Partners agreed to buy Walnut Creek, Calif.-based Relation Insurance Services from Parthenon Capital and Century Equity Partners.

❓ Answer key: On Tuesday I asked you to name the well-known Silicon Valley VC who's in advanced talks to switch shops, with a hint about how he'd be trading in Sand Hill Road for San Francisco.

- The answer was Keith Rabois, who is leaving Khosla Ventures for Founders Fund, as we first reported yesterday afternoon at Axios. Go here to read more on Rabois, who tells me it was the "most difficult professional decision” he's ever made.

🎧 Pro Rata Podcast: Our new episode focuses on the controversial arrest of private equity investor Mike Calvey in Russia. My guest is Red Notice author Bill Browder, who sees parallels between Calvey's experience and his own. Listen here.

The BFD

Ÿnsect, a French startup that breeds insects to become ingredients for pet food, fish food and plant fertilizers, raised $125 million in Series C funding.

- Why it's the BFD: Because the company claims this deal will let it build the world's largest insect farm. It's also believed to be the largest-ever round for an ag-tech startup outside of the U.S.

- Investors: Astanor Ventures led, and was joined by Bpifrance, Talis Capital, Idinvest Partners, Finasucre and Compagnie du Bois Sauvage.

- Bottom line: The specific bet here in on mealworms, which Ÿnsect argues are more nutritious than the flies bred by its competitors.

Venture Capital Deals

• Lalamove, a Hong Kong-based on-demand logistics company, raised $300 million in Series D funding co-led by Hillhouse Capital and Sequoia Capital. http://axios.link/pBaJ

• Mojio, a Campbell, Calif.-based SaaS platform for connected cars, raised $40 million in Series B funding from Assurant, Bosch, T-Mobile, Innogy Ventures, Iris Capital, Telus Ventures, Trend Forward Capital, Kensington Capital, Amazon, BDC, Deutsche Telekom and Relay Ventures. http://axios.link/gLHK

• Lytics, a Portland, Ore.-based customer data platform for marketers, raised $35 million in Series C funding. JMI Equity led, and was joined by return backers Comcast Ventures, TwoSigma Ventures, Rembrandt Venture Partners and Voyager Capital. www.lytics.com

🚑 BiomX, an Israeli developer of phage therapies, raised $32 million in Series B funding from backers like OrbiMed, Johnson & Johnson, Takeda Ventures, 8VC, Mirae Asset Management, Seventure Partners and RMGP. http://axios.link/HJDf

• Armoblox, a Sunnyvale, Calif.-based provider of natural language understanding tech for cybersecurity, raised $16.5 million in Series A funding led by General Catalyst. http://axios.link/C3Lv

• Epogee, an Indianapolis-based developer of fat replacement and flavor enhancement ingredients, raised $8.3 million led by HG Ventures. www.epogeefoods.com

• Tillable, a Chicago-based farmland rental management startup, raised $8.25 million in Series A funding led by The Production Board and First Round Capital. www.tillable.com

• ParkHub, a Dallas-based provider of B2B parking tech, raised $13 million in Series B funding led by Arrowroot Capital. http://axios.link/Q7yy

• Imagen, a UK-based SaaS video management platform, raised £6.5 million in Series B funding led by Downing Ventures. http://axios.link/w57R

• Capitalise.com, a London-based online financial marketplace for accountants, raised £3.5 million in Series A funding led by QED Investors. http://axios.link/WpVB

Private Equity Deals

• Authority Brands, a Columbia, Md.-based portfolio company of Apax Partners, acquired Clockwork, a Sarasota, Fla.-based provider of HVAC services, from a subsidiary of Centrica (LSE: CAN). www.clockworkhomeservices.com

• Caisse de dépôt et placement du Québec invested $400 million into Allied Universal, a Santa Ana, Calif.-based security services provider, at a valuation north of $7 billion. http://axios.link/80Xm

• DoubleVerify, a New York-based marketing measurement software company owned by Providence Equity Partners, acquired Zentrick, a Belgian provider of middleware solutions for online video advertising that had raised around $4 million from firms like Fortino Capital. http://axios.link/982o

• MBK Partners agreed to pay more than $1 billion for the Asia-Pacific assets of chocolatier Godiva. http://axios.link/ugRy

• Perforce Software, a Minneapolis-based portfolio company of Clearlake Capital Group, completed its purchase of Rogue Wave, a Louisville, Colo.-based provider of cross-platform software developer tools, from Audax Private Equity. www.perforce.com

• Platinum Equity agreed to buy Livingston International, a Toronto-based trade services firm. www.livingstonintl.com

• Qlik, a Radnor, Penn.-based business intelligence company owned by Thoma Bravo, agreed to buy Israeli big data management software maker Attunity (Nasdaq: ATTU) for approximately $560 million in cash, or $23.50 per share (18% premium to yesterday’s closing price). www.attunity.com

• Standout Capital acquired a majority stake in VisBook, a Norwegian maker of property management software for hotels and activity providers. www.visbook.com

Public Offerings

• Lyft reportedly plans to launch its IPO road-show on March 18, meaning it could list on the Nasdaq in early April. http://axios.link/6lyX

Liquidity Events

• Global Infrastructure Partners is considering a sale of its nearly 49% stake in Terminal Investment, a Geneva-based developer and manager of container terminals in 23 countries, per Bloomberg. http://axios.link/6FHe

⛽ HitecVision hired Jefferies to find a buyer for Verus Petroleum, a British North Sea oil and gas company that could fetch $500 million, per Reuters. http://axios.link/d23w

