Axios Markets

March 15, 2019

Was this email forwarded to you? Sign up here.

Situational awareness:

- A federal judge ruled that Qualcomm must pay Apple nearly $1 billion in patent-royalty rebates. (Reuters)

- Bill McGlashan, a high-profile private equity investor who was among the parents charged in the college admissions cheating scandal this week, has either been fired from or resigned from TPG Capital. (Axios)

- The SEC is suing Volkswagen and CEO Martin Winterkorn alleging both "perpetrated a massive fraud" and repeatedly lied to U.S. investors in connection with the "Dieselgate" scandal. (CNBC)

- The Bank of Japan maintained its negative-interest rate policy and cut expectations on exports and economic output. (Reuters)

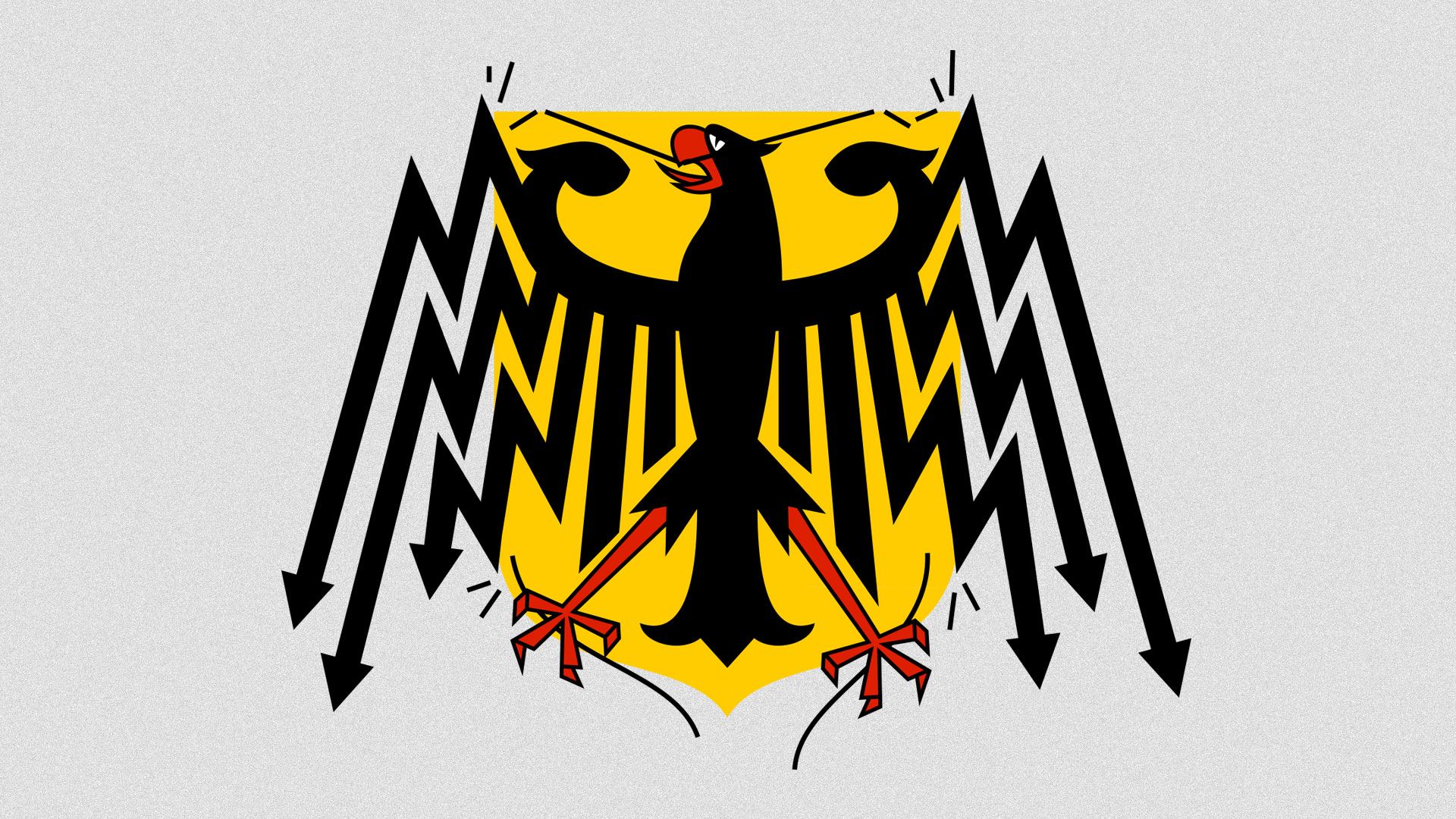

1 big thing: Germany is Europe's most dangerous country

Illustration: Lazaro Gamio/Axios

While Brexit has captured the world's attention, the bigger story is happening in Germany.

Driving the news: Germany is headed almost certainly for a significant slowdown in growth and very possibly into a recession. Which route the country takes has major implications for Europe and the rest of the world.

After recording zero growth in the fourth quarter of 2018, narrowly avoiding back-to-back quarters of economic contraction, one of Germany’s most prestigious research institutes Thursday cut its expectations for German growth this year by almost half.

The Munich-based Ifo Institute also said the pace of employment growth is decelerating. That followed data showing the country's all important manufacturing sector had significantly slowed, badly undershooting economists' expectations.

- That's a major problem for Germany because exports make up about half of its GDP.

"Germany's economy is really exposed to any shifts in the international market," George Friedman, founder and chairman of Geopolitical Futures, tells Axios. "You have a problem with the largest economy in Europe not really being in control of its own economy. So in that sense it's the most dangerous country in Europe because it's the most important country and incredibly vulnerable."

The big picture: As the driving economic and political force in the euro zone, the world's third largest growth engine, Germany is expected to help pull its neighbors out of an economic malaise, but right now it's reflecting the broader weakness.

The 28-member bloc is facing widespread growth declines (Italy is in recession, Sweden just avoided one) and political instability from Brexit and growing anti-euro populism.

- "At this point the German economy is more the victim of problems in the global economy than the cause," says Jeromin Zettelmeyer, a senior fellow at the Peterson Institute for International Economics.

However, Zettelmeyer believes Germany still has some lifelines because its domestic economy remains strong and the ECB has positioned itself to help give Europe a boost. Germany could also pass fiscal stimulus, if lawmakers can agree on a bill.

What to watch: "If you see services slowing, consumer confidence going down significantly and payroll numbers falling, a softening of the labor market, one should start worrying more," Zettelmeyer tells Axios. "The other thing to watch is how sustained is the decline in industrial production? If we see another decline in industrial production next month I would really be more worried."

2. China concludes NPC

China's Vice Premier Wang Yang (Left), President Xi Jinping and Premier Li Keqiang applaud after the foreign investment law was passed during the closing session of the National People's Congress. Photo: Greg Baker/AFP/Getty Images

Chinese officials overnight completed the 2019 National People's Congress. Notably, lawmakers passed a bill to eliminate the requirement that foreign companies transfer proprietary technology to Chinese partners and said it will protect against "illegal government interference."

The body also pledged greater cooperation with American and European companies on Belt and Road initiatives.

Over the course of the policy meeting lawmakers passed several proposals:

- Cut this year's growth target to 6% — 6.5% from "around 6.5%."

- Increased tax and fee reduction to 2 trillion yuan (about $298 billion) for 2019, from 1.3 trillion yuan in 2018.

- Pledged more bond issuance by local governments to support higher fiscal spending.

- Announced China will not give up on "structural deleveraging" and will strive to keep total deleveraging "broadly stable."

3. "Ratings agencies hate to downgrade a company"

During a recent media event in Manhattan, Charles K. Bobrinskoy, head of the investment group at Ariel Investment, talked about one of the biggest lessons he learned during and after the 2007–2009 financial crisis about debt and company balance sheets.

"What we found was that we, like a lot of other people, had been relying on the ratings agencies to assess the balance sheets of companies and the problem was that ratings agencies hate to downgrade a company because it’s an admission of a mistake. If you downgrade, by definition, it means you were wrong before. So they're very slow to downgrade.

"And who pays for those debt ratings? The companies themselves. So there’s an inherent bias at the ratings agencies against downgrading companies."

"The equity industry just does not have the debt skills, the credit skills, that really it should have and we think this is going to show up again in the next downturn."

"I was surprised when I came to the industry to find that people just don’t spend a lot of time on balance sheet analysis because if things are going OK it really doesn’t matter. In fact, leverage helps when things are going well.

"Debt levels in corporate America have inched up and up and up. We’re getting back to debt levels that are similar to what they were in 2007. Bankers have not held a lot of bad news in their portfolios so we think they’ve gotten a little lax."

4. PBMs are changing but drug prices aren't

As part of its plan to lower prescription drug prices, the Trump administration wants to restructure pharmacy benefit managers' business models. It wants them to profit from flat fees, rather than the complex rebates they rely on now, Axios' Caitlin Owens and Bob Herman write.

- The administration and the pharmaceutical industry argue that because rebates are tied to drugs' list prices, making those rebates less lucrative for PBMs will help bring down prices overall.

Yes, but: This transition to a new business model is already happening on its own. And drugs' list prices are not coming down.

- PBMs are keeping a smaller share of rebates and passing more along to their clients.

- Instead, PBMs are collecting more revenue through various fees — the same shift the Trump administration envisions — and through a practice called "spread pricing," according to a Pew analysis.

- Express Scripts, one of the largest PBMs, explicitly told investors last year it would find "an alternate funding / pricing structure" to offset lost rebate dollars.

Why it matters for the market: Pharmaceutical companies have largely held their ground in 2019, with the First Trust Nasdaq Pharmaceuticals ETF (FTXH) up around 11%, broadly in line with the S&P 500. Drug pricing has been a major concern of investors as the Trump administration has taken an interest in the sector.

The bottom line: "One can call something a rebate, a flat fee or an elephant. It still represents a lucrative flow of money, and the influence that goes along with it," said Robin Feldman, a UC Hastings law school professor who recently wrote a book exploring these deals.

5. Like zero-fee ETFs? How about negative fees?

Investment firm Salt Financial plans to offer a fund that will temporarily pay investors to hold it, according to regulatory filings unearthed this week by Bloomberg, and analysts at Moody's Investor Service believe there's more of this to come.

- "It changes the psychology of the marketplace," Stephen Tu, a Moody's vice president, tells Axios.

Why it matters: While Tu wouldn't predict just how far the trend of negative-fee ETFs could go, he did say he thinks more asset managers will be offering to pay investors to hold their funds.

The negative-fee ETFs are the latest in the war by asset managers to attract money that is moving quickly out of active funds. In 2018, mutual funds saw the highest yearly outflows on record.

- "The consumer trend toward passive investment products is akin to the adoption of an improved technology," Tu wrote in a recent Moody's white paper.

What's next? Moody's is anticipating so much more money will move into passive investing vehicles, in large part because of low fees, that by 2021 they expect passive funds to hold more assets than actively managed funds.

- As of December 2017, researchers at the Fed found that passive funds accounted for 37% of combined U.S. mutual fund and ETF assets under management, up from 3% in 1995.

- Investors are moving to passive strategies not just because they're cheap, but because management fees and commissions are a form of "leakage in earnings," Tu argues.

How a negative-fee ETF works: During the first year, ETF holders will earn 50 cents for every $1,000 invested in Salt's ETF, capped at $100 million, at which point it will be shared with all investors. A $2.90 management fee may be applied after April 2020.

Between the lines: Tu tells Axios that the fund's fee waiver of $34 on $10,000 of invested capital (offsetting $29 in fees to net $5 paid to the investor) likely can be offset by these companies through securities lending, i.e., loaning out stock to short sellers.

Editor's note: The top story in Thursday's newsletter on Brexit and the European economy was corrected to show Maastricht limits say government deficit should be no greater than 3% of GDP (not 60%).

Sign up for Axios Markets

Stay on top of the latest market trends and economic insights