More M&A

• APM Monoco, a family-owned jewelry brand based in Moncaco, is seeking a buyer in a deal that fetch nearly $1 billion, per Reuters. http://axios.link/Cp0l

• Constellation Brands (NYSE: STZ) announced that it wants to sell some of its lower-end wine brands. http://axios.link/KFyI

🚑 Magellan Health (Nasdaq: MGLN), a Scottsdale, Ariz.-based healthcare plan and pharmacy benefits manager, will consider a sale after coming under pressure from activist investor Starboard Value, per Reuters. It has a market cap just north of $1.7 billion. http://axios.link/6r5G

🚑 Owens & Minor (NYSE: OMI), a Richmond, Va.-based medical supplies distributor with a market cap of around $408 million, is considering a sale, per Reuters. http://axios.link/x8kf

⛽ RWE, the German utility giant, will receive unconditional EU approval to buy the renewables units of E.ON and Innogy, per Reuters. http://axios.link/G4ri

Fundraising

🚑 MPM Capital raised $400 million for its seventh early-stage healthcare VC fund. www.mpmcapital.com

• Sunstone Capital, an early-stage European VC firm, has rebranded to Heartcore Capital and raised €160 million for its latest fund. http://axios.link/y7vi

• TPG Sixth Street Partners, a credit affiliate of TPG Capital, is raising $2 billion for a new fund focused on growth-stage companies, per Bloomberg. http://axios.link/LG1g

It's Personnel

• Amit Jain rejoined TA Associates as a Menlo Park-based vice president. He had been with the firm between 2013 and 2016 as an associate, before leaving to join Marlin Equity Partners. www.ta.com

• Seth Meyer joined Hercules Capital (NYSE: HTGC) as CFO. He previously was CFO for Swiss Re’s commercial insurance unit. www.htgc.com

• SNH Capital Partners promoted Susan Blanco to managing director and head of the private equity firm’s San Francisco investment team. www.snhcap.com

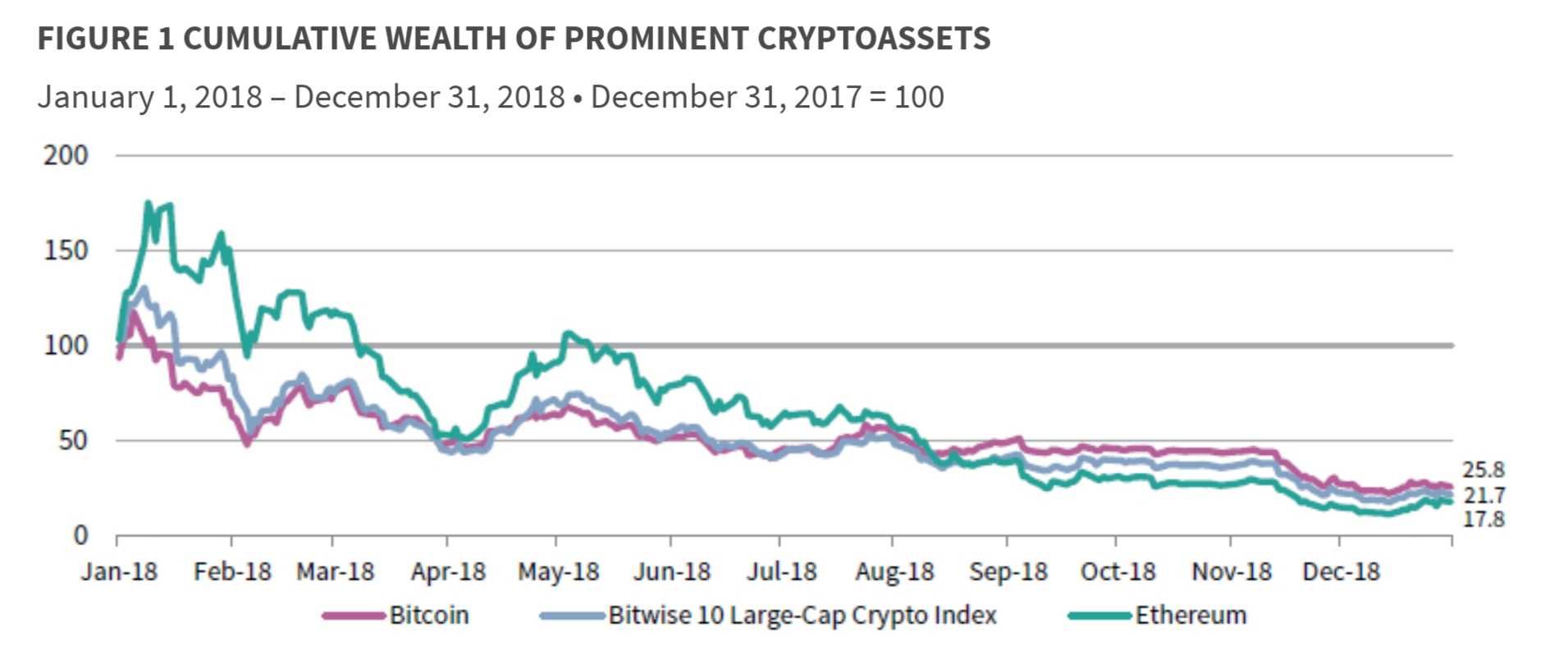

Final Numbers: Crypto collapse

Sign up for Axios Pro Rata

Dan Primack’s briefing on VC, PE & M&A for dealmakers